I have read several analysis reports recommending to buy large integrated oil companies versus the market because they have underperformed. Careful.

Yes, in the last weeks the market has risen considerably and the brokers dust off the “Buy” recommendation machine and recommend laggards. I have nothing against it. But I, just in case, would list the reasons why Big Oil, as stocks, generate more risk than return.

1) Big oil is not a good way to play the oil price. The average price realization of their basket of crudes has fallen inexorably to stand at an average of $65-68/barrel, while oil contracts and licenses underpinning the future growth are very restrictive in terms of taxes and profit sharing between the producer and the company (production sharing contract). Moreover, most of Big Oil’s mid-term growth is heavily weighted to gas. This has led to most of Big Oil to generate returns of 33% in “legacy assets” and much lower, close to 15% on new projects. Therefore, to reinvest cash generated at 33% in projects that generate 15% returns destroys shareholder value, even if it’s a decision of business survival.

2) An industry that invests 33% of its capitalization to replace less than 100% of its reserves. One reason why the sector “does not work” is that multiples seem cheap (PE 8.5 x, Dividend yield 6%), but what really matters is the cash flow generation in a sector as capital-intensive as this one. Free cash flow yield has fallen year after year from 7% in 2003, with oil at $30/barrel to a very poor 3.6-3.8% in 2010 with oil at $80/barrel. Since depreciation of assets is still lower than the capital invested, the real PE (the “Economic PE”) is much higher, close to 9.5x … no longer so cheap, right? If we add that such investments can hardly replace the reserves consumed, it adds to the sector problem: “running to stand still”.

3) Diversification does not add value (to shareholders.) Another typical argument is that mega oil companies are trading at prices far lower than their sum of parts. As we have discussed other times, the conglomerate discount of about 30% is justified when the generation of returns of some of the parts is much lower than the core business. For example, one of the major listed companies invests 15% of their capex in areas (refining and power) that generate a return on capital employed of 5.5%. Then it is justified that the valuation of such activity does not add up, but substracts to the remainder of the valuation of other activities.

4) Lots of reserves does not mean value. The valuation of big oil based on reserves is not valid, unless the company, like E&Ps, was for sale. If, in addition, it appears that these companies do nothing more than buy new reserves to replace those consumed, the value of the conglomerate does not exceed $4/barrel (proven and probable) until they start generating cash. That is the reason why Big oil trades on traditional PE multiples, EV/DACF and free cash flow yield.

5) Beware of dividends. The last argument is that Big Oil pay a great dividend. Right. But it is also true that since the fall of free cash flow we have discussed, much of that dividend is paid with additional debt. So it is difficult to see that dividend as increasing in US$ terms, unless we consider that debt is too low. And at first glance, it seems like it. With 20-30% debt to capital (equity) on average, companies seem to have very little debt. But if we add working capital requirements, and turn to the equation “free cash-capex-dividend “, it is difficult to be positive, as these enormous dividends are not sustainable in a cyclical environment. Additionally, with a Free Cash Flow yield at around 3.6-3.8% for 2011 for US and Euro names and heavy requirement to ramp up capex on exploration, high dividends should not be considered as sacred.

Integrated oil companies appear attractively valued on 12-month forward P/Es relative to the market. However, once we adjust for the sector’s under-depreciation, they no longer look as attractive. The 12-month forward P/E adjusted for under depreciation shows US and European majors trading above historical norms relative to the market. As I mentioned before, the adjusted 12m forward P/E of Euro Big Oil, for instance, at 9.2x, is in line with that of the market, not 20% cheap, as the unadjusted number suggests.

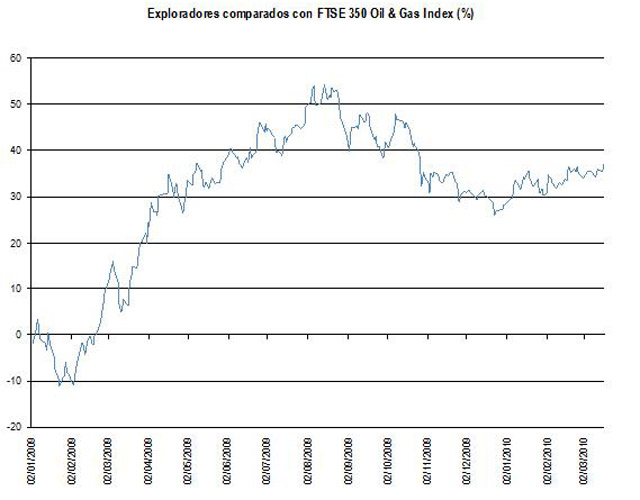

In my opinion, Big oil does not provide defensiveness vs market turmoils. So, you can only buy for the very short term. A typical case of “value trap” of stocks that seem cheap, but they are not. After a 17% stock market crash in 2010, the surprise is that they are not cheaper looking at forward estimates. I am more interested in “restructuring story” stocks such as Repsol (July 2010), so disliked by my readers and by analysts and, like the national team, rocking, driving value through the simplification of business, or in independent explorers. In my opinion, to invest in oil, it seems obvious, we must invest in companies that have real exposure to oil. Or not invest at all. Washed down hybrids are only a waste of capital and a headache.