“The Spain bailout is the one they do not want to ask for and the one nobody really wants to give”The “Spanish Bailout”… Wrong term. No rescue for Spain, but the rescue of the Spanish state and its political spending, which is very different.

The biggest risk that investors in bonds perceive is that Spain depends on an ECB support signed by some countries whose citizens do not want more bailouts. Additionally, the market is negatively surprised by the credit ratios of our country, which is already on the verge of reviewing its 2012 deficit target again, to a 7 to 7.2%. And as much as exports improve, they do not offset the effect of four consecutive years with deficits of 7% to 10%, some 350 billion of accumulated deficit since 2008. If we add the future maturing debt, which totals 500 billion in the next four years, the over-supply of Spanish bonds compared with the investor’s ability to absorb more sovereign risk is simply unaffordable .

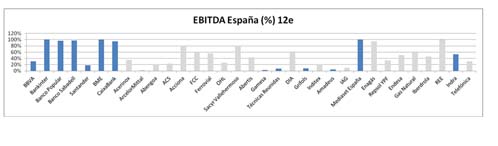

With the risk premium below 390 basis points and the yield on the benchmark 10-year at 5.75%, we have witnessed the euphoria … of the state. The spending bubble is guaranteed, Draghi supports it. Meanwhile, companies continue to see credit diminishing, and when they receive lending, it is with rates up to 350 basis points higher than the cronyism corporate zombies. And in this process of mummification of the real economy, it is not surprising that non-performing loans of banks reach a 10, 5% and have risen to 178.6 billion euros.

The question is not whether or not there will be a bailout. Unfortunately it is only a matter of time. The question is what will happen the next day.

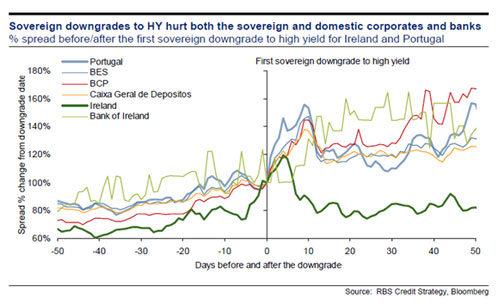

- Whatever Standard & Poors or Moody’s say, a bailout is the realization of the impossibility of free market finance. Therefore at the time the ECB purchases the first bond, bailout is similar to ” default “. That is known by our politicians and businesses.Using high-level political pressure to avoid junk bond rating before the election is only kicking the can forward. The Moody’s report is very clear. Without bailout Spain would not be ” investment grade ” , ie an independent country that does not satisfy the solvency and liquidity requirements.

- Absolute dependence on ECB: The day after the bailout Spain is an intervened state. Well, even more intervened. Fans of the “Icelandic solution” will be rewarded with their dream, being a country controlled and handcuffed (by the Troika in this case). The Spanish bailout is the one that nobody wants to give and no one wants to ask for. Nobody wants to concede it because ” once you pop there is no stop “. Spain would rely on the ECB to ensure its economic viability, but also would fall under the scrutiny of that entity that would examine monthly the country’s accounts to see how we go. If you think that there have been cuts in Spain so far, you are wrong. They really come the day after the bailout.

- Companies have the greatest difficulty. The “crowding out ” effect of the bailout implies that, again, access to credit is restricted to companies that are left the few crumbs of credit from European countries that have increased their debt by 3 trillion euros since 2002, and intend to continue. With refinancing needs of European private companies, which create jobs, of a trillion through 2015, it will be a race between predator states, banks deleveraging and companies, in the middle, suffering higher taxes, more interventionism and less credit.

When a country’s solvency, as shown in the graph below, depends entirely on the salvation of the ECB, the risk extends, it is not mitigated. And it’s amazing that, despite the promises of unlimited support, Spain’s solvency is valued at very low levels.

The risks of the next day of the bailout are:

The greater fool theory, and the German plan

Let me tell you what the market calls “greater fool theory.” It is the popular way to try to influence the price of an asset by saying that “someone”-preferably far away and unable to disprove, as “the Chinese” or “the Russians “- is coming, to try to” convince ” investors to buy. Indeed, it sometimes works. Between 2005 and 2009, half of the Ibex was a “greater fool theory ” driven by media rumours of “they tell me for a fact that Chinese will buy it. ” But it works only for a while and then investors learn not to believe the rumors. What happens now with the ECB, which has not bought a single Spanish bond, is similar. And the problem is that they expect it to work.

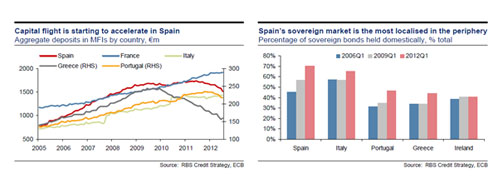

The German plan, is that, as they do not trust their partners, they want more or less in the middle of 2013 that the outstanding debt held by local investors of problematic countries is at least 85%, preferably 100%. When the debt of Spain and other countries is in domestic hands, the problem and the risk of default and contagion is not European or global, but local and, therefore, countries will have to take good care of breaching their commitments, because the effects of the default fall on the population – internal default-, given that Spain has its social security, pensions and private plans more than 80-90% invested in local public debt.

When they say that Spain would ask for the bailout but not use it, they assume that only the threat of Draghi actions will force international investors to buy Spanish bonds. I don’t see it. If the ECB forces the maximum risk premium relative to the Bund to 200 basis points, as they say, it will provide the hilarious situation where Italy has to contribute 1.5% of their GDP to the bailout with its own cost of debt at higher levels. Donation?. Then we will have to do the same for Italy and it becomes a pyramid scheme. To infinity and beyond.

Virtual Bailout is a myth

There is no “soft” or “virtual” bailout, limited conditionality, temporary liquidity or any adjective you want to invent.

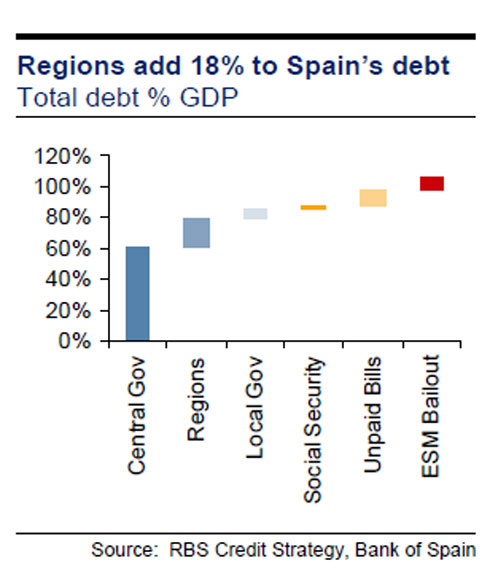

It is a mortgage and the mortgage cost. And when the country depends on the ECB, once it buys the first bond, the state is mortgaged for life. Unless we curtail public spending that neither Hollande, nor our politicians want to cut. The cuts will come to the big items: pensions and unemployment. No. exports are not going to save us when public debt is 110% of GDP.Private debt … Very publicFor investors, the tales of “debt accounted for deficit purposes” and gimmicks to account less real indebtedness do not matter. Here what counts is all debt and all that is guaranteed by the state. It might be repeated again and again, but it’s a lie, that “private debt is the problem.” Not so. Public debt is our problem. There is no demand and that is why we have to ask for a bailout. And in no small part because a large portion of the debt misnamed as “private” are unpaid bills, guarantees and government IOUs, debt of public companies … none of them counted as “excessive deficit”. But debt nonetheless. Taking into account all financial liabilities issued by the public sector, Spain’s public debt exceeds one trillion euros. And if you add endorsements and guarantees, more … see the chart below.

Illegitimate debt. Ecuador without oil

There are parties in Spain that call for an “audit” of the public debt-default-, deem it as illegitimate -default-and restructure-default-. Calling “illegitimate debt” to those commitments that have been generated under a democracy and especially between 2008 and 2011 with the approval of each of the parties and unions is surprising to say the least. But above all, they are all living in the land of the unicorns if they think default will impact on future access to credit, on the risk premium and the “social rights of citizens.”

If Spain defaults, we will see the collapse in unison of the Social Security and Pension Funds, invested up to their 90% limit on sovereign debt. And we would see the crisis extend an average of three years, and a drop of 7% of GDP ( Cost of sovereign default, De Paoli, Hoggarth and Saporta ). But above all, when I hear the comments about other countries that have declared illegitimate their debt there is a small point they tend to forget. Almost all countries that have survived these restructurings were oil-rich countries. We want to be Ecuador, but with no oil. And, of course, without its risk premium. And of course, without the credit restrictions of Ecuador. With abundant, cheap credit that we can declare illegitimate again in 2020 and move on. A joke.

Accumulation of debt is not growth