First, the IEA definition of crude oil is “crude oil including lease condensate”. Does this matter?. To some, yes. Not to me. Differentiating condensate and natural gas liquids from crude reminds me of the debate of oil sands versus API 35 oil. Whatever goes into your tank and makes the car run, baby. EROEI?. Sure, still very strong as shown in my post here (read). My biggest issue is to think EROEI is static and will not improve, when shale gas has gone from 3 to 1 to 6 to 1 in many areas.

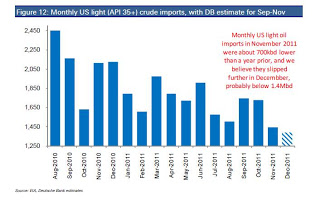

Third, regulation and politics. The most important is the restriction on the export of crude from the US by law. US concern about “energy security,” will likely keep the restriction in place for a while. The Jones Act, which mandates that any intra-US shipping by water be done using vessels under US flag, built in the US, and manned primarily by US crews also increases the costs of shipping within the US.

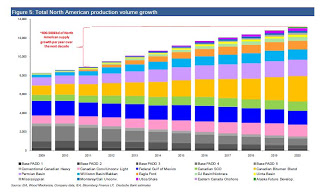

This analysis from Deutsche Bank shows that “the forecast, which we consider a base case with more upside over the medium-term than downside (in fact, given the Canadian oil sands project queue and the tendency for unconventional plays to surprise, we think there could be considerable upside, though we think it is important to understand the limitations of dynamic prices and infrastructure, which keeps our estimates relatively modest compared to a few recent bombastic predictions), suggests that North American production will add, on average, 400-500kbd of oil production growth per year over the next decade, with annual peaks as high as 650kbd.”

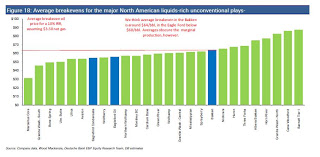

This analysis from Deutsche Bank shows that “the forecast, which we consider a base case with more upside over the medium-term than downside (in fact, given the Canadian oil sands project queue and the tendency for unconventional plays to surprise, we think there could be considerable upside, though we think it is important to understand the limitations of dynamic prices and infrastructure, which keeps our estimates relatively modest compared to a few recent bombastic predictions), suggests that North American production will add, on average, 400-500kbd of oil production growth per year over the next decade, with annual peaks as high as 650kbd.” “Most of the major US unconventional plays have average economic break-evens below $70/bbl, and average breakevens in the Eagle Ford liquid windows appear to be $60/bbl or below. In the Bakken we think the average is around $65/bbl.”

“Most of the major US unconventional plays have average economic break-evens below $70/bbl, and average breakevens in the Eagle Ford liquid windows appear to be $60/bbl or below. In the Bakken we think the average is around $65/bbl.” The United States has over 24 billion barrels of recoverable oil in shale, abundant oil supply delivered thanks to hydraulic fracking, a tried, tested and proven extraction technology. Companies like EOG, Anadarko and Marathon are already developing shale oil fast. Other countries could benefit from this revolution, particularly in Latin America. First things first and let’s start with the U.S.

The United States has over 24 billion barrels of recoverable oil in shale, abundant oil supply delivered thanks to hydraulic fracking, a tried, tested and proven extraction technology. Companies like EOG, Anadarko and Marathon are already developing shale oil fast. Other countries could benefit from this revolution, particularly in Latin America. First things first and let’s start with the U.S.

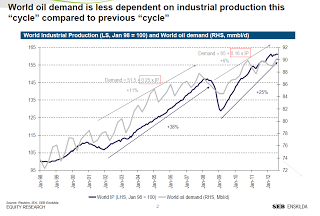

The other leg of energy independence is oil demand decline due to efficiency. This chart explains a lot:

“US energy independence is not a pie in the sky. It’s realistic”

“US in 2005 imported 2/3 oil; 2011, 49 percent. Forecast 2014: below 30. By 2035, 15 percent”

On EROEI: “as long as consumers are willing to pay for it and resources are there, consuming some energy to produce energy is fine”

Interesting shale update daniel, i am also following other shale focused companies like Oasis,Continental, Pioneer or Sanchez energy.

As an energy focused fund manager,it affects to you(your portfolio) a lot movements of the S&P aka general market?

I ask you in the way developed world seems to enter a recesion, and market could fall in high %.

Second part would be, as WTI seems heading down for a while, you think it would affect a lot to traded oil companies in general ?

Thanks daniel !

yes, energy names tend to have a higher beta to the market and they have suffered recently. The Bloomberg World Oil & Gas Index is down 4.8% this year despite oil being up 4% mainly because of weaker earnings than expected. WTI has less of an impact on stocks than Brent.

It would be difficult for the IEA to project 11 million bbl/d of production by 2020 if the story was not a technological one. For the last hundred years, the industry has focused on extracting the portion of domestic reserves that have pooled into accessible reservoirs of oil and/or gas, the hydrocarbons having migrated from adjacent rock formations, or “source rocks”. The next hundred years of oil and gas production will focus upon extracting the portion of reserves that remain trapped in these source rocks. Today’s horizontal and fracturing technologies are what will allow this to be done in an efficient and productive manner.

I guess it is early days for this shale oil …

http://crashoil.blogspot.ie/2013/02/fracking-rentabilidad-energetica.html