In this era of monetary fiction, one tends to read all types of undocumented and misguided views on monetary policy. However, if there is one that really is infuriating is the MMT science fiction.

One of its main principles is based on a fallacy.

“A country with monetary sovereignty can issue all the debt it needs without default risk”

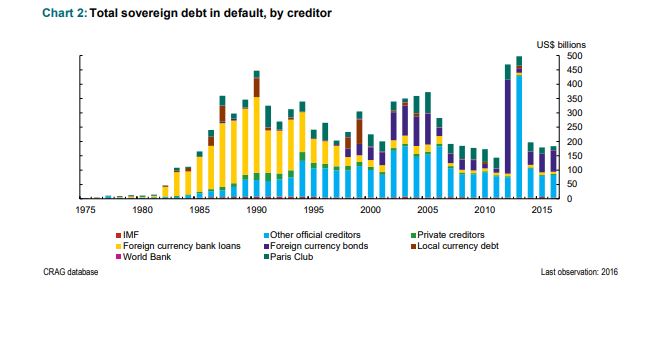

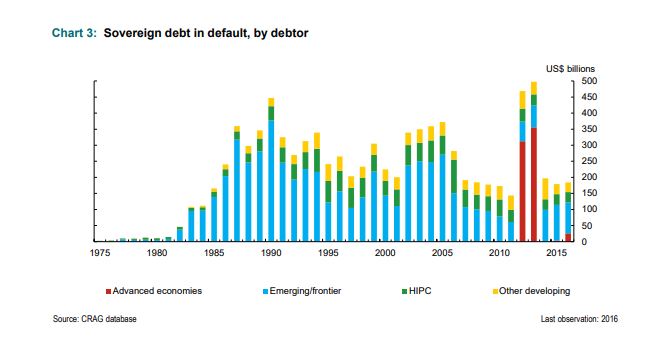

First, it is untrue. A report by David Beers at the Bank Of Canada has identified 27 sovereigns involved in local currency defaults between 1960 and 2016 (database here).

(source: Bank of Canada, David Beers)

David Beers explains: “A long-held view by some investors is that governments rarely default on local or domestic currency sovereign debt. After all, they say, governments can service these obligations by printing money, which in turn can reduce the real burden of debt through inflation and dramatically so in cases like Germany in the 1923 and Yugoslavia in 1993-94. Of course, it’s true that high inflation can be a form of de facto default on local currency debt. Still, contractual defaults and restructurings occur and are more common than is often supposed”.

No, a country with monetary sovereignty cannot issue all the debt it needs without default risk. It needs to issue in foreign currency precisely because few trust their monetary policies. Most local citizens are the first ones to avoid domestic currency exposure and buy US dollars, gold or cryptocurrencies (now), fearing the inevitable:

Most governments will try to cover their fiscal and trade imbalances by devaluing and making all savers poorer.

“A country with monetary sovereignty can issue all the currency it needs” is also a fallacy.

Monetary sovereignty is not something the government decides. Confidence and use of fiat currency are not dictated by the government nor does it give said government the power to do what it wants with monetary policies.

There are 152 fiat currencies that have failed due to excess inflation. Their average lifespan was 24.6 years and the median lifespan was 7 years. In fact, 82 of these currencies lasted less than a decade and 15 of them lasted less than 1 year.

(source: Bloomberg)

Given that the world of currencies is a relative one, the average citizen of the world will prefer gold, cryptocurrencies, US dollars or Euros and Yen despite their own imbalances rather than their own currencies.

Why is this? When governments and central banks worldwide try to implement the same mistaken monetary policy of the US and Europe or Japan but without their investment security, institutions and capital freedom, then they fall into their own trap. They weaken their own citizens’ trust in the purchasing power of the currency.

The MMT answer would be that all that is needed then is stable and trustworthy institutions. Well, it does not work either. The first crack in that trust is precisely currency manipulation to finance bloated government spending. The average citizen may not understand monetary debasement but certainly understands that their currency is not a valid reserve of value or payment system. Because the value of the currency is not dictated by the government, but by the latest purchase agreements made with such means of payment.

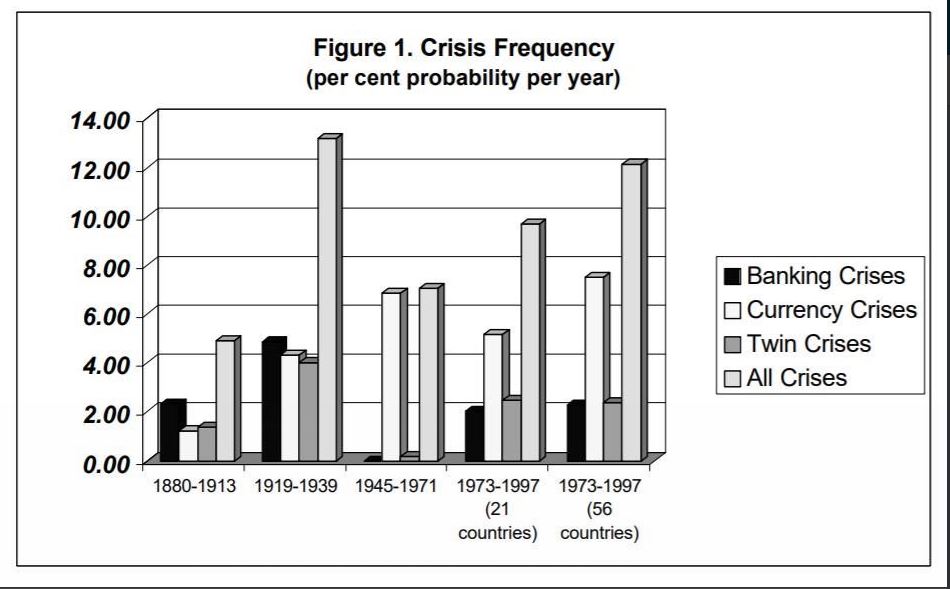

Governments always see economic cycles as a problem of lack of demand that they need to “stimulate”. They see debt and asset bubbles as small “collateral damages” worth assuming in the quest for inflation. And crises become more frequent while debt soars & recoveries weaker.

(source World Bank, Deutsche Bank)

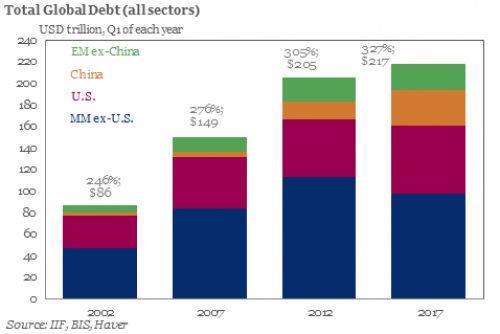

The imbalances of the US, Eurozone or Japan are also evident in the weak productivity growth, high debt and diminishing effectiveness of policies (read “Monetary Stimulus Does Not Work, The Evidence Is In“).

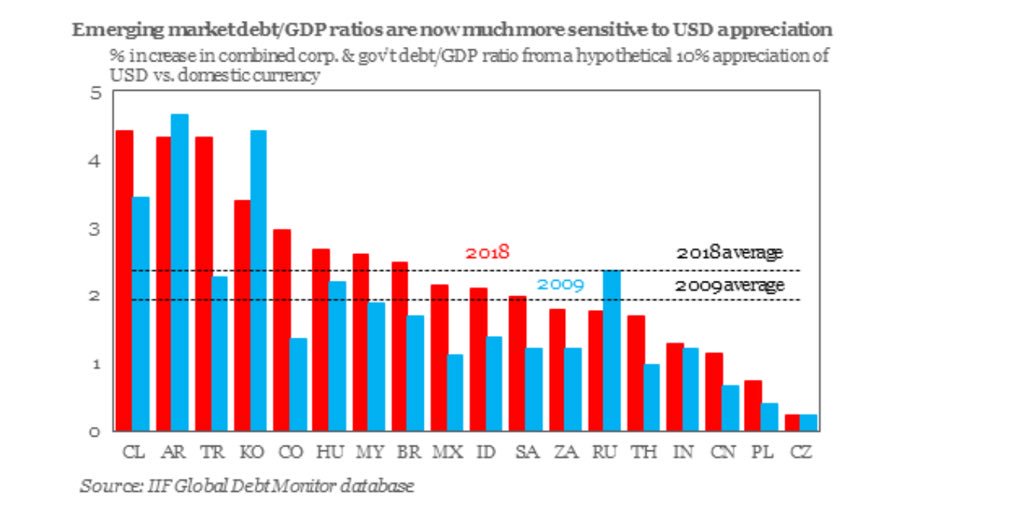

(source IIF, BIS)

Countries don’t borrow in foreign currency because they are dumb or ignore MMT science fiction, but because savers don’t want government currency debasement risk, no matter what yield. The first ones that avoid domestic currency debt tend to be domestic savers and investors, precisely because they understand the history of purchasing power destruction of their governments’ monetary policies.

Some 48% of the world’s $30T in cross-border loans are priced in US dollars, up from 40% a decade ago, according to the Bank of International Settlement. Again, not because countries are stupid and don’t want to issue in local currency. Because there is little real demand.

(source IIF)

As such, governments cannot unilaterally decide to issue “all the debt they need in local currency” precisely because of the widespread lack of confidence in the central bank or the governments’ perverse incentive to devalue at will.

As reserves dry up, and citizens see that their government is destroying purchasing power of the currency, the local savers read minsters talk about “economic war” and “foreign interference”, but they know what really happens. Monetary imbalances are soaring. And they run away.

(source: Capital Economics)

Inflation is not solved with (more) taxation.

Many MMT proponents solve this equation of inflation caused by monetary excess denying that inflation is always a monetary phenomenon, and saying that inflation would be solved by taxation. Is it not fantastic?

The government benefits the first from new money creation, massively increases its imbalances and blames inflation on the last recipients of the new money created, savers and the private sector, so it “solves” the inflation created by the government by taxing citizens again. Inflation is taxation without legislation, as Milton Friedman said.

First, the government policy makes a transfer of wealth from savers to the political sector, and then it increases taxes to the “solve” inflation it created. Double taxation.

How did that work in Argentina? That is exactly what governments implemented, only to destroy the currency, create more inflation and send the economy to stagflation (read).

These two factors, inflation, and high taxation, negatively impact competitiveness and ease to attract capital, invest and create jobs, relegating a nation of enormous potential, such as Argentina, to the final positions of the World Economic Forum index, when it should be at the top.

Excessive inflation and high taxes are two almost identical factors that hide an excessive public expenditure that has acted as a brake on economic activity since it is not considered as a service to facilitate economic activity, but as an end in itself. The consolidated public expenditure reached 47.9% of GDP in 2016, a figure that is clearly disproportionate. Even if we consider primary public expenditure, that is, excluding the cost of debt, it doubled between 2002 and 2017.

The idea that a country’s debt is not a liability but simply an asset that will be absorbed by savers no matter what is incorrect as it does not consider three factors.

- No debt is an asset because the government says so, but because there is a real demand for it. The government does not decide the demand for that bond or credit instrument, the savers do. And savings are not unlimited, hence deficit spending is not endless either.

- No debt instrument is an attractive asset if it is imposed onto savers through repression. Even if the government imposes the confiscation of savings to cover its imbalances, the capital flight intensifies. it is literally like making a human body stop breathing in order to conserve oxygen.

- That debt is simply impossible to assume when the investor and saver know that the government will destroy purchasing power at any cost to benefit from “inflating its way out of debt”. The reaction is immediate.

The Socialist idea that governments artificially creating money will not cause inflation, because the supply of money will rise in tandem with supply and demand for goods and services, is simply science fiction.

The government does not have a better or more accurate understanding of the needs and demand for goods and services or the productive capacity of the economy. In fact, it has all the incentives to overspend and transfer its inefficiencies to everyone else.

As such, like any perverse incentive under the so-called “stimulate internal demand” fallacy, the government simply creates larger monetary imbalances to disguise the fiscal deficit created by spending and lending without real economic return. Creating massive inflation, economic stagnation as productivity collapses and impoverishing everyone.

The reality is that currency strength and real long-term demand for bonds are the ultimate signs of the health of a monetary system. When everyone tries to play the Fed without the US economic freedom and institutions, they only play the fool. Monetary illusion may delay the inevitable, a crisis, but it happens faster and harder if imbalances are ignored.

However, when it fails, the MMT crowd will tell you that it was not done properly. And that it is YOU, not them, who do not understand what money is.

Daniel, that was an outstanding article, thanks! I have one question, though. In the following sentence:

“Even if the government imposes the confiscation of savings to cover its imbalances, the capital flight disappears.”

…shouldn’t the word “disappears” be replaced with “intensifies” or “increases”? The more that a government debases its’ currency by creating more out of thin air, the greater the incentive will be for people to move their assets into a more stable medium, whether it’s dollars or gold or foreign real estate. If capital controls are enacted, the incentive becomes even greater. The word “disappears” makes it sound as if capital controls lessen the incentive for capital flight

Again, thanks for a very articulate, well reasoned article!

You are right. I was trying to write reappears, but “intensifies” makes more sense. Thanks for the shout out.

Kelton and Werner suggest that the government could (and should) invest in gdp growing domains/ capital that improves productivity, and otherwise idle resources/aspects of the economy that are not at full capacity. I believe the Government of Canada did use the Bank of Canada to issue itself virtually interest free loans at times between 1938 and 1974 to help with mega-projects such as the St. Lawrence seaway construction. I’ve seen the list of such borrowings, and the amounts were never exorbitant. I wonder if this technique could be used in a situation like in Saskatchewan, where steel mills are being hit with temporary (hopefully) U.S. tariffs. This might cause significant layoffs and economic disruption. Can government funds be injected there to help its functioning for a period. If so, why is it better for the government to borrow funds at interest from money-lenders than from the Bank of Canada for no interest? I also wonder about situations where the government can spend money now to save it later. Investing in social housing has been shown in recent studies to dramatically reduce social problems and costs. Education is a similar story. Thanks for your time. I look forward to learning from you.

Dear Dan, what you mention is very different from what MMT proponents suggest. You are right, there are incidents when governments can support investment with real return. However, think about this for a moment. If those projects are worthy and profitable, why did the private sector pass on them? There might be a few occasions in which there is a logical explanation to that answer, but most of the times governments will use public resources for white elephants (massive projects with high debt and no real return) to “inflate” GDP. The Canadian government has -thankfully- never done anything remotely similar to what MMT defenders propose, and one of the reasons why the Canadian dollar is a stable currency is because governments, for the most part, understood that the private sector should not be crowded out by political spending and even less monetize that debt. Even so, the extent of the housing bubble is concerning and money supply growth is part of the reasons behind it. Thanks a lot for the comment and for following.

You don’t understand MMT at all. You probably should before you try to critique it again.

See? Lovely. Just what I say in the last sentence. MMT believers always resort to “you don’t understand”. Like a cult. Lovely. Read: https://mises.org/library/upside-down-world-mmt

Oh good lord. Pathetic.

You just described yourself, congratulations.

Agreed.

MMT does Not say, except in shorthand, that MS governments can not go broke in their own currency. You need to add “as long as resources are available for sale” It’s not MMT’s fault if that is left out of the description. So you are right to say they cannot issue all the debt they want., but that is not what MMT says, so it is incorrect to attribute that to MMT. Some people, you included, know enough about MMT to be misinformed. But that’s a hazard with any theory or law.

What makes MMT real is the constitution which gives the power to create currency to the government. In the US case it’s a currency law passed in 1792 that set up the dollar and it ran concurrently with the English pound and Spanish dollar right up to 1840. as legal tender. But even then only the US dollar could created by the Federal government.

MMT says federal taxes do NOT fund federal spending, not 1 cent. Taxation CANNOT be a source of revenue – except for the non MS states and us. Obviously you have to have government money before you can pay tax so spending gas to come first. Spending comes from the federal government provisioning itself and creating work. You cannot create money without first there is a debt to pay. When the government buys its debts, the debt is extinguished at that moment so the money is not liability money, unlike bank debts. There is no free money. It is always associated with debt, it is an IOU. The government is free to create currency to pay down debts, and that is a book keeping operation in the Federal Reserve to mark up numbers in accounts held there.

Governments are not in the business of profit making. They also don’t have to borrow or save their own money. They set the ground rules for the private sector to profit from. They provide the laws and the infrastructure , the welfare and entitlements they are DUTY BOUND to provide to everyone, none of which needs be profitable. It is stupid policy to take away what is the infrastructure and health and education. This is vastly inefficient because buying healthcare the people have to use their post tax earnings and pay for the corporations profits out of their hard earned post tax dollars. Government healthcare etc is free.

To close it’s worth understanding what budget surplus and deficits stand for. The federal government has annual budgets, and each fiscal year balances to zero, then restarts. So in a given year the spending is greater than the destruction of the currency, by taxes., so we have a deficit . this is spare funds that feed into the economy and helps it grow. On the other hand a balanced or surplus budget is a surplus of taxation withdrawn from the economy. As an accounting identity the government surplus must equal the non government deficit so the private sector has to stump up the resources to balance the figures.

This always leads to recessions and depressions.

I could go on, but that’s enough for now.

Lots of interesting points I disagree with but will comment in further articles as too long to explain in a response. Regards and thanks for the comment. Watch this space.

Hi John. As promised, I am back.

First, the literature on MMT constantly refers to “a country with monetary sovereignty can issue as much currency or bonds as it wants. And that it is entirely up to the government how much of each and what interest they pay on any bonds”. None of those assessments are true, in fact they are all untrue.

Second, to your point.

“Spending comes from the federal government provisioning itself and creating work. You cannot create money without first there is a debt to pay. When the government buys its debts, the debt is extinguished at that moment so the money is not liability money, unlike bank debts. There is no free money. It is always associated with debt, it is an IOU. The government is free to create currency to pay down debts, and that is a book keeping operation in the Federal Reserve to mark up numbers in accounts held there”.

Here comes the problem of MMT. It does not understand the perverse incentive of “first money” recipients. Government receives the first money created and passes the imbalances to the last recipients, savers and salaries. The idea that it is a perfectly designed IOU that will not generate high inflation and subsequent larger imbalances can only come from the incorrect perception that govermnnment has a perfect assessment of supply and demand and a pristine understanding of slack or oversupply in the economy. There is no evidence of that, rather the contrary. It has the incentive to always assume any problem is a demand problem and create more IOUs. An IOU has an asset attached, just like any other instrument of borrowing. if that asset is the NPV of economic growth it is exactly like lending to a company that overestimates its earnings potential. In the case of the company it goes bankrupt, in the case of the country it destroys purchasing power of the currency and sends citizens into stagflation or hyperinflation. Because once it does not work, government has all the incentive to print more IOUs.

“Governments are not in the business of profit making”. of course they are not. They are not in the business of crowding out the private sector and stealing those profits and savings through inflation and currency debasement either. Yet that is what they are incentivised to do when the diagnosis they make of any economic problem is that it is a “demand problem” that they have to solve borrowing against our grandchildren’s savings.

Governments’ entitlements and welfare are a consequence of a solid, profit driven private sector, and the wealth creation and savings of citizens. Those entitlements and welfare only exist because there is a strong motor in the economy.

The government, by definition, has all the incentive to believe that the private sector is not working “as it should”, because it does not spend its money, but others’. Hence the typical fallacy of “excess savings”.

If you distort the process of wealth creation starting with the IOUs based on govenments’ view of what is fair and needed, instead of supporting a stronger private economy where millions of agents make mistakes and other make great successes, one single agent -government- supports a constantly weakening economy that disincentivises precisely the government’s source of revenues by imposing its incorrect diagnosis to others’ via monopoly actions. Printing money does not solve that imbalance, it worsens it.

Again, MMT’s mistake comes from an angelical view of government in the process of money creation, an optimistic analysisi of the first and last recipient of money problem and a completely distorted understanding of government’s ability to understand supply and demand of money.

I completely disagree on your sum-zero analysis. The world runs on surplus, always has. Deficits are not always and in any case spare funds that feed into the economy. Deficits are borrowing on future expectations. The same as a loan can be good, not all loans and any loan are good for the economy. When unproductive lending, as most government spending deficits are today, overtakes real productive investments with real economic return (remember Keynes?), it stagnates the economy and destroys the purchasing power of currency.

Ultimately, my problem with MMT is always the same. MMT views government as a force of good that perfectly understands the needs of the economy and has no perverse incentive to create large imbalances and pass the problem to citizens through financial and political repression.

No process of money creation can be productive when it is imposed by an agent that controls not just the financial but the police and military system. The same way that we have rightly criticised some private banks’ actions, imagine what it becomes (and history proves it) when instead of being banks competing -and failing- you have a monopolistic power that imposes force to all other agents. The failure is imposed on citizens too.

That is why MMT rightly criticises the current inefficient process of money creation and then massively fails when its proponents defend that the imbalances created by private money creation will be solved by… government coertion!. It is truly like making the right diagnosis about a customers’ cirrhosis and recommending the barman to take control of the customers’ drinking habits.

Even worse, MMT tends to ignore those risks as collateral damages that will be solved some day by a sum-zero view that the economy will respond, and it does not, because the agent that has been given the power is also the one that implements repression on its citizens, without any market or competitive force to stop it. Finally, the country-nation boundaries and sector boundaries that MMT sets to generate its top-down view of how th eeconomy works is simply inexistent in real life anywhere. it is not there for the US or China and, obviously, even less for the rest of the world.

Enjoyed the chat. I suspect we will enter into an “agree to disagree” debate, and any example of failures I give you will be met with “that was not real monetary sovereignty” answers. But I thank you for the interesting comment. The best so far. Congratulations

First off, this isn’t quite what MMT says “A country with monetary sovereignty can issue all the debt it needs without default risk”

It says it can issue as much currency or bonds as it wants. And that it is entirely up to the government how much of each and what interest they pay on any bonds.

http://bilbo.economicoutlook.net/blog/?p=40250

It says it can always afford to purchase anything in it’s own currency that is for sale. If they rely on imports for something necessary or they lack the productive capacity then money printing would just be inflationary. Whereas not all rapid money supply growth is inherently inflationary. http://evonomics.com/moneysupply/

You will only see inflation if there are raw material shortages (water, sand, labor, oil, ect). MMT says that inflation, not the national debt, should be the dependant policy variable you are targeting when determining taxes/spending.

And just so you don’t come back with another gotcha let me correct the previous commenters haste. Absolutely every government can be segmented into these three sectors: Domestic Government, Domestic private, Foreign sector. It is an accounting Identity that the three sectors must sum to zero. Which is why this graph is symmetrical: https://twitter.com/UserFrIENDlyyy/status/1015799580166950912

So countries like Norway, that are huge exporters, have no problem constantly running a Gov surplus without throwing their private sector into debt. And it is why every time the US, with our massive trade deficit, even decreases our Gov deficit too much it can force the private sector to go underwater (which does not last long before it creates a recession. Here is the math behind the sectoral balances: http://bilbo.economicoutlook.net/blog/?p=32396

Feel free to tweet me if you want clarification on anything else MMT.

“it can issue as much currency or bonds as it wants. And that it is entirely up to the government how much of each and what interest they pay on any bonds”.

Cool, it is a complete fallacy as well. As proven in the article.

No, those three segments are not an accounting identity that sum to zero. That is as incorrect or as science fiction as believing that demand and supply of money grow in tandem.

The examples of Norway and the US are exactly what I say. No, none of those countries issue as much money and debt as they please. Hence the budget limits and the measures implemented by government in Norway.

Sorry, none of what you wrote changes what I explained.

No, a country with monetary sovereignty CANNOT issue as much currency or bonds as it wants. And EVEN LESS SO that it is entirely up to the government how much of each and MUCH LESS what interest they pay on any bonds”

Sorry, but not at all.

Excellent article, but the mind boggles when reading:

“When everyone tries to play the Fed without the US economic freedom and institutions, they only play the fool.”

Are you implying that everything you cogently wrote does *not* apply to the USA?

Given that the US government is entirely on the same path, one would conclude that the inevitable crisis will be at planetary scale, something we did not yet witness even in the previous century.

No, it does apply to the US (as I say as well in the article, explaining it goes from crisis to crisis due to this policy). I only explain that most countries “copy” the Fed only in printing. Thanks for the comment

MMT is easy to pick apart, but you are more of less saying a gov with a printing press can’t print as much as it wants. Maybe that’s nit picky, but I can’t read articles that start with a denial of a fact. The best critiques of MMT, and the best description of monetary policy, come from Cullen Roche. I keep trying to find others worthy of him, but unfortunately even the ones that come close like you sort of do, find ways to then entirely miss the mark.

I don’t deny a fact. I deny a myth propagated by MMT proponents. Thanks

1. Debt hawks have been claiming the U.S. debt is a “ticking time bomb since 1940. (See: https://mythfighter.com/2020/09/06/your-periodic-reminder-after-80-years-the-federal-debt-still-is-a-ticking-time-bomb/)

In 1940, the federal debt was $40 billion. Today, it has grown to about $25 TRILLION! That’s a 62,500% increase.

The “time bomb” still ticks. 80 years of doomsday predictions, and still wrong. Will they never learn?

2. The federal “debt” is not debt in the usual sense. It is nothing more than the total of DEPOSITS into T-security accounts, which are similar to interest-paying safe-deposit boxes. Because the government has the unlimited ability to create dollars, it never touches the dollars in T-security accounts.

To “pay off” the so-called “debt,” the federal government merely returns the dollars to the account owners. The government could pay off the entire debt tomorrow, simply by returning the dollars in the T-security accounts.

Then we would have $0 “debt.”

3. The sole purpose of T-security accounts (“debt”) is NOT to provide spending dollars for the government, but rather to provide a safe parking place for unused dollars. This helps stabilize the dollar and also helps the Fed control interest rates.

Thus, the U.S. government does not borrow. It has no need to borrow. It creates dollars, ad hoc, by paying creditors.

4. Inflation is not caused by “excessive” federal spending. There is no relationship between federal spending and inflation. (See: https://mythfighter.com/2021/03/20/federal-deficit-spending-causes-inflation-except-when/).

All inflations are caused by SHORTAGES, usually shortages of food or energy.

The illusion that spending causes inflation comes when governments REACT to inflations by printing currency, exactly the wrong thing to do.

A government actually can cure an inflation by spending to obtain the scarce items and distributing them to the populace. For example, Zimbabwe’s inflation could have been cured had the government purchased food from abroad and/or helped the farmers grow more food.

Thus, increased spending often can cure inflation. That is how Germany cured its prewar inflation and paid for the mightiest war machine the world had ever known.

5. The federal government neither needs nor uses taxes. In fact, all tax dollars sent to the Treasury are destroyed upon receipt. They cease to exist as part of any money measure (M1, M2, M3, L).

That is why no one can answer the question, “How much money does the U.S. government have?”

The only answer is, “Infinite.”

The sole purpose of taxes is NOT to provide spending money to the federal government but rather to control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to encourage.

Currently, the federal government is “printing” (misleading word, money is not printed) trillions of stimulus dollars. The debt hawks are setting their hair on fire and predicting crises.

There will be no crises, But the debt hawks will do what they have been doing for the past 80 years. They will ignore reality, and continue to claim the so-called “debt” is a “ticking time bomb.”

Pitiful.

Your entire thesis is based on science fiction, especially the one about infinite money.

There are a few articles in this website debunking the phoney MMT myths.

Then it would behoove you to actually explain how a government like the US, issuer of a fiat currency, does not technically have infinite money, or providing links to such explanations!

It may have infinite money, but not infinite reserve currency with stable purchasing power. Zimbabwe has infinite money. Try using it to buy anything. You can understand that.

Que tendrá que ver Zimbabwe y la mayoría de los países que cita con la MMT. sabe usted que es la soberanía Monetaria. Son soberanos monetariamente desde el punto de vista de la MMT los ejemplos de países a los que usted hace referencia. Se lo digo. Nada

Oooooh claaaaro. Nadie es soberano monetario según la MMT excepto EEUU… Ah, que tampoco porque depende de los flujos monetarios de Asia y el resto del mundo. Ah, que el euro tampoco porque depende del flujo de superávit comercial en dólares. Ah, que el Yuan o el Yen tampoco porque depende de la entrada de flujos en divisas de sus empresas. Acaba usted de demostrar por qué la MMT es una bobada sin ninguna lógica. Enhorabuena.