So being bearish, what does the market bet on?: Opec capacity additions beyond historical achievements. I call it the Perceived Oil NGO, willing to lose money and develop below cost no matter what.

Remember what bears expected in January:

A) After a disappointing 2008, non-OPEC supply should bounce back “rapidly” in 2H09 (this is essential to strip any geopolitical risk out of the oil price)

B) New start-ups add 1.4MBD to gross production by mid-09, 1.9 MBD by end ‘09

C) Demand is in structural decline and will never recover to 87 mmbpd (and efficiency and the electric car will take care of any bounce).

Starting from the end, demand destruction due to expensive, subsidised marginal technologies would be totally acceptable at $140/bbl, not at $40/bbl (below the marginal cost of several areas), not to mention the impact of credit crunch on marginal technologies, the lack of proven substitution of electric cars (minimum horse power, need more than 60 minutes to charge half the battery) and the huge need of gas and oil as electricity generating sources if electric vehicles are successful.

As for supply, remember the “dead certain projects adding 1.925kboepd of production” in 2008? Either not on stream or flows c60% way below expected.

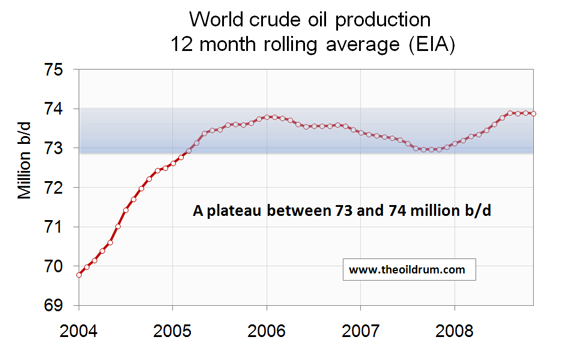

This is no peak oil view. Peak oil is about reserve depletion to extinction. This is about massive increased technical challenge and cost to achieve secondary and tertiary recovery in a world with 39 available rigs to 2009 and only 140 new rigs built until 2020 (for information purpose, Saudi Arabia would need them all to keep its current flows).

Has anyone stopped to think how much of incremental supply relies on Kashagan starting up in 2012 and flowing peak in 2013? 15%.

We are betting on Opec capacity including Iraq to increase 1.3mbpd every year in the next two years. Where are the rigs and the equipment on those projects? The two giant projects we expected are “delayed sine die”… and the service providers, Schlumberger and Technip, have no comment on timeline.

If you could take the rig counts in Saudi Arabia from 45 to 50 up to 2,000 over a decade they could basically sustain their current production at best. What you would have to do is take every rig in the world to Saudi Arabia. They are going to have one hell of a time going to 160 rigs by the end of 2009, which is their announced plan. Where are those rigs?

Saudi Crude Production in 2007 was 8.47m bl/d. Incremental crude volumes for 2008 came from:

1) Khursaniyah, Fadhili, Abu Hadriyah (AFK) which is due to start up in 3Q with peak production of 500k bl/d. 2008 contribution of 155k bl/d (500k bl/d in 4Q plus half quarter in 3Q).

2) Shaybah II with 250k bl/d in 4Q, peak production of 250k bbl/d, contributing 30k bl/d in 08 (half quarter in 4Q).

Adding these volumes together would imply crude volumes of 8.24m bl/d.

However, Khursaniyah is delayed and at the start of the year it was expected Q1. The delay equates to 280kb/d shortfall vs. expectations, or 3.3% of Saudi production.

In addition there is the decline of the base. CERA put Middle Eastern decline at ~5%, which would be about 400kb/d versus some commentators which have assumed less.

So the explicit slippage is 280kb/d or 3.3%, the impact of decline and delay is 680kb/d or 8%.

The International Oil Daily mentioned in January industry sources stating that Saudi Aramco looks set to miss deadlines on most of its projects. Khursaniyah may not reach full output of 500 kbd until December 2009, two years after schedule, as the contractor has struggled to source corrosion-resistant materials for the natural gas separation unit. Khurais (1.2mbd by end 2009) is expected to be six months late, although indications of 0.8mbd by end 2009 would be in line with my view anyway (there is room to slip more). Shaybah and Nuayyim (250kbd and 100kbd respectively) are both expected to slip from end 2008 to 1Q 2009. Khurais remains a key sensitivity, for both Saudi and the global market.

Meanwhile the signs of demand bottoming down started to appear last week (draws in crude versus an expected build of 3.5mm barrels).

Yes, it is still time to buy energy stocks… As long as they are strong in balance sheet, good cycle managers with strong dividend streams. As for renewables… the future is solid, but the near-term is heavily dependent on credit. Too tough a bet short-term.