If there is anything that we have learned from the development of the British economy since the Brexit referendum is that doomsayers were wrong. Continue reading Brexit. May’s Way Is Not The Only Way

All posts by Daniel Lacalle

US dollar strength. Causes and opportunities

Catching a falling knife is never a good idea. Continue reading US dollar strength. Causes and opportunities

OPEC’s Dilemma

The fundamental problem of the last OPEC meeting is the evidence of the division between two groups. One, led by Iran, which wants higher prices and deeper cuts, and the two largest producers, Saudi Arabia and Russia, who support a more diplomatic position. Continue reading OPEC’s Dilemma

The fundamental problem of the last OPEC meeting is the evidence of the division between two groups. One, led by Iran, which wants higher prices and deeper cuts, and the two largest producers, Saudi Arabia and Russia, who support a more diplomatic position. Continue reading OPEC’s Dilemma

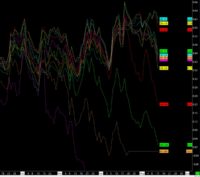

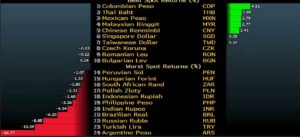

Trade War? No. Saturation of Monetary Excess

In the past week, emerging markets have seen the highest outflows since September 2015. Additionally, the Chinese market and its currency have completely roundtripped from the January highs. Continue reading Trade War? No. Saturation of Monetary Excess

In the past week, emerging markets have seen the highest outflows since September 2015. Additionally, the Chinese market and its currency have completely roundtripped from the January highs. Continue reading Trade War? No. Saturation of Monetary Excess