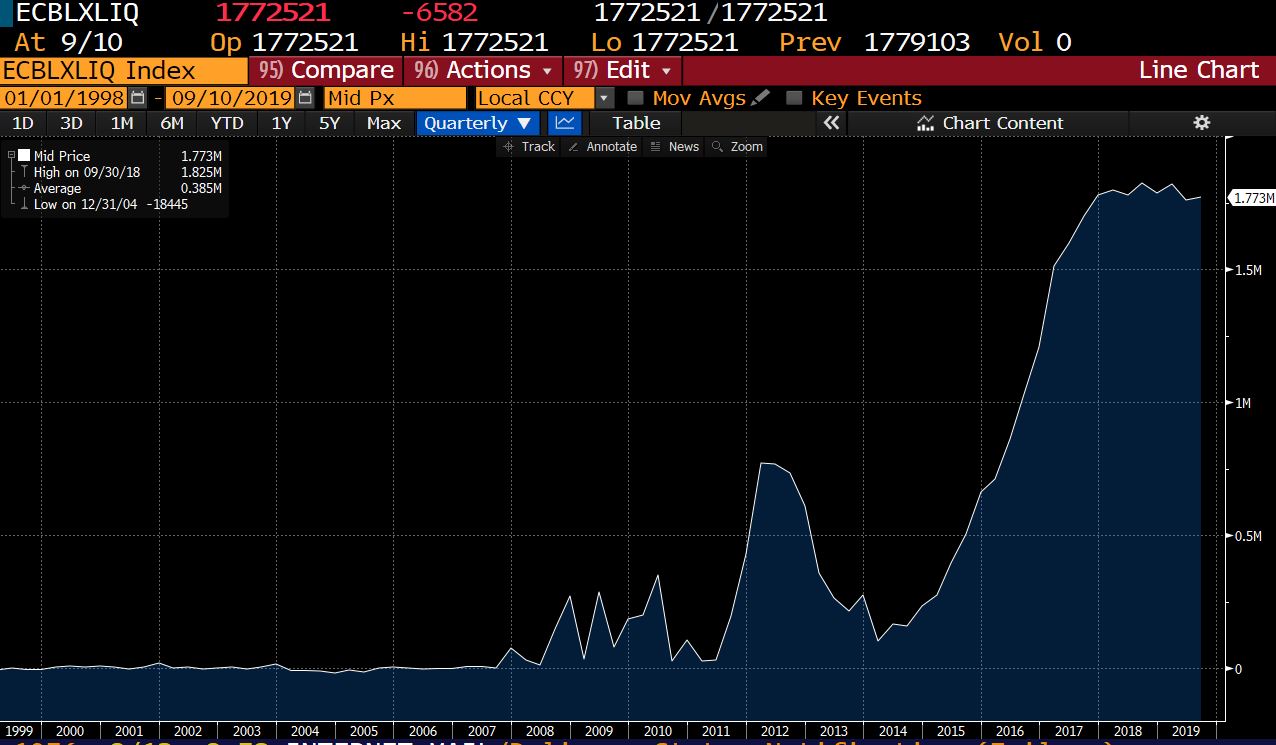

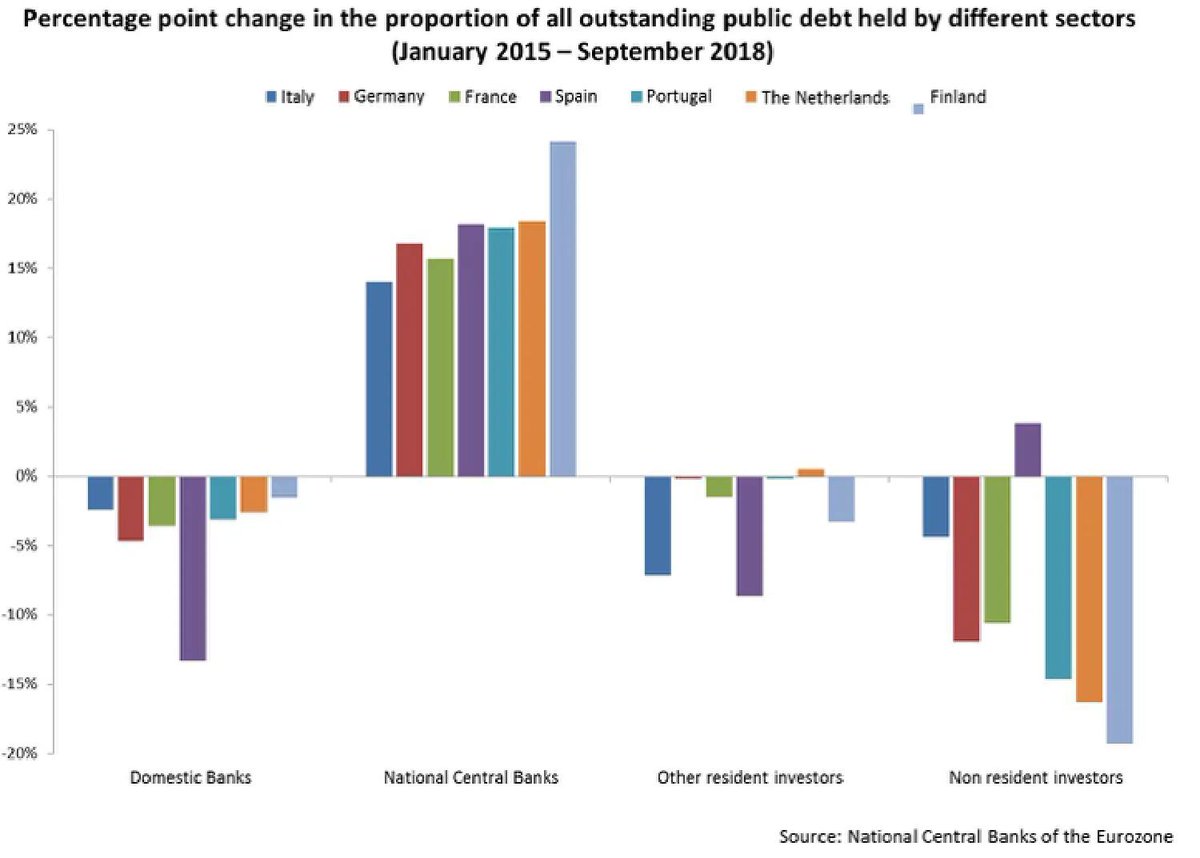

. Raised rates modestly to show signs of normalization putting rates closer to inflation, as well as giving the opportunity to understand what is the real demand in the secondary market for sovereign bonds.

. Condition all asset purchases on governments implementing structural reforms and delivering on deficit targets.

. Redirected the liquidity injections to a broad-based asset purchase system for specific requirements with a dividend and solvency commitment from financial entities (so the ECB gets liquidity back in dividends) and eliminate the negative rate on deposits.

. Increased detail on forward guidance to monitor the level of success of measures.

The eurozone’s key problems are:

. Demographics. The aging and diminishing population have significant impacts on consumption and investment patterns.

. Excess capacity. The eurozone economy is excessively leveraged to the global economy and has increased capacity expecting a growth that never happened.

. Malinvestment. Years of negative rates have incentivized current spending and malinvestment in low productivity or subsidized sectors. Multi-factor productivity growth is close to negative.

. Technology. The eurozone has not lost the technology battle, it never presented itself to it. Lack of technology innovation, strong companies, and intellectual property are a burden on growth.

. Government intervention. High tax wedge and excessive regulation on high productivity sectors while massive subsidies to low productivity sectors have made the eurozone economy less dynamic. Almost all stimulus plans have been directed at government spending.

. Lack of competitiveness. The excessive burden on the industry under misguided environmental measures like the price of CO2 and other taxes have not boosted the green economy and weakened the industrial fabric.

None of these are likely to be solved by increasingly loose monetary policies. In fact, loose monetary policy acts as an unintended perverse incentive to maintain those imbalances.

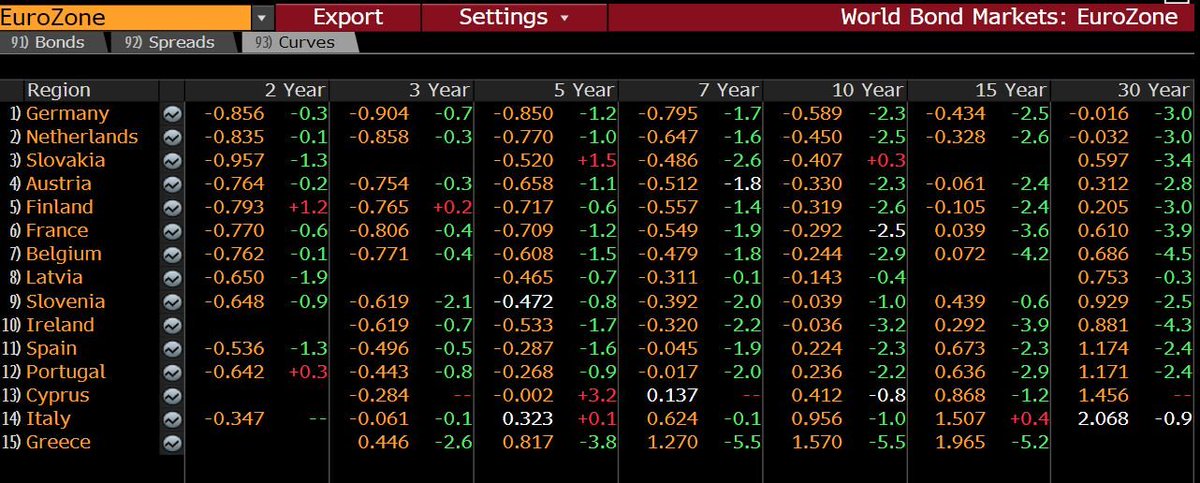

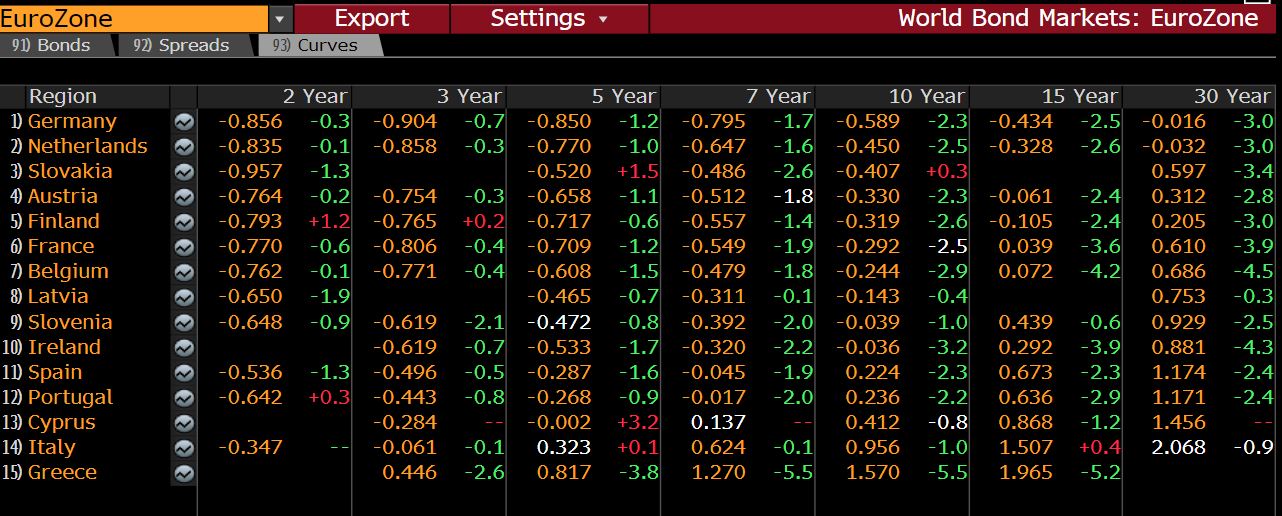

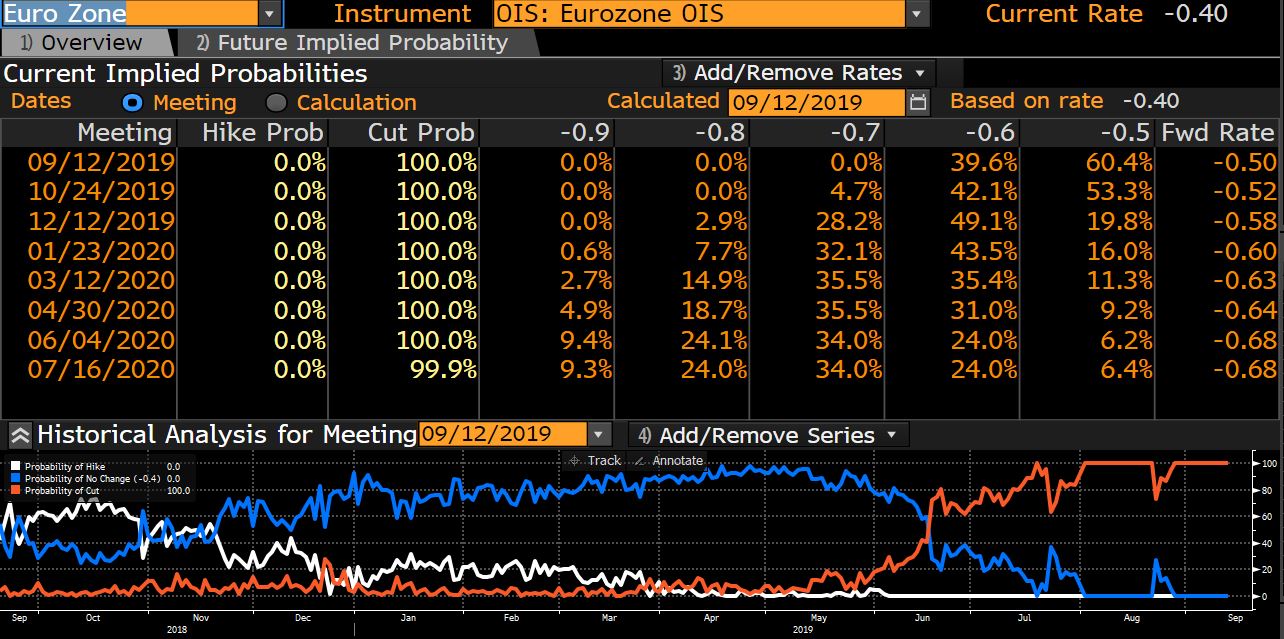

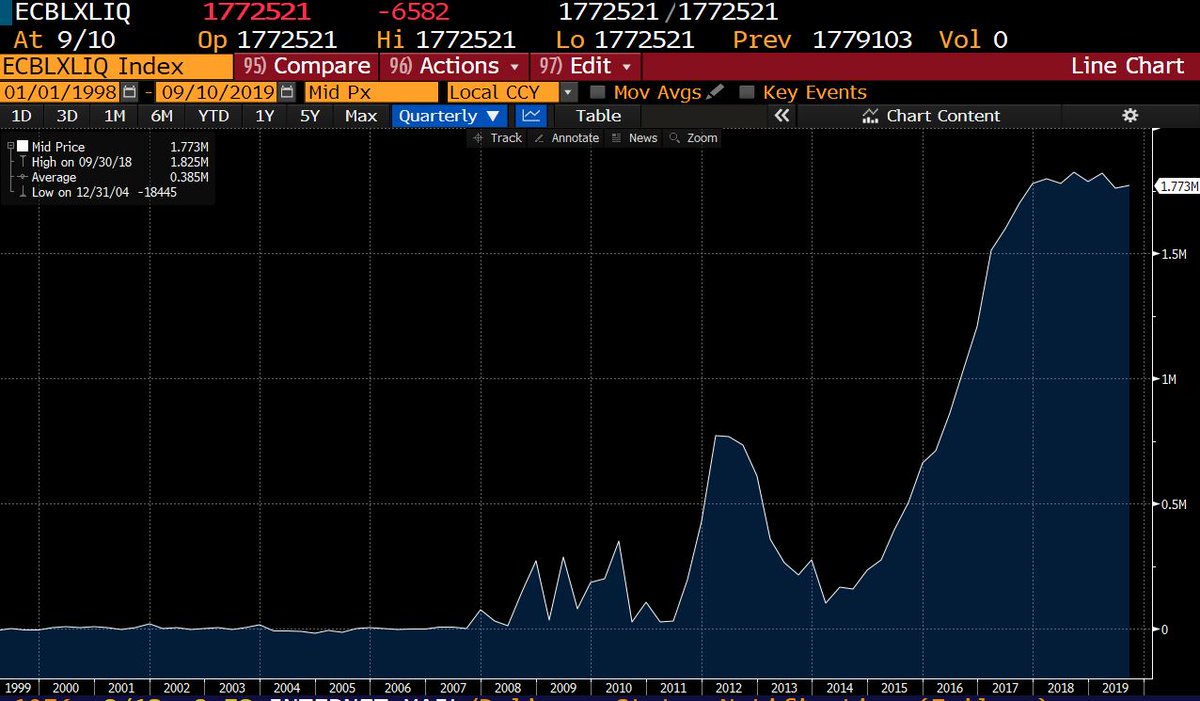

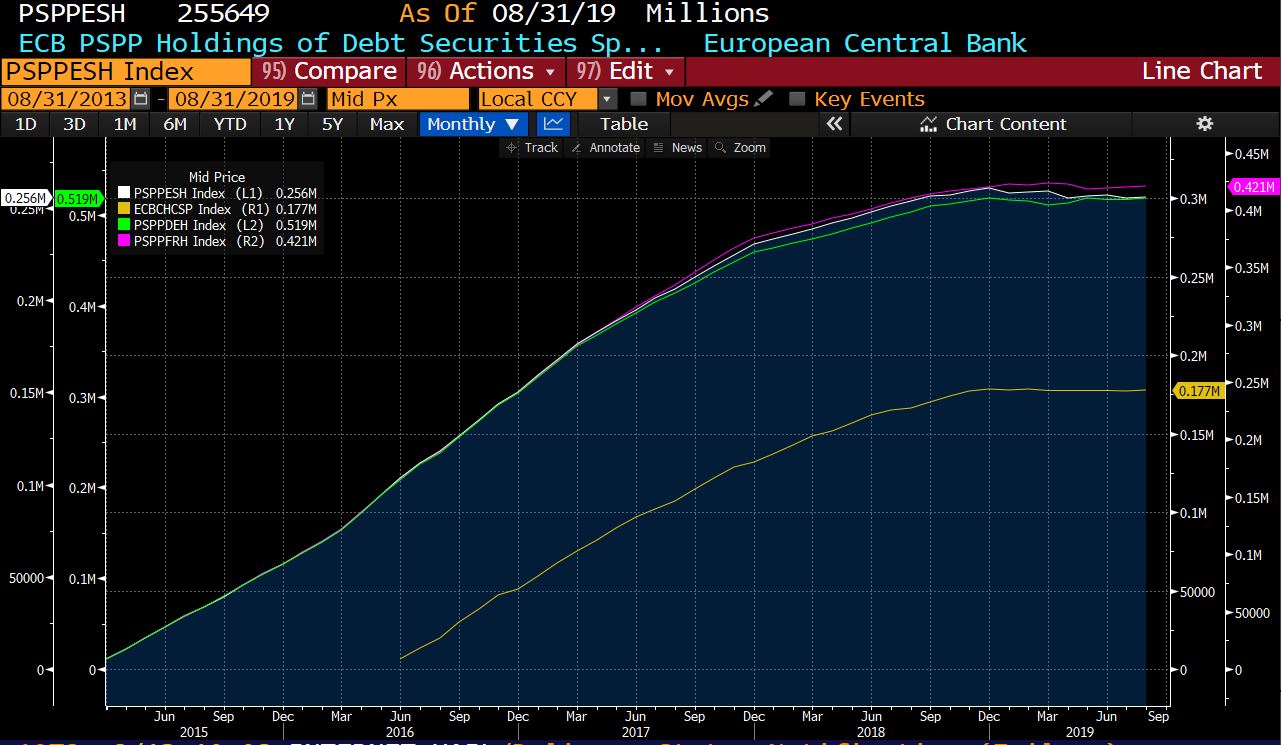

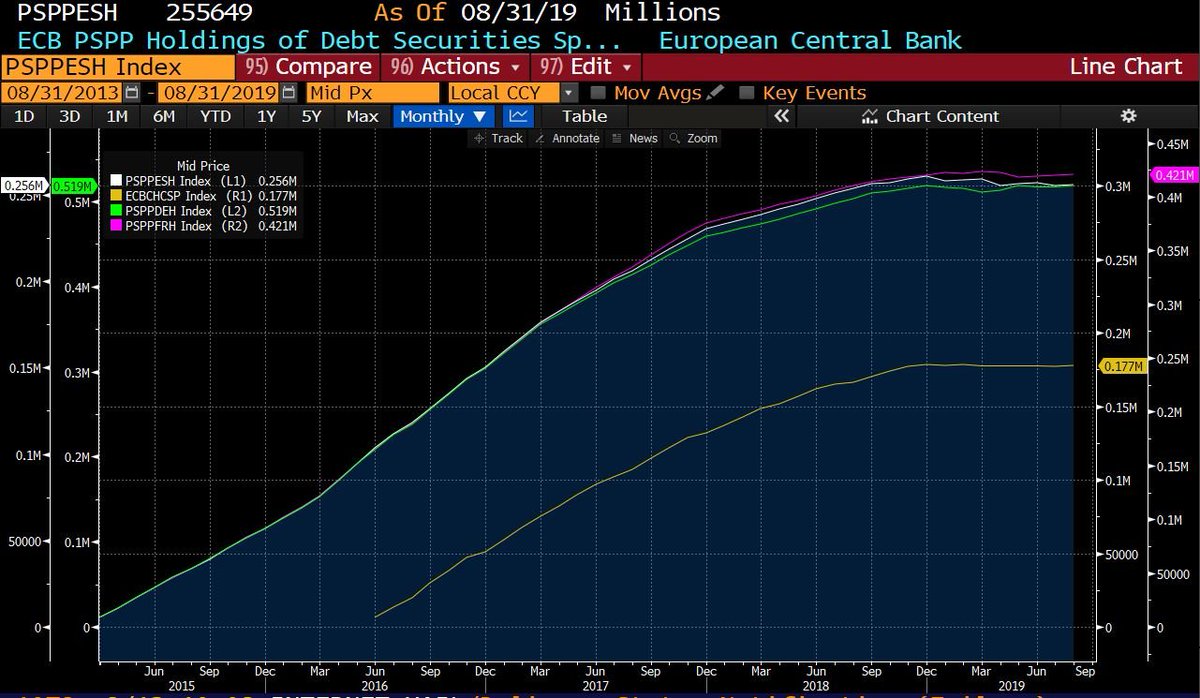

This disguises risk and creates an enormous bubble.

This disguises risk and creates an enormous bubble.

Spot on analysis, it will all end in tears worse than 2007/8 2&2 are 4 not five