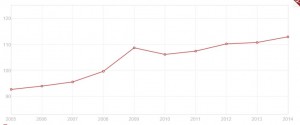

Chart shows money supply as a percentage of GDP in the OECD countries (courtesy of World Bank)

The monetary laughing gas machine has not delivered, and its consequences are felt all over the world, as seen in emerging markets. Currencies are collapsing, commodities at multi-year lows, stagflation… Years of cheap dollars flooding the markets, financing long term investments with short term QE-driven liquidity created overcapacity, distortions and bubbles… Bursting in front of our eyes ahead of a rate hike.

One of the biggest difficulties that the OECD faces is that they have launched massive stimulus plans that have ballooned the balance sheets of central banks and inflation has not been created, as they expected, while growth remains more than disappointing. Remember the three Ls: “low interest rates, low growth, low inflation”.

In the past five years, the G7 countries of have added almost $ 18 trillion in debt to a record $140 trillion, with nearly five trillion from the expansion of the balance sheets of their central banks, to produce only one trillion dollars of nominal GDP.

That is, in five years, to generate a dollar of growth the G7 have “spent” $18, with 30% coming from central banks. All of this maintaining the total consolidated system debt at 440% of GDP.

The “investment” in growth that is supposed to be come from astronomical deficits, debt and aggressive expansion of central banks simply does not bear fruit.

Central banks buy bonds that pay some interest, fine, but the value of the principal depends on keeping the financial bubble alive.

To try to tacke the “crisis”, the central bank prints money -expands credit- to buy bonds from the financial system and private savings in order to “alleviate” the balance sheet of the banks and help credit flow to the real economy.

However, by perpetuating this, the central bank has made the mistake of becoming the largest single purchaser, thus maintaining “bubble” valuations.

First mistake: the central bank buys bonds with a higher valuation compared to fundamental supply-demand value. Therefore, although these asset purchases generate a return -the central bank receives coupons of those bonds-the valuation of the principal is only justified by the central bank itself.

Second mistake: thinking that the valuation was unjustified. By extending monetary policy and asset buyback for years the central bank goes from buying “bargains” that actually traded at an unjustified discount, to purchase “whatever” is available. And it generates a bubble in bonds. It creates its own trap as the possible capital loss of buying overvalued assets is “fixed” by the central bank itself, fueling the bubble.

Third mistake: The risk curve shifts and markets increasingly pay less yield for greater risk. Thus, each new program of monetary expansion generates two perverse effects: banks and investors still prefer bonds and liquid assets, and increasingly invest less in the real economy. And the central bank is forced to perpetuate the asset purchase program in order to avoid another financial crisis. That is why money velocity collapses.

After all, excessive risk taking, be it from the financial sector or from the central bank, is the same. The imbalances that are generated are similar. However, if the financial system creates an asset bubble, it is spread among a large number of entities with different risk exposures. If the central bank feeds the bubble, especially in sovereign bonds, it creates more financial repression, printing more for longer and always paid by taxpayers and savers, whether through a lower value of the currency, more inflation, or higher taxes.

That is why the words of Mario Draghi are so important: “monetary policy cannot replace reforms”, “It is crucial to have cooperation between economic policy and structural reforms.”

Central banks cannot print growth. They may buy some time, but the effect, like “monetary laughing gas”, is short lived.

Interest rates:

Japan: 0%

Euro area: 0.05%

US: 0.25%

UK: 0.5%

China: 4.6%

India: 7.25%

Indonesia: 7.5%

Russia: 11%

Brazil: 14.25%

Iran: 21%