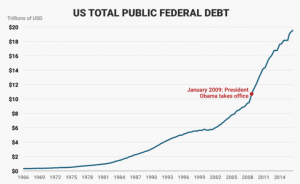

It is sad to see that, facing the evidence of the failure of demand-side policies and money printing, many commentators propose some of the most outdated and failed policies in modern economic history. In the UK, Mr. Jeremy Corbyn, the new leader of the Labour Party, believes that the government spends too little. With a current 44.4% of GDP public spending, saying the government spends “too little” is an insult to taxpayers and efficient public bodies alike.

But Mr. Corbyn wants to penalize the private sector creating the largest transfer of wealth from savers and taxpayers to government ever designed. The People´s QE (quantitative easing).

In Europe, we are already used to the follies of magic solutions from populist parties. Syriza, Podemos, and others always come up with “magic” and allegedly “simple” ideas to solve large and complex economic issues, and always fail when reality kicks in, but there are few that match the monumental nonsense of the wrongly-called “People´s QE”. It is the “Government´s QE”, rather.

Why is this People’s QE a bad idea?

The analysis starts from the right premise. Quantitative Easing, as we know it, does not work, and creates massive imbalances. So what do they propose? Sound money? Erasing perverse incentives of printing money and unjustifiably low rates? No. Doing exactly the same, but passing the massive perverse incentive of currency debasement to politicians who, as we all know, have no perverse incentive whatsoever to overspend (note the irony).

The UK policy of increasing money supply in the past has always been based on two premises to avoid hyperinflation and currency destruction: the independence of the central bank as a central pillar of monetary policy, and the constant sterilization of asset purchases (ie, what it buys is also sold to monitor market real demand). The balance sheet of the Bank of England has remained stable since 2012, coinciding with the highest economic growth period, and is below 25% of GDP.

Corbyn´s People´s QE means that the central bank will lose its independence altogether and become a government agency that prints currency whenever the government wants, but the increase of money supply does not become part of the transmission mechanism that reaches job creators and citizens in the real economy. All the new money is for the government, with the Bank of England forced to buy all the debt issued by a “Public Investment Bank”.

The first problem is evident. The Bank of England would create money to be used indiscriminately for white elephants, a disastrous policy as seen in many EU countries, that only leaves overcapacity and a massive debt hole. By providing the public investment bank with unlimited funding, the risk of irresponsible spending is guaranteed. In a country where citizens are aware of wasteful public infrastructure, this is not a small risk. However, the monetary imbalances created by this policy would generate a massive “crowding-out” effect and incentivise cronyism, as the private sector would suffer the consequences of inflationary and tax pressures as well as unfair competition from government and its crony sectors.

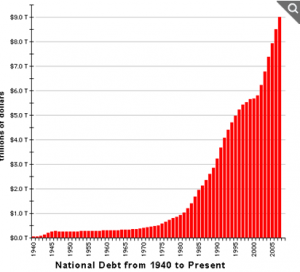

The second problem is that rising public debt, even if “monetised” (hidden in the balance sheet of the investment bank), would still cripple the economy even with perennial QE. Printing money does not reduce the risk of rising imbalances as we are seeing all over the world. And the new bank´s potential losses would be covered with more taxes.

The idea of building lots of bridges and airports all over the place to “create” jobs would be mildly amusing if it hadn’t failed time and time again and forgets the cost of running those infrastructure projects once built, apart from the debt incurred. All paid by the taxpayer, who guarantees the capital of the Public Investment Bank.

The third problem is that inflation created by these projects is paid by the usual suspects, the private sector, and citizens, who do not benefit from this spending as the laws of diminishing returns and debt saturation show.

The Socialist idea that governments artificially creating money will not cause inflation, because the supply of money will rise in tandem with supply and demand of goods and services, is simply science fiction. The government does not have a better or more accurate understanding of the needs and demand for goods and services or the productive capacity of the economy. In fact it has all the incentives to overspend and transfer its inefficiencies to everyone else. As such, like any perverse incentive under the so-called “stimulate internal demand” fallacy, the government simply creates larger monetary imbalances to disguise the fiscal deficit created by spending and lending without real economic return: Creating massive inflation, economic stagnation as productivity collapses and impoverishing everyone… except itself.

Additionally, trade deficits would widen to unsustainable levels as imports outweigh exports.

Tax increases, higher cost of living and, above all, destroying a large part of the British private sector as the government monopolizes the major sectors of the economy and increases taxes for the rest.

These dangerous magic solution policies have already been implemented in the past. It is the Argentine model of Kirchner and Kiciloff disguised in Anglo-Saxon terms, a model that has only created stagflation. It is also the Venezuela model (Mr. Corbyn was a defender of Chavez and his economic policies). To think that the government can decide how much money is created and spend it on whatever it wants without thinking of the consequences for the economy.

The myth is that they say printing money will not cause inflation because it will increase productivity and the increase in money supply will come in tandem with more goods and services.

“Inflation occurs when you have more money chasing the same or less amount of goods and services. If you have money creation that increases productivity, yes you have more money but you also have more goods and services…the supply of both increases in tandem, so you don’t necessarily have to have inflation.”

The problem? It is simply a myth debunked by history. Every single attempt at this socialist myth of productivity, supply and demand moving in tandem because the government says so, fails. It never happens. The government does not have better or more detailed information than the private sector of what goods and services the economy needs, and even less knowledge of how to boost productivity because it does not have the incentive of profitability and efficiency, just of maximising budget spending.

Productivity collapses as government overspends on white elephants and politically motivated investments with no real economic return. The supply of goods and services does not increase in tandem with money supply in an open economy dependent on imports like the UK’s. Basically, the theory sounds nice, it simply never happens.

At least, when private banks “create money”, they have an incentive to lend with a real economic return and to try to recover the principal, with an interest. They might fail, and therefore my defense of a minimum cash coefficient and sound money. However, the government has no such incentive, rather the opposite. To create money to spend on politically motivated items, and pass the imbalance through inflation and currency debasement to the productive sectors.

The lesson from Japan was clear: “Individual consumption only went up by around 0.1-0.2% of GDP and failed to increase long-run consumption. Overall, the program did not ignite inflation or help Japan out of its economic rut”. And the lessons from Chile with Allende, Argentina with Kiciloff are scary.

Corbyn forgets that the public sector cannot exist without private sector revenues. Printing money does not create prosperity, it dilutes it. Be it through current or other QEs.

The aristocrats of public spending always think that intervening on money creation and the economy is going to solve everything.

Do they know this will not work either? Yes, but the final objective is different. To make government control all aspects of the economy, whether it is in recession or in depression. For Corbyn, the government is infallible and any mistake it makes has to be blamed on an external enemy.

If Corbyn implements this “People’s QE”, it will be “Venezuela with tea and cakes”.

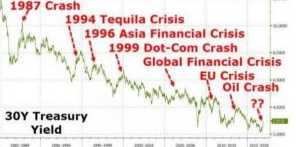

The People’s QE is the same as any other quantitative easing, a massive monetary imbalance today under the promise of solving it in the future. The current QEs will likely end with a financial crisis. The People’s QE would do the same. Except that the “alleged” beneficiaries, the “people”, will likely be drowned in inflation as the mirage of money supply and goods and services growing in tandem is proven as fake as it is in today’s QE programs. But without sterilization and transmission mechanisms, the inflation that is created today in financial assets would make prices soar due to devaluation.

Monetary imbalances always create inflation. Whether it is asset price inflation or goods, it is the symptom of aa larger problem. Because all monetary imbalances end with either a financial crisis, massive inflation or massive unemployment once the small and temporary effect of the monetary placebo ends.

The artificial creation of money without any support is always behind every crisis. The People’s QE has failed every time it has been implemented. This would not be different.

Daniel Lacalle is Chief Economist at Tressis SV, has a PhD in Economics and is author of “Escape from the Central Bank Trap”, “Life In The Financial Markets” and “The Energy World Is Flat” (Wiley)

Images courtesy Google Images

Further Read: The Upside Down World of MMT

Money, Fiscal Policy and Interest Rates. A Critique of MMT