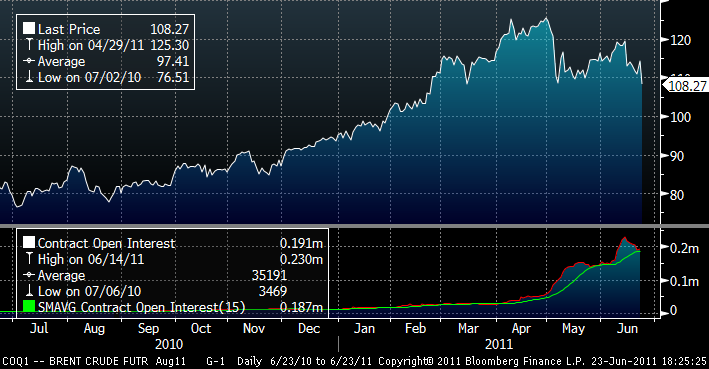

Oil fell 5.5% on Thursday 23rd June on news that the IEA’s member states are to release 60mb of their strategic stockpiles, 30mb from the US and 30mmb from elsewhere.

This could look in time as one of the dumbest decisions, in my opinion, since the day when the UK sold all its gold reserves between 1999 and 2002 at around $280/ounce… unless the IEA sees a material economic recession ahead and then the new QE of the economy is artificially lowering the price of oil.

The U.S. strategic petroleum reserve is at a historically high level with 727 millions barrels, of which 293 millions barrels (40%) are sweet and 434 millions barrels (60%) are sour. The International Energy Agency reported in April 2011 that SPR in OECD Europe and OECD Pacific totaled 186 millions barrels and 391 millions barrels, respectively.

The release of SPR crude announced today thus represents approximately 4% of U.S. reserves and 5% of SPR reserves in OECD Europe & Pacific.

This is the 3rd time in the past 50 years that IEA has released strategic reserves. The last three times, the improvement in oil prices that they looked for resulted in three subsequent super-spikes. This, I fear, will be the outcome again soon. Furthermore, this time we do not have the price-cushioning barrels of the North Sea (declining at 7% pa, as we mentioned here) or Mexico, which is falling as well. So the call on OPEC, even if demand continues to slow down, will increase to 30.1mbpd, making prices go higher.

The IEA, yet again, is panicking about the impact of the Libyan conflict. It is seeing that the war is unlikely to end soon, and sees the loss of Libyan barrels (1.5mmbpd) as an issue after the failed OPEC meeting. But the market is well supplied. The only issue they worry about is price, which has been caused by the insane money-printing of the Fed not by demand-supply dynamics (hence the wild inflation in all dollar denominated commodities, of which oil incidentally is the third least appreciated since 2008, by the way).

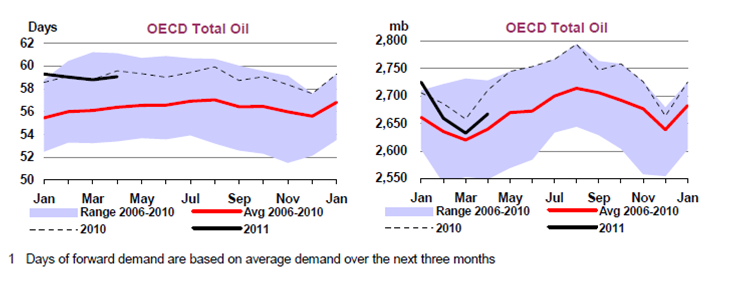

Also, the US failed to pressure Saudi Arabia into discounting its crudes on world markets, which was one of the most paternalistic requests ever seen. Obviously, Saudi Arabia didn’t agree, because, to start with, the reason why OPEC didn’t raise quotas was because demand is weakening (as we said here), and given the 5-year high levels of inventories at Cushing, they would essentially pump oil to be added to more storage.

The IEA decision could also come from fears of escalating tensions between Iran and Saudi Arabia, with calls from the latter to “squeeze out” Iran from the oil market. Given that Iran and Venezuela stand at the highest-end of the OPEC countries’ break-even price (close to $70-80/bbl, versus peers at $45-50/bbl), the IEA might be doing Saudi Arabia a favour, but a very short term one as it can create a geopolitical issue that brings oil back right up.

But this measure is meaningless in the grand scheme of things. 60mb is about 43 days of lost Libyan barrels and, wait for this, less than 0.2% of annual global oil demand (considering 87m bpd). It will achieve only one thing: to increase the OECD dependence on OPEC by September.

Meanwhile, the drought in China is poised to drive a spike in short term diesel demand. Severe drought conditions have curtailed China’s hydroelectricity generation… and electricity consumers will look to replace state electricity with their own power generation, oil. Middle distillates already account for the largest part of Chinese oil demand, so the entire IEA decision could be absorbed by the Chinese increase in diesel consumption in two months before the rain season.

So the analysis says that give that the market is well supplied and economic data in the OECD is weakening, the IEA only wants to cover the drought-driven demand spike from China, avoid oil prices from over-heating and help the debilitated OECD recovery.

The only way in which the measure will work is if, in effect, demand will weaken into 3Q and the call on OPEC does not rise. If the demand analysis is incorrect, China and India continue to grow or geopolitical supply issues get worse (13 dead in Baghdad today not helping) then the oil market will go back to price a tighter environment. Any move in demand above 88mbpd and the entire measure is absorbed.

It doesn’t matter if OPEC has 4.5mmbpd of spare capacity, because this spare capacity is centred in Saudi Arabia, UAE and Kuwait, and is predominantly heavy-sour oil. And this measure will not help diplomatic relations with any of them, will be seen as desperate and in any way could be absorbed immediately.

Granted, the IEA can release more Strategic Reserve barrels, but then the weakness of the OECD and the call on OPEC rise. It’s a catch-22 measure and will not be of great aid to the OECD economies, which are not weakening due to high oil prices (oil burden is less than 5% of OECD GDP), but due to out-of-control spending, rampant deficit, printing of currencies and EU’s puzzling management of the Greek-PIIG crisis.

Finally, two of my industry friends rightly highlight that “we are heading into a US election year and the political dividend from appearing to push oil prices lower is very attractive (Bill Clinton knows it well, he did it too)”. “President Obama wants to appear tough on oil and keep gasoline prices low in July. But a few weeks later we will be back where we started. Lower prices only accelerate demand anyway”.

Well done, IEA. another QE in disguise.

Link to my interview in Spanish radio, go to minute 12.30 (http://gestionaradio.com/getplayer.php?aud=16502)

Other posts:

http://energyandmoney.blogspot.com/2011/01/some-energy-thoughts-for-2011.html

http://energyandmoney.blogspot.com/2011/05/impact-of-chinese-slowdown-on-oil-and.html

http://energyandmoney.blogspot.com/2011/06/china-slows-down-as-saudi-arabia.html

http://energyandmoney.blogspot.com/2011/03/war-in-lybia-and-possible-algerian.html

http://energyandmoney.blogspot.com/2011/02/lybia-in-flames-and-clash-of.html

http://energyandmoney.blogspot.com/2009/11/china-exxon-and-war-for-resources.html

This is pure politics; Bill Clinton and his Secretary of Energy, the Ex-Governor of New Mexico, Richardson, would threaten (or would) release crude every time oil rose above $25.00/bbl. Made great populist headlines.

At the same time the President and his regulatory onslaught is holding up permits in the Gulf of Mexico, Alaska and the western United States, delaying or worse, forever removing hundreds of thousands of barrels of US crude from market. That lost crude hurts revenue, jobs and oil and gas supply.

Let’s face it; Washington is filled with idiots!

Agree. Makes no sense. Politics to appear “tough”on oil prices and keep gasoline prices down in July.

Keep in mind too that of the 85mbbpd 70 are on long term contract. All of Libya’s 1.5mbbpd was sweet and on LT contract. Those people now have to go to the spot market to fill their need. So, on a spot basis, demand just spiked 10% because of the war, adding 1.5bbpd, even for a couple of months, has a huge impact on price and very little downside when looking at longer term, which is what governs SPR policies. Not a bad play actually. When you say there is spare capacity, you’re right, but it takes several months for it come online smoothly, especially when it’s heavy. Theses 2 months might just be what the time needed to ramp up that spare capacity.

Thanks Vincent. Interesting thought, and makes sense considering Saudi Arabia’s messages about ramping up into Q3.

There’s also thoughts on the price of oil directly impacting the effectiveness america’s QE1+QE2 as the first outlet for the enormous liquididities are $ denominated commodities, the king of which is brent. As you mentionned, Obama’s reelection games is on, so he’ll try to protect the effectiveness of his liquidity injection. Each $10 spike in brent is diverting $5B a month from the “real” economy ($10*15mbbpd*30).

Agree… And a week on after the announcement oil is back at virtually the same price. The auction for 30mmbbls went at an average of $3 to $7 discount.