Front Row represents the personal view of Rodrigo Rodriguez, European Head of developed cash trading for Credit Suisse.

I am flying to Spain today in order to bring my family back and stop my “London Madrid “ weekly commute, I honestly have to say that I need them back!!!…I miss my wife and the little beast but more importantly this morning I could not find my car keys and I had to take a cab to work …I need to be back to a normal family life, without excesses, even boring if you want sometimes, but consistent and productive.

I am flying to Spain today in order to bring my family back and stop my “London Madrid “ weekly commute, I honestly have to say that I need them back!!!…I miss my wife and the little beast but more importantly this morning I could not find my car keys and I had to take a cab to work …I need to be back to a normal family life, without excesses, even boring if you want sometimes, but consistent and productive.  So the expected rotation from bonds to equities has not happened yet and I will try to explain why on the next topic about the equity risk premium , but on the meantime :

So the expected rotation from bonds to equities has not happened yet and I will try to explain why on the next topic about the equity risk premium , but on the meantime :

Let’s go back to our old format of analysing what is about to happen and where is the next catalyst( with my personal view on each off them):

- Sat Nov 17 – China Oct property prices (out Sat night) : Get ready for it… there are new Sheriffs on Town, expect proper positive Chinese data for next 12 months…who knows if it is true or not?

- Mon Nov 19 – US NAHB housing index and existing home sales (10amET) : Bernanke said it clear yesterday, “ there will be QE till the houses….double?”

- Tues Nov 20 – Bernanke speaks at Economic Club of NY …and we know what he wants to say…. QE4…HERE WE GO…

- Tues Nov 20 – Eurogroup meeting to discuss Greece …Do not worry there are going to be 10-15 more of this…but I have the feeling that on this one they will release the money Greece needs

- Tues Nov 20 – China Leading Eco Index (out Tues night) …and this time it will lead

- Tues Nov 20 – BOJ policy decision (out early Tues morning) . I honestly think that people has miscalculated the importance BOJ is going to have in the future.

- Thurs Nov 22 – European Leaders Summit (Nov 22-23). Told you 10-15 of this….

- Thurs Nov 22 – Eurozone flash PMI for Nov. And we know they will not be positive.

- Thurs Nov 22 – US markets closed for Thanksgiving Let’s remember we all have a lot of things to give thanks for.

- Fri Nov 23 – European Leaders Summit (Nov 22-23). Is this a new one.? Sorry it is a two days event…

- Sun Nov 25 – Spain regional elections – Catalan election Nov 25 I will no comment on this, as you all know my opinion…the only think I guarantee you is that they will not action the thread of independence as it is not viable financially speaking.

- Sun Nov 25 – Italy: Centre-left holding a primary on Nov. 25 to select its candidate for prime minister . Will Italy come back to haunt us?

- Fri Nov 30 – MSCI Semi Annual Review. Changes effective as of the close Fri Nov 30. Is there any risk appetite left?

What about December?

- Mon Dec 3 – Euro group meeting 12 left….

- Tues Dec 4 – Merkel’s CDU Party Congress. Dec 4-5. Expect strong language from Germany against the peripherals…

- Tues Dec 4 – meeting of all EU Fin mins 11…

- Thurs Dec 6 – ECB rate decision (7:45amET press release/8:30amET press cone) And this time HE WILL CUT!

- Wed Dec 12. Fed meeting. Decision 12:30pmET, eco forecasts 2pmET, press conf 2:15pmET. ….QE4….If market does not rally I bet you he announces bigger monthly activity

- Thurs Dec 13 – European Leaders Summit (Dec 13-14) Seriously? Do this people ever work?

After all we have lived this year you have to agree with me that there are no reasons for this market to move on the back of the event above , is it???

Clearly the market is in a dynamic that on no news it will deteriorate however the Elephant in the room , the only comparable catalyst is …..the Fiscal Cliff!!!!, and I honestly do not think that there would be such a cliff, if US politicians have any sense they will agree sooner than later and so will Spain to the bailout.

Those two factors together invite me to still be bullish till year end, as I think that is where the blood will be .

Complacency and optimism 3 weeks ago in the market was clearly excessive but now it is the opposite, people have clearly reduced their books and it is now when a market rally will properly damage everyone’s performance.

That is why my money is on the upside…any positive coming from the “Cliff “ negotiations and we will close the year near the 1450…see you there!

On Ullicks’ words : You have to recognise that every ” outfront maneuver ” is going to be lonely. But if you feel entirely comfortable then you are not far enough to do any good.

That warm sense of everything going well is usually the body temperature at the centre of the herd Only if you are far enough ahead to be at risk do you have a chance of large gains

Equity Risk Premium ? Is this an absolute indicator?

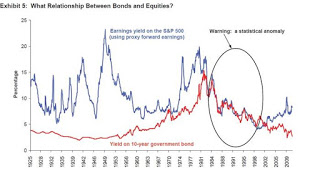

During this year one of the arguments that most of the bullish strategist , and the simple traders like me have defended for investing in equities was the equity risk premium being too high

Luckily for me , three years ago I discovered this guy, that had outperformed even on his nursery days and I made him an offer to join us, Tej not only has photographic memory but he knows how to use it. A touch too fond of himself but a guy worthy to listen…

Today he came with an explanation he had read and investigated further on the Fed model/ equity risk premium model. According to Tej, this model biggest problem is that it is based on the assumption that risk is constant and we all know that it obviously is not.

i.e. it is stupid or at least not efficient to look at Earnings yields vs. bond yields but to the difference between the vol of both. It is only when such vol becomes the same when the Equity Risk premium model should work.

In the graph at the top of this article it is clear the Bens’ target is for the light blue line to go as close to zero as possible then we will be back to a period similar to the one from mid 80s till beginning of 2000.

While the graph we found calls this period a statistical anomaly, I do think that period is the one that better defines the relation between bonds and equities as it is the moment at which markets turned electronic and therefore efficient.

How could you expect an immediate reaction between equities and fixed income on the 60s when sales people flew around the world writing orders on their notepad that would trade on their return to the US? (or so my friend Clarke Pitts told me once)

So once again , this takes me to the point that I think we are nearer to the new equity rally or a proper treasury sell off than ever as funds will have to come back to equities.

Now it is all about Japan…

Those of you who know me well , know that I fell in love with Japan a long time ago while I lived there and since then I have followed everything related to that country with extreme interest , on that topic the trade I have been calling for the last three years is long USDJPY , and more importantly for the last 5 : long Japanese Equities….They say that good things happened to those who wait, so would this time be the one. ? In a piece published by 13D research I read:

Watch Japan—it may lead the world in the biggest asset allocation shift in history—out of bonds into equities. During the third quarter, the Japanese economy contracted at its fastest pace since last year’s earthquake and tsunami—an annualized decline of 3.5%—which puts the country at risk of its fifth economic recession in just the last 15 years. Moreover, in September, Japan reported its first seasonally-adjusted monthly current account deficit since 1981. Japan, once the largest net capital exporter of the world, is now on the verge of becoming a net capital importer.

The global markets—particularly for foreign exchange, JGBs and U.S. Treasuries—are most likely unprepared for Japan to become a consistent net importer of capital. There are signs indicating that the political impasse in Japan may be coming to an end, as Prime Minister Noda may soon dissolve the Lower House of the Diet, which would kick off the beginning of the next general election. If that happens, we expect to see the dovish LDP leader, Shinzo Abe, take the reins from Noda earlier than expected, which would exert more pressure on the central bank to ease policy further to weaken the yen even before the BOJ governor Shirakawa finishes his term next April. Although the depreciation of yen would help lift share prices of Japanese exporters, this could also pose potentially large risks to exporters from other countries, particularly those of SouthKorea.

Guess what happened this week….Elections were called

Further exacerbating the current economic woes, Japanese households are holding the most cash since 2005, according to BOJ data. The record high cash levels have certainly offset some of the BOJ’s quantitative easing efforts to date, risking a protracted deflationary cycle if the BOJ fails to convince markets that it is serious about meeting its 1% inflation rate target. Consumers will be encouraged to postpone consumption to the future if they believe deflation will continue.

Equities are the best hedge for inflation

Last week, Japan reported its September current account deficit of ¥142 billion yen ($1.8 billion), the country’s first seasonally-adjusted monthly current account deficit since 1981. September’s seasonally-adjusted trade deficit of ¥980 billion ($12.3 billion) was also the largest monthly trade deficit since records began in 1993. This marks a very significant turning point in which Japan—which had once been the world’s largest capital exporter—has become an importer of capital, with potentially enormous ramifications.

Richard Howard of Hayman Advisors recently made the following comments on JGBs: “It all came down to this idea that there was an internal self-funding mechanism in Japan, that essentially the Japanese economy and interest-rate environment could exist separate to the rest of the world…It wasn’t going to last forever, and in fact it is rapidly approaching a turning point .”

Japanese companies have been repatriating capital for a long time, but that cannot last for ever and they know what is about to happen otherwise why is M&A of Japanese companies buying Foreign ones doubled on size this year.

And as a closing remark , there are more reasons to buy the IBEX : “ SPAIN SAYS 118 ARRESTED DURING STRIKE VS 196 IN MARCH….” 🙂

Previous Front Rows:

http://energyandmoney.blogspot.co.uk/2012/11/front-row-in-obama-we-trust.html

http://energyandmoney.blogspot.co.uk/2012/10/market-front-row-will-they-wont-they.html

hey Daniel,

About Japan, what do you think is the reason for the first account deficit since 1981,are your expectations for the future for this deficit to increase or is more likely japan to keep being a net exporter?

About USDJPY,althoug your comments, i remain bearish, having no position plan to enter short USDJPY (long yen), my thoughts are:

– Currently, Japanese household wealth held abroad is relative to 55% of Japans GDP –> with ZIRP, and declining rates in developed world with no perspectives of any increase, many of these savings can come back to japan.

– I think In order for Yen to top, in japan should start having inflation(don’t think that), start growing(complicated at least, taking into account world is also entering recesion)

– I know a growing net importer position could damage my point, but i’am not very worried of that at this point(because of global no-demand)

– Last: Everyone seems to be calling a major bottom in USDJPY (CNBC,…), but net commercial position makes nothing to keep increasing.

Thanks for your time, nice blog !

I understand your line of thinking for a short term trade. Additional QE and fiscal cliff help you on the other side of the trade (the USD).