“Recovery begins from the darkest moment” John Major

We have started to see signs of optimism in Europe supported by a macroeconomic environment that, far from being attractive, is showing some encouraging data. But the fragility of the recovery is still high.

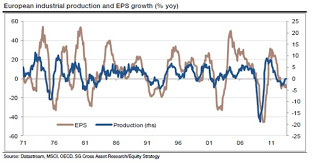

- Industrial production indices are approaching expansive levels.

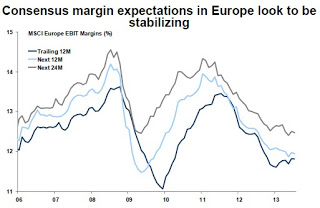

- Corporate margins are improving, quietly, thanks to exports and cost control.

- Private debt has been reduced to 2006 levels.

- Financing costs for small and medium enterprises, including Spain and Italy, have fallen to two-year lows.Gas imports have increased for the first time since 2008, which is very relevant to industrial activity.

Recovery is extremely weak since, at the same time, countries persist in tax rises and attacks on disposable income that depress consumption. And if we don’t see an improvement of consumption, all other variables are simply smoke.

Unemployment and consumption are the two great scourges of Europe. With all the government support and a highly interventionist state, unemployment in France has reached three million people. In Spain, above 6 million, it has dropped only by 31 people in August, a moderate slowdown in job losses. But job creation is only going to happen when consumption recovers, and that will not happen in an environment where disposable income is curtailed and taxes destroy families and SMEs. The fiscal burden in the European Union is already about 40%.

Threatening to raise taxes on big business now is another huge mistake. They’ve been a pillar of internationalization and growth, and thanks to them we now have global multinationals, employing tens of thousands. But these strategic moves cost a great effort in debt and weak balance sheets.The cleaning of such balance sheets has not been completed in full, despite cost savings and divestitures, and to raise taxes is a dangerous move that creates more harm than good. Because these large corporations are also big employers, generate the bulk of private investment in the countries, and their social security contributions are one of the main guarantees of the financial sustainability of the welfare systems. Further tax changes would also delay the entry of foreign capital until conditions are stable and attractive.

The European Union has warned France that it can not go higher in its tax burden, but this week we read that in 2014 there might be more tax increases. Spain is seeking to raise 25 billion more adding new taxes. Unfortunately, as always, these measures delay the recovery and do not generate the desired revenues.

The tax increases are not helping consumer or employment, but also do not improve the borrowing countries. Keep in mind that at the end of 2013 the debt to GDP in the euro area might exceed the current 90.6% by at least 1%, and that the state deficits continues to rise above 4%. In this environment of low interest rates and moderate risk premiums, there seems to be little problem, but low interest rates and strong bond demand do not last forever.

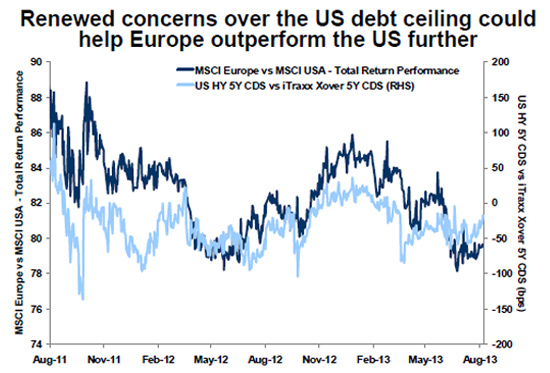

Europe, main beneficiary of fear of U.S. debt ceiling

From the point of view of the credit market, there is little to worry about, because Europe is likely going to be a beneficiary of the fear that the US exceeds the debt ceiling in October. 16.4 trillion dollars in debt, the fourth time pass this limit since Obama arrived, despite the timid spending cuts and tax increases. A problem that is not going to find a simple solution like the last time, as Republicans will not accept further increases in taxes.

But the relative calm in Europe can not mask the huge debt problem across the eurozone, and should be used to prepare a challenging winter.

After the German elections, the pressure to accelerate reforms and reduce deficits will increase, no matter who wins. We saw it in the debate between Merkel and Steinbrück. None of them questioned austerity, but the pace of it. In fact, they accused each other of being too complacent with Greece.

Thus, European countries, and peripherals in particular are going to have to face excessive deficit budgets, and three risks :

- An Italian government crisis amid debt ratios that are much higher than expected.The financing needs of the public sector already reached 60 billion euro as of August 2013, almost double the figure of 2012.

- A current account deficit in France of nearly 60 billion in 2013, and a debt to GDP that is on its way to 100% in a short period of time (currently 91.7%).

- A deficit in Spain that, despite the recovery, is exceeding all targets. It was 4.38% in the central state, compared with year-end target of 3.8%.

So why be optimistic?

Since the problem can be short-term financing and that Germany and the paying countries will continue to press for the much needed structural reforms, it is likely that, as I have commented in CNBC a few times, the European Central Bank might conduct another liquidity injection (LTRO) to help the financial system to face the risk of higher interest rates and possible bumps in the huge portfolio of government debt that banks accumulate. Only in Spain, more than 213.6 billion. European banks accumulate up to 20% of Europe’s sovereign debt and that weight is monitored constantly by the European Central Bank.

But, like other liquidity injections, the problem will be generated if it is used to give another kick to the can and take this slight recovery as an opportunity to increase tax pressure and delay the reform of governments that spend between 10 and 50 billion more than they collect structurally. Because then we will find the same problem as in previous periods of slight improvements: the bureaucratic machine crushes the recovery.

Olympics

On Friday bets soared giving Madrid some chance to win the 2020 Olympics organization, above the favourite city, Tokyo.

For Spain, the possibility of organizing the Olympic Games can be, as always a double-edged sword. On the one hand, the analysis of The Economic Journal (The Olympic Effect , Andrew Rose and Mark Spiegel) estimates that trade improves 20% over the medium term. On the other hand, it has a cost and means a debt that will probably be very hard to add, even if most of the infrastructure is already built. But if most of it is built there ill be little impact on employment and growth. The Madrid bid is sold as a “low cost” one ith an estimated budget of 1.6 billion euro. Even if that figure is doubled, it’s a small percentage of GDP and groth. We’ll see.

Of the countries that have hosted Olympic Games since 1976, exactly half generated a net profit, and the other half, either lost money or barely broke even. In the UK the cost fell at almost 9 billion pounds and generated a positive impact on the economy of more or less the same amount, about 8 billion, according to the BBC; 8.8 billion according to the Mayor of London.

In any case, with or without Olympics, there are reasons to believe in the Spanish recovery, as I said in my article “Spain, Bottoming Out” , and we should not overlook the positive data in Europe, but growth will not return until disposable income improves. And if the tax burden is increased, it is not good news.

Well done Daniel, but no body is hearing you from the spanish goverment, they doesn´t like technocrats, they never have mind in solve anything, just short-term “ideas” or excuses to go on squeezing citizens… they are crap and thats all folks.

We need a well oriented movement against this politicians and that will never come until people really feel angry and without resources.

Best regards, Julio from Spanishtan.