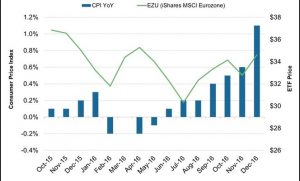

Inflationists are happy. Prices rise to five-year highs and some rub their hands with the idea that their grand plan to create inflation by decree is going to be a success.

Inflation, the tax of the poor, applauded by no consumer anywhere ever.

The discourse of inflationists is simple and, therefore, farcical. If inflation increases, the debt “deflates”, entering into a process of deleveraging as liabilities of states, companies and families loses value each year. “If inflation rises to 4%, every year, we have 4% less debt,” I was told in a television program. I thought “great, and if it’s 50% in two years we have no debt.” A joke.

The problem of the Eurozone is very different and will not be “solved” by inflation.

New Eurozone debt issuances in 2017 are estimated at €20 to €40 billion, a total of € 885 bn to €900bn in 2017, according to ING and Morgan Stanley, respectively.

The Eurozone´s debt repayment capacity, according to Moody’s, has reduced to 2007 levels due to accumulated deficits, deterioration in cash flows and the creditworthiness of public and private agents.

The problem with the simplistic argument of consensus inflationism is that it does not happen. From Deutsche Bank to Morgan Stanley, many are warning of the risk of “trusting” in an inflationary exit to the liquidity trap.

– With rising inflation, real interest rates and interest expenses rise, in countries that do not reduce debt in absolute terms.

– Tax revenues do not grow with inflation because overcapacity remains – 20% in the Eurozone -, most of the inflation increase comes from higher energy costs, and this creates weakness of margins and revenues. Anyone who thinks that real wages are going to grow at or above inflation with the stock of unemployment that still exists in the eurozone, must be joking.

– Input costs increase more than sales, because of overcapacity, aging population, and higher imported oil and gas prices. Imports rise, and ability to pass-through to final prices diminishes.

– “Existing” debt -stock- reduces its value due to inflation, but deficits and interest expenses rise.

If we take the refinancing needs of the Eurozone, close to € 1 billion a year, and assume an increase in inflation to double from current levels (2.2%), any serious analysis that takes into account the particularities of the European economies can easily see that the effect on the cost of financing of economic agents and the increase in deficits exceeds, by a ratio of 1.05 to 1, the alleged “benefit” of devaluing the stock of debt.

In fact, low prices have been a very relevant factor in cementing the Eurozone recovery. If it were not for low CPI, it would have been much more challenging for families to endure the bubble-led crisis and subsequent real salary decrease and unemployment rise. Anyone who thinks that inflation would have prevented the crisis is ignoring the factors behind the Eurozone recession. The questionable Phillips curve link between CPI and unemployment was debunked decades before.

Of course, the inflationist alchemist is confident that these risks – which they cannot deny – will be canceled-out by the European Central Bank’s monetary policy, which will have to repurchase everything that is issued to prevent real rates from rising alongside inflation.

Welcome to the recipe for stagflation.

When artificially manipulated rates fall below real inflation, credit growth collapses, real productive investment falls and, with it, the velocity of money. In fact, the only investment and credit that is encouraged by this policy is high risk and very short term oriented to compensate for the difference between reality and manipulated rates.

The truth is that the Eurozone cannot get out of the liquidity trap when 90% of net funding needs are used to cover deficits that pay for current expenses. We saw it when inflation in the Eurozone was 3 to 5% … But then, debt and annual structural deficits were much lower.

Expenses rise, due to inflation, but revenues don´t increase the same way, due to structural circumstances of productivity and weak margins.

SMEs, 90% of companies in the Eurozone, cannot transfer these price increases to their margins – and thus their tax payments- because inputs rise more than revenues. The same happens with wages.

If we add a structure of “big companies” in Europe comprised of industrial conglomerates with very low productivity, poor returns and high external indebtedness due to foreign acquisitions, their sensitivity in profits and tax payment to inflation increases is very low. The estimates of the Tax Foundation and other studies show that inflation increases has a very poor translation to profits. Almost zero, even negative.

Families in Europe have managed to reduce their indebtedness admirably in these years. And the vast majority of their wealth is in deposits. If we think that an aging population is going to buy more in real terms because prices rise, we have not learned anything from the evidence of the past. But some will say that this time is different.

The problem with the Eurozone is that it is trying to solve structural problems with any measure except the one that fixes the perverse incentive that perpetuates stagnation. The constant transmission of wealth from the efficient and the saver to the indebted and inefficient.

The EU tries to fix the economy without touching the mechanisms that slow it down. High government spending, low productivity and poor competitiveness.

The European Union is increasingly burdened with fixed costs and unproductive spending, putting stumbling blocks to the economy in favor of more white elephants and bureaucracy. Inflation by decree is not going to change it. It will extend it.

But many will tell you that it is for your own good.

Daniel Lacalle is PhD in Economics and author of “Life In The Financial Markets” and “The Energy World Is Flat” (Wiley)

Article published in Spanish in El Espanol

Graph courtesy of Market Realist

One thought on “Europe will not benefit from Inflation”