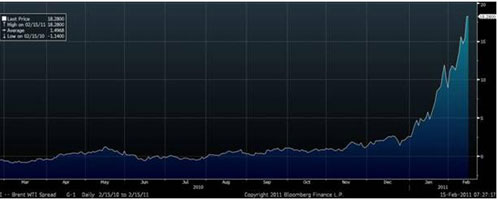

The UN resolution 1973, supported by the Arab League and accepted by Russia and China, has a clear immediate goal: Overthrow the Qaddafi government. What is not clear is what the ultimate goal is and what will be the position of the West after supporting a rebellion without defined leaders, common goals or government project. As we discussed in this column, the reality of Libya and its many tribes is more complex than we would like to admit. As a friend of mine says, “careful what you wish for,” because we are still regretting the support to the “freedom fighters”, the Taliban, in Afghanistan.I commented several weeks ago to our readers that the information that came from friends in companies based in the area, Schlumberger, Halliburton, Petrofac, Saipem and Technip were not encouraging for those who expected a quick fix. And my fear that this conflict will lead to a long, bloody and difficult transition with multiple factions similar to the Iraq and Afghanistan examples is increasing. I hope I’m wrong.

Indirectly, the two powers that derive benefit from all this are Russia and China . Russia has gone from being viewed, unfairly in my view, as a country in which western investment was a big risk to be a huge opportunity, and Gazprom is now the best source of security of supply of gas, with annual volumes of 136BCM that are cheap and safe for the European Union. The agreement between Total and one of my favourite companies, Novatek, which is likely to include Statoil, is a clear example. China has very little presence in Libya, a few Petrochina exploratory wells, but benefits in two sides . On the one hand, less international competition in Sudan, Uganda, Nigeria and West Africa, where they continue accumulating reserves, and on the other, potential access to new licenses, as they did in Iraq.

In Libya, the fact that rebel forces are multiple and with no clear leaders means that the balance of power in a future without Qaddafi depends largely on the support of Western countries, becoming with Iraq as a second vertex of control and strategic deterrence both to contain Iran and to protect Saudi Arabia and Israel. Libya is not only important for its production 1,660,000 barrels of daily exports, but as a test scenario of the fragile process of a possible change to democracy .

The exposure to Libya of major energy companies is relatively small, except in the case of ENI, OMV, where Libya is 20% and 24% of their net assets, and Repsol, with 7%. From other oil companies the most exposed are Marathon (12% of its production), Gazprom (less than 6%), and to a much lesser extent, Conoco Phillips (USA), Total (France), Hess, Statoil (Norway) and Occidental (USA).

But I have the feeling that the ultimate goal of an operation of this size, without forgetting to support the civilian population, which is obvious, is to have an operations center that allows to monitor Algeria and other neighbors that can potentially be a greatest destabilizing factor.

Libya has gone from being acclaimed in 2006 by our countries to the Chair of the Human Rights Commission of United Nations (the only vote against was the USA) to a regime to remove. But the danger of intervening, with a weekly cost, according to the Daily Telegraph , of $500 million for the allies, is that the war goes on forever and then it becomes more difficult to support other countries. And this brings us to Algeria, a country of enormous strategic importance , with 4,500 million cubic meters of proven gas reserves, the tenth country in the world, and 12 billion barrels of proven oil reserves.

Algeria is essential for Spain. It’s almost 30% of the natural gas consumed in the country according to official sources. But it is a relationship that benefits both countries, and Portugal. The joint venture of Repsol-Gas Natural, has the Algerian national company, Sonatrach, as one of its main suppliers. And, despite the legal dispute that the two companies hold (€ 1.5 billion in arbitration) and the loss by Repsol-Gas Natural of the Gassi Touil contract in 2007, there is no doubt that Spain is very important for Algeria, and that both parties are bound to understand each other. Additionally, a consortium involving Endesa (12%) and Iberdrola (20%) with France’s GDF Suez and Sonatrach, among others, has invested in the Medgaz pipeline that links Algeria to Spain. Spain’s energy investments in Algeria are around $5 billion. The Algerian company also holds shares in the Portuguese EDP (and hence its subsidiary in Spain, Hidrocantabrico) and provides another 2BCM of annual gas supply to Portugal. Algeria, therefore, is not at all irrelevant to the Iberian Peninsula.

In Libya, the opposition is tribal, and the religious-ideological content is limited, but in Algeria strategists perceive that the risk of a revolt against the regime of Abdelaziz Bouteflika can not only affect the supply of gas to Spain, with the devastating effect that this could have on the battered economy of the EU and its credit risk, but there are also fears that moderate opposition can again be dominated by radicals. In Algeria, in addition, the impact on Western investments extend to many more countries than those mentioned in Libya. Therefore, it is hard to think of the action on Libya as an isolated event.

Further read:

Lybia in Flames:

http://energyandmoney.blogspot.com/2011/02/lybia-in-flames-and-clash-of.html

Egypt and MENA risk:

http://energyandmoney.blogspot.com/2011/01/here-is-summary-of-my-views-on-egypt.html