(This article was published in Cotizalia on April 7th 2012)

However, after the announcement of Spain’s budget, the Ibex (at the close of this article), plummeted to 7,500 points, reaching the lows of 2009, while the risk premium exceeded 430 basic points. We have spoken many times about the Ibex’s troubles. An ultra-leveraged index, the most heavily subsidized in Europe, with very poor earnings growth expectations, to which we must add a tax measure that aims to raise 5 billion euros from an index that reported a net income of 30 billion euros in 2011.

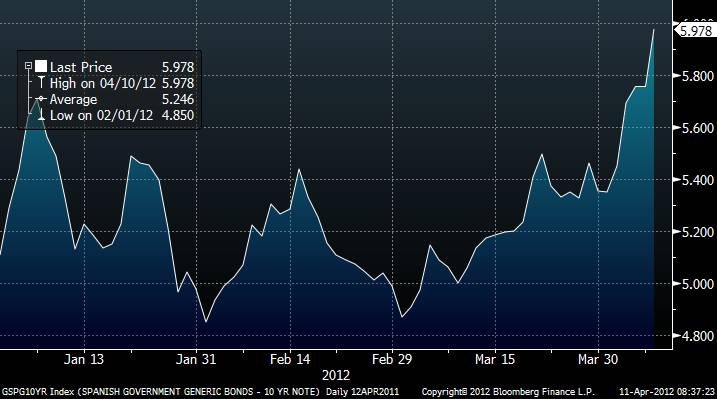

But what really intrigues me is what is happening in the debt market. I am optimistic and believe this government is willing and open to listen, so here’s my contribution.

We do not want to admit it, but in the bond market there are three major challenges:

The spread with Bunds at 430 bps is a problem. Because it shows that massive injections of liquidity do not work. As well as being a disastrous measure that takes money from the pockets of taxpayers and savings to give it to the overgeared inefficient zombies, these liquidity injections support and rescue those who have done wrong, and moreover, the placebo effect has a lower impact each time. It shows that default risk does not change. As we explained here, debt is not solved with more debt (Read here)

But … Why? If the Spanish budget was “very tough” and the government is doing the right thing, why does the market run in the opposite direction?.

First of all, it is worth highlighting a very important thing. The market does not want Spain to do badly. No way. Because Spain is not Greece. Spain is the 4th economy of the Eurozone and several times the size of Greece and as such it can not be “rescued”. If Spain falls, goodbye friends, nice to meet you. Say goodbye to the S&P 500, the Eurostoxx, Germany and the EU.

So if the market does not want Spain to fall and the budget is very conservative helping Spain to reduce the deficit … What’s the problem?

That neither the one nor the other. Investors of sovereign debt by definition are the most conservative investors in the market, and they are not convinced by the budget, either on the side of the revenues, which seem very optimistic, nor on the side of the expenses. On the revenues, the Spanish government expects to increase revenues in 2012 by 4.7% from the income tax (73 billion versus 69.8 in 2011). However, in the first two months of the year, revenues in this item have fallen 2.8%. Even in February, with the tax increase already in place, revenues from this item only grew by 1%. In an article, in Spanish, my friend Juan Carlos Barba points out the challenges of the budget and the differences of estimates, which could lead to a deficit that actually reaches 7% versus the target of 5.3% (Read here). The Laffer curve in all its glory. More taxes, less revenues. That is why I believe that the government has to be harder and more aggressive on expenditures, which is the lion share of the problem in Spain. They can.

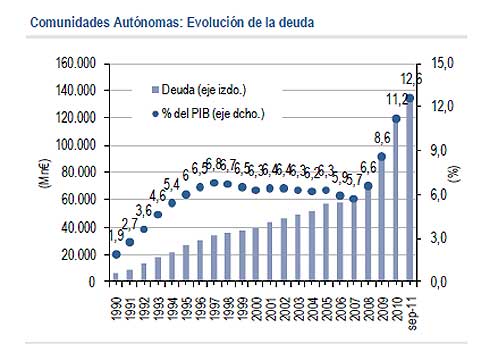

(chart above shows regional communities’ debt, which is not accounted as state debt)

(chart above shows regional communities’ debt, which is not accounted as state debt)

The problem of the budget for investors is that it does not reduce the weight of the state in the economy, which is already way above 50%, the debt to GDP rises to 78%, which is almost 120% including private debt, autonomous regions and state-guaranteed debt, tariff deficit, unpaid bills etc. The total saving that the Spanish budget targets, 27 billion euro, is equivalent to the amount that Spain will spend on paying interests from the massive debt, not more. So, if the total debt continues to rise, budget cuts and tax increases only to pay interests the big elephant in the room, the big problem, is unsolved. An unsustainable and hypertrophied public sector and the massive burden of the regions, seventeen “small kingdoms” that have already increased their expenditures in the middle of “austerity measures” in 2011 by 10%, and will increase spending yet again in 2012. In some regions the public sector is larger than 55-60% of the region’s GDP, for example in Andalucia or Extremadura. This would all be fine if the expenditure had generated growth or jobs. But it has been the opposite. Money has been wasted in vast quantities and employment has plummeted. This is not austerity, it is keeping public spending orgy. Only a radical change on this point would improve Spain’s credit rating.

Investors make their numbers. Just a deviation in the estimated income of 3-5% down, could make the deficit skyrocket to between 8 and 10% above the government target.I assure you that markets have high hopes that this government, with absolute majority at the national level and in almost all regions, would be reducing total debt and the weight of the public spending, not to reduce its growth, cut subsidies and worthless megalomaniac expenditures and repay capital, stop capitalizing interests constantly. And the disappointment is greater when there is trust and hope placed but the government maintains the status quo. But they still have time to rectify. A hundred days are a hundred days.

Politicians are ignoring the effect of deleveraging of financial institutions on demand for sovereign bonds, not least because banks, their advisers, do not comment it. The Norwegian investment fund just reduced further their exposure to Europe. Not only governments have to do the right things, curtail political spending and encourage private job creation, which is the one that pays taxes, the public sector consumes taxes… States must take account that the pie of money available to invest in sovereign bonds continues to decline. And that makes what we consider “our rights”-unlimited access to debt, and cheap- unaffordable unless we change radically the structure of public spending.

The funds available for European debt have been reduced by an average of 20 billion euros a year every year since 2007, according to our own studies. Not only the cake has reduced, but competition is fierce, as no country has reduced its debt-issuing voracity. And of course, by increasing the money supply by 6% pa, we only have placebo effects. Because the increase in money supply is clearly inadequate compared with the increase of public and private indebtedness, but in addition it generates stagnation, deflation in the goods, products and services from our economy and much higher inflation in raw materials and imported foreign goods. In fact, most of the inflation generated in the EU between 2007 and 2011 is from commodities and foreign goods. The states are still in debt, but practically nothing of the additional money supply goes to the real economy, industries or households. It stays in zombie banks that purchase sovereign debt with ECB funds (paid by current and future citizens in taxes) and use the difference to keep zombie companies alive “until it stops raining.”

Of the 200 billion taken by the Spanish banks of the ECB all have been consumed in bond buying, cover the fall of deposits (-7.5% in 2011) and cover their own debt maturities, but neither the state’s nor private balance sheets have improved. Many investor are surprised at why very few companies and banks have taken the injection of Draghi liquidity and the “placebo effect – stock market euphoria” to raise capital and cut debt. Why? Better to be a zombie among zombies than victim of the greed of the of the hunger of the undead. Like Japan, but with a difference. A private and public debt that no one has reduced “because the recovery is coming.” UBS recently commented “the banking stresses are not yet addressed: We see the system as undercapitalised, poorly-funded and badly reserved …”.

No wonder that many companies do not generate free cash flow in the IBEX. Because when you generate it, it is seized by the governments in taxes. At least when the company generates no free cash flow it enters the list of “rescue-able”. And they keep as much income as possible in tax havens. I always say that there are no tax havens, there are tax hells.

But the problem is that Spain can not be rescued. The cost would exceed 500 billion euro and that cannot be afforded by the EU. Especially because as we talk about Spain, France is also close to the territory of danger, with a debt to GDP that will reach 100% soon.

A bond investor cannot accept just 5.9% for a 10-year bonds of a state+region apparatus that will swallow + 10% of expected revenues, because as we review the growth rates to more logical levels (-2 % in 2012 and -0.4% in 2013) the investor asks himself “where will the money come from?”.The Spanish institutions, constantly talking of acquired rights, seem to think that money is free and that we deserve it “at any cost”. It seems that public spending (political, not public) that is advocated so insistently by the political parties was not paid through taxes and borrowed money at an interest rate. And those who lend money have a nasty habit of expecting to receive that money back.

The investor asks only that expenses match revenues. Those who decide to cut essential services like education and healthcare but maintain more advisers than Obama, more official cars than the UK and France together, countless regional TV stations and zombie semi-state owned companies, 17 separate governments, regional embassies, grants and 5% of GDP in subsidies are those that we voted to manage these resources. All an investor asks is that resources be managed based on a reasonable income and based on the demand for bonds that the country can take. Spain can not be, even if it wanted, more than 30% of the European supply of bonds. And let’s see when we start implementing zero-based budgeting. Budgets that can only grow are a fallacy of “bull market”.There is, of course a solution. Curtail political spending and zero based budgeting. With courage. Adjust expenses to income.

Bill Gross, from PIMCO, said “Greece is a Zit, Portugal a Boil, but Spain is a Tumor”.Spain is the bridge between recession and the Euro recovery. Spain is much more important than we think. I am a Spanish citizen and I cannot believe that we can not reduce a bloated state. It’s time to raise awareness and decide where we go. History will not forgive us.Here is an excellent blog that details the Spanish debt evolution at regional and state level:

http://javiersevillano.es/BdEDeuda.htm#BCE

and the Economist:

http://www.economist.com/node/21551520

This from Ahorro Corporacion, one of the best Spanish brokers:

Spanish public debt sales by foreign investors (€53,538Mn since November) have been offset by the resident sector’s purchases, especially by domestic banks (€71,965Mn during the same period). However, the pace of public debt purchases by domestic banks (€25,000Mn/month) doesn’t appear sustainable over the long term (especially without expectations of additional ECB liquidity injections). As a result, the key factor for a sustainable decline in Spanish interest rates appears to be the recovery of foreign demand, which is only likely to occur if there are deeper structural reforms and the government meets public deficit targets.

Without any recovery of foreign demand we don’t foresee a sustainable downtrend in Spanish interest rates albeit the impact of carry trade deals and possible secondary market purchases by the ECB could help set a cap. Assuming a scenario without purchases of new Spanish debt issues by foreign investors in 2012e and renewal of only 50% of their Spanish debt positions which mature in 2012, the resident sector would need to purchase 100% of the Spanish Treasury’s net issues this year (€38,826Mn) plus maturities not renewed by the foreign sector of €24,635Mn (total Spanish public debt maturing in 2012 of €149,300Mn * 33% held by foreigners * 50% non-renewal hypothesis). In total, the resident sector would need to finance €61,461Mn, which we believe is possible given liquidity provided to domestic banks by the ECB’s two 3-year LTROs (Spanish banks received around €250,000Mn from the two LTROs, which should be used for: meeting banks’ 2012 debt maturities of €106,100Mn, meeting 2013 maturities of €79,900Mn, and purchasing public debt to take advantage of carry trade opportunities).

More: ABC in Spain reports here that:

The cost of the public sector in Spain exceeds 200 billion euros a year . That’s the cost structure to hold the public sector in Spain as: central government, regional and local communities, municipalities, county councils and town councils and the long list of public companies, agencies and entities linked to them all. More than three million public employees from all levels of government and its agencies and public enterprises. In keeping with the extensive machinery of its public sector, Spain spends right now almost a quarter of its Gross Domestic Product (GDP). Just to pay the salaries of public employees, this year Spain will spend about 100 billion. The figure includes not only officials but also the long list of political appointees and consultants , temporary workers and contractors in the extensive network of public companies and agencies. The bulk of all that spending on salaries is for the autonomous communities, some 60 billion euros, with nearly two million workers on the payroll.