In OECD countries with current demand oil consumption is 18.3barrels a year

So if OECD countries slash their demand by 25% it will still be 14.64 barrels a year

However, if oil exporting countries demand goes up by a mere 7% their consumption will be 4.28 barrels a year.

Indigenous population growth in OECD is +0.1%, and growing 1% from immigration (ie going from countries where the average person consumes 2 barrels a year to countries where they will consume at least 4)

Population growth in oil exporting countries is up 5%.

Doing the maths, the demand doom picture is overestimated.

On to Supply:

A) In a tough credit environment, even large and medium sized E&Ps are and will have to drastically cut expenditure in exploration and development. Even worse, service companies are too small and cannot get credit for large rig projects (look at SBM and PFC).

B) Large caps are cutting expenditure (albeit selectively) already. If they see a weakening of demand all that RDS has to do is reduce the number of trucks in Canada bringing oil sands product from 35 trucks to 5. Boom.

C) Demand needs to fall at least 3%pa to come back in line with the usual demand-supply balance going forward

D) Even if all these things happen the call on OPEC increases, as non-OPEC supply is doing nothing but shrink.

E) 75% of the current projects require at least $40/bbl (technical, not service charge). Companies are not waiting for oil to fall to $20/bbl to revisit these projects which are only being developed because demand exists. If not, these projects can be shut down rapidly (Khursaniyah, Khurais, Genghis Khan, Atlantis, Kashagan, Rosa, Dalia).

Demand NEEDED to fall more than what consensus and sellside expected. I am happy with demand falling a lot, because the problem is depletion.

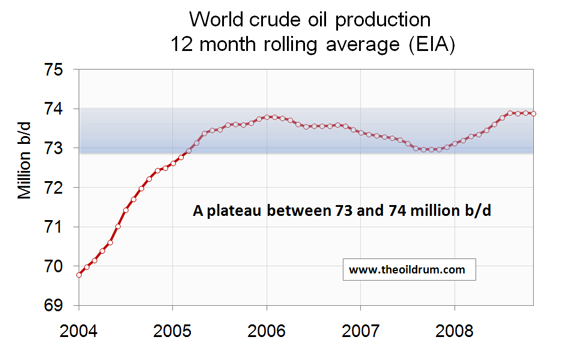

Supply is not there, and deffinitely not from non-Opec as consensus estimates (a ramp up of 1mmbpd when year to date it is down). Depletion rates are 4-6%. Even if you consider 0% depletion you need demand to fall a another 5%.

Call on OPEC increases, and self-consumption of producing countries is rising. Price, as such, is adjusting to see where mid term supply, demand and depletion go. That is not an indicator of bearishness.

I bet:

A) 12 month trail reserve replacement will be less than 90%

B) demand will fall accordingly

C) Demand – supply balance will remain the same

More importantly, I am happy that oil falls because the contango curve is steepening again… and bears have yet to explain why, if this is an anomally and fundamentally unjustified, it has continued and widened for seven months at levels never seen before October 08. As the only true safe havens of the equity market, I expect in less than a month investors will come back to revisit high quality, differentiated stocks that discount $30/bbl, trade at 7xPE 2010, 3-4.5x EV/DACF 2010 and FCF yield of 14%.