This is a guest contribution by Mark Alexander @marknewdarkage, offering a different perspective to mine on the Brexit debate. I welcome the comments and his contribution to an essential debate.

Most days will never make the history books. They are normal, uneventful, and often humdrum. No so Thursday, June 23, 2017! That was the day when the Brexit referendum was held: It will go down in history. Possibly as the day when Britons took collective leave of their senses!

This was a referendum that should never have been held. At least not the way it was held. History is not going to be kind to David Cameron, the then prime minister, for holding the referendum, because his reasons for holding it were not sound. From the start it was a high-risk referendum. And this wasn’t his first high-risk referendum either. He had already held the Scottish referendum on independence. That could easily have gone wrong for him: It could have led to the break-up of the United Kingdom. On this occasion, it didn’t. But that question has not in any way been resolved. Indeed, the Brexit referendum has made it more complex. So the problem has simply been put on back burner. The question will almost certainly rear its ugly head again sometime in the near future. Then there’s the Irish question. Will Ireland eventually unite and stay in the EU? Brussels has already stated that there is a place for a united Ireland in Europe, since the land border between the north and south is a point of dispute for Brussels. England will look pretty sick if Scotland turns to the EU, and a united Ireland too. That would leave England and Wales looking pretty diminished in power and strength!

The Scots voted to remain in the EU, so they are hardly pleased with the outcome of the Brexit referendum. They feel cheated, because the Scots are far more pro-EU than the English generally are. This can almost certainly be traced back to Scotland’s history; and to the fact that Scotland has done rather well out of its membership of the Union. Further, when the Scots voted to remain in the UK, they had been given assurances that the status quo would hold, i.e. that the UK would remain in the EU. But that hasn’t happened; so very many Scots are very displeased with the outcome of the Brexit referendum for that reason alone. And rightly so!

David Cameron made many mistakes when he held the Brexit referendum. One of the main mistakes was that it was held on the basis of a simple majority. But this was a ‘constitutional’ issue, an issue with far-reaching consequences to our future way of life, which, in my opinion, needed some added stipulations. For example, it should have stipulated that perhaps a 60% majority would have to vote for Brexit for it to take place. This would have been far better for national unity.

The eventual result was roughly 48% of voters voted to remain in the EU; and 52% voted for Brexit. Had this simple majority referendum been held on another day, perhaps two weeks later, the outcome could well have been quite different. Reversed, in fact. So, by not having a clear and large majority in favour of Brexit, the UK has been split almost right down the middle, split into Brexiteers and Remainers. Had there been a 60% stipulation, all the voters would have had to accept the will of the majority. But 52% voting for Brexit is hardly a clear majority! Thus, the country has been divided: Brexiteers are cock-a-hoop with the outcome of the referendum; Remainers, crestfallen.

Moreover, the nature of debate prior to the Brexit referendum was poor. People were not given the clear facts about the costs of remaining or leaving the EU. Debate was based on emotion rather than reason, on gut feeling rather than fact.

There would have been advantages to remaining in the EU; but they were not spelt out clearly and simply. Further, there were many downright lies told about the EU, and many false promises made too. The populists made sure of that. For example, Nigel Farage promised that there would be £350 million per week extra that could be made available for the National Health Service if we left the EU. What a con! Of course, this has since been abandoned. Nobody talks about it now. But that amount of money was bandied about before the referendum as an incentive for people to vote for Brexit. So, in a way, people were deceived. Are you listening, Mr. Farage?

Nigel Farage also promised that migration to the UK would be very much reduced. That’s a total and utter myth. What will happen is that migrants will come to the UK form the Indian subcontinent and other areas in the world instead of coming from Europe. This will change the demographics of the UK. European migrants would not have done so. Europeans share a similar, nay common, culture to the British: They are largely Christian, if only in name. They pose no threat to our way of life; and they will not try and change British culture. That cannot be said for all migrants.

Then Michael Gove, Boris Johnson and Gisela Stuart promised that our economy wouldn’t be affected if we left. Good luck with that, mesdames et messieurs! What planet were they living on?

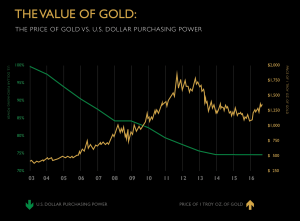

It was also promised that the Brits would be able to save money on energy bills. Well, as most of our energy is imported, and as the pound sterling has gone into free fall since the Brexit referendum, it is rather difficult to see how energy prices will ever be able to come down as a result of Brexit.

There were other promises too. All of course have been or will be broken. For example, it was stated that funding for science and research would be unaffected if we left the EU. So much for that!

It was also stated that Turkey was close to joining the EU, so there’d be another five million migrants to cope with. Well, things are working out quite differently for Turkey these days. It is highly unlikely that Turkey will join the EU anytime soon. In my opinion, Turkey’s accession to the EU was a silly notion from the start. It was the Brits who seemed to push for Turkey’s accession, much, I believe, to the chagrin of many in the German and French establishment. Nor have the electorates of Germany and France ever been keen on Turkey’s accession to the EU.

The list of false promises and lies goes on. Let that short list suffice. The examples given are illustrative of the parlous state of the debate that took place prior to the referendum.

The Brexit referendum has left people like me disenfranchised. Anyone who is Conservative-leaning, but pro-EU, no longer has a political home. But it is in the Conservative Party that the problem started. The Conservative Party, David Cameron’s party, has always been split between Europhobes (some call them Euroskeptics) and Europhiles. The Europhobes have been largely made up of people who cannot let go of the past, people who hark back to Britain’s glorious past, Britain’s days of the British Empire. In my opinion, these people just cannot let go of the past. We should now be embracing a different future – the future which Europe has offered us. Instead of that, though, we are cutting ourselves adrift, and turning to Trump’s America. And we all know how fickle he is! We are trading the certainty of Europe for an uncertain future as America’s great friend and partner. But that arrangement will only be as good as the president in office. It offers no guarantees.

Now I realize that the EU isn’t perfect. There is much wrong with it. To start with, it is too “dirigiste” and bureaucratic. These criticisms are valid and correct. Indeed, it can be easily argued that economic growth is stifled as a result. But this was reason for the UK to jump in to the EU with its two feet, and demand the changes they wished for. We could have pushed to fashion Europe into our own image. Instead of this, we have triggered Article 50 and thereby thrown the baby out with the bathwater.

It would be interesting to ask one simple question: Would this Brexit referendum have occurred had Margaret Thatcher been prime minister. Obviously, it is difficult to tell for sure, since she is deceased. However, it is true to say that she was no fan of referenda, and considered them to be merely “advisory” if held in a parliamentary democracy, which, of course, the UK is.

She was no real fan of the EU either, at least not the concept of the European superstate. What Margaret Thatcher was a fan of was the concept of the EU as a trading bloc. She wanted the countries of Europe to co-operate and trade with each other for the good of all, and for the barriers to trade to be dismantled, and for prosperity to ensue. She hated the concept of a federal Europe. And she abhorred the idea of the UK being held in a vice, a vice of regulation and unnecessary laws and red tape. And this brings us, I believe, to where we are today, to why the 52% voted to leave the Union.

The British way is to behave in an ad-hoc manner. It is not the British way to plan long into the future. This is the EU-way. Brits are reactive in many ways: They react to the need of the moment. This, however, is less true of the Germans.

EU directives have caused much resentment in the UK. British people resent being told what to do by outsiders, especially overpaid, unelected bureaucrats. They see the institutions of the EU as too expensive and unnecessary. With the excessively high salaries Brussels bureaucrats pay themselves, and their enormously high pensions, it is very difficult to argue with their gripes.

There is, of course, a historical dimension to the great British antipathy towards the European Union. The EU is run very much for the benefit of the Germans. Take the euro: It has been a boon for German exports. The old deutschmark was a very high value currency. The less high-value euro has given Germany an advantage for exporting. The euro has given German companies a comparative advantage. Many Brits resent this. They feel that the war was won by Britain, but the peace has been won by Germany.

It is plain to see that even though the euro has been a godsend for Germany, it has been a nightmare for Greece. It has decimated the Greek economy. That country is truly in a vice. But they should never have been allowed into the euro in the first place, because their economy wasn’t strong enough. It has been said that they were helped into the EU by Goldman Sachs cooking their books! Goldman Sachs masked Greece’s true debt to get them into the single currency.

It is difficult to see a way out for Greece, other than to exit the Eurozone. Greece has been lumbered with a currency which is totally out of sync with its economy. To such an extent that great poverty has been caused in Greece as a result of the adoption of the euro. This is the real tragedy.

These catastrophes, and many others, all helped to bring many Brits to conclude that it was time to get out of the EU. But I believe it is true to say that the final nail was hammered into the coffin by Angela Merkel opening the door to a million-plus ‘refugees.’ Why? Because by opening Germany’s doors to them, Merkel was also opening the doors of other countries them too. That was so because of the free movement of labour in the EU, and because of Schengen.

It is my belief, however, for all the faults of the EU as it stands today, it has brought many economic and political advantages.

Perhaps the first and most important advantage it has brought is to peace. It has brought peace to a hitherto warring continent. Since the start of the European project, there has been peace in Europe. The idea of the citizens of Europe––the French, the Germans, the Spaniards, the Italians, the Dutch, etc.––all being brothers and sisters is a fine one. Peace, before the advent of the European project could not be relied upon, as we all know. What will happen when the UK leaves? And France under Le Pen? So much is talked about Frexit these days? The EU could fall like dominoes if one country after the other starts demanding a referendum. Not only in France, but also in The Netherlands there has been talk of an exit from the Union, the so-called Nexit. There has even been talk of an Öxit! Austria’s right-wing populists dream of that! Before we know it, we could be back to the bickering which was so characteristic of European politics of yore.

Then there is the question of the prosperity that the EU has brought to most of us, not least Britain itself. I remember the dreadful state of the British economy when we entered the then Common Market (EEC), Margaret Thatcher was all for our entrance into that, for it was a trading bloc, and Thatcher was all for trading blocs. She might have been “lukewarm” on many aspects of the EU, but she was certainly not lukewarm on trading blocs. She was for anything that gave prosperity a boost. It is wrong to conclude that Margaret Thatcher was totally anti-European though. Thatcher wasn’t anti-EU, she simply had a different vision for it.

Nothing sets out Thatcher’s views on Europe better that her Bruges Speech, delivered in 1988. It was a classic Thatcher speech. It shows exactly what she thought about the question of Europe. Two quotes from this speech are as follows: “We have not successfully rolled back the frontiers of the state in Britain, only to see them re-imposed at a European level.” And the second quotation is this: “Europe will be stronger precisely because it has France as France, Spain as Spain, Britain as Britain, each with its own customs, traditions and identity. It would be folly to try to fit them into some sort of identikit European personality.” But she added: “Our destiny lies in Europe.”The Conservatives today have forgotten this. There has been no greater Conservative in my lifetime than Mrs. Thatcher. She was a true Conservative; and knew exactly where our interests lay.

Britons were grateful when we were allowed to enter the EEC. At that time, Britain had been in the grip of socialism. In fact, socialism had brought the UK economy to its knees. Britain had become the “sick man of Europe.” All this has been forgotten; and I fear that it has been forgotten to our own peril. History has got an awful habit of repeating itself. Just because we have a Conservative government at the moment doesn’t mean that socialism could not take hold again. What happened once could happen a second time.

So two very important consequences of the European nations coming together have been the guaranteeing of peace in Europe, and the prosperity that the European project has brought us.

Then there has been the positive advantage of inward-investment in the UK as a direct result of our membership of the EU. The UK has always been attractive for firms to set up here, because of Britain’s membership of the EU, Britain’s proximity to mainland Europe, its favourable tax laws and, of course, its added advantage of the English language itself. For example, it is easier for an American company to set up here for that reason alone. How inward-investment into the UK will be affected by Brexit is anyone’s guess? Not favourably, almost certainly.

But there are so many other benefits to the European Union: some economic, some socio-political. The free movement of labour, for a start, has enabled many people, especially the young, to move to other European countries to search for employment and educational possibilities. Older people can often realize their dreams of buying a retirement home in the sun.

As a result of the EU, the choice of goods and foodstuffs in the shops is unprecedented. When I was young, it was not so easy to get French, Italian or Spanish foodstuffs in the local supermarket. In fact, it was very difficult. Today, you can buy such foodstuffs in almost any supermarket. Before we joined Europe, one would have to travel farther afield to an expensive delicatessen, where the foods would often be available, but at high cost because of tariffs.

Then there is the wonderful chance people have today of using the health services of other European countries either free of charge or at a reduced cost, with the European Health Insurance Card. We will have to give this up in return for Brexit too.

There are so many other disadvantages of leaving the EU for Britain. Those mentioned are but a few of the many. One could go on and on. Even though I do not view the EU through rose-tinted spectacles, I can only feel only sorrow when I think of the time when Britain will actually leave the Union. We will lose much, but gain little. They talk of gaining sovereignty, for example. But what does sovereignty mean in a globalized world? How much sovereignty does any nation, either big or small, really have today? As people are not islands, so nations aren’t either.

Article 50 has been triggered. But Brexit negotiations will take at least two years to complete, and many think it will take a whole lot longer than that by dint of the complexities of the ‘divorce settlement.’

As far as I am concerned, Brexit is a bad idea. In economics, nobody has a crystal ball of course; but one can well-imagine that things will not go as smoothly for the UK economy as the majority of Brexiteers imagine they will. I fear that we are in for a rough ride ahead. The pound sterling might continue its decline in value, too, causing further price inflation.

Brexit has created division in the UK; and it is certainly causing division between the British and continental Europeans. I fear that the cost of Brexit will outweigh any benefits accrued therefrom. One hope that we Remainers can still hold on to, however, is this old “It ain’t over till the fat lady sings”.

@ Mark Alexander

All Rights Reserved

Please read Mark’s blog