As I mentioned in CNBC recently, oil was on its way to re-rate. Since then, Brent has risen 6%, with WTI +7.5% despite US record production (8.9 mbpd) and perceived slow-down of demand growth. Continue reading Geopolitics and the Oil Price

Category Archives: Sin categoría

Mortgage Rates Explode in US

Brussels and the Curse of Lender’s Generosity

“Debt is the slavery of the free” Publilius Syrus

In Spain we have spent weeks hearing the supposed benefits of “relaxing deficit targets” and listening to many regional governments talk about “sharing the funds” as if debt was a donation and not a liability. Then, suddenly, the Troika arrived in Madrid and reminded us of what no one wanted to acknowledge. That debts have to be repaid and that there are no unconditional loans. Now, after a lost decade inflating the political spending burden, Spain faces more problems because the country has delayed for too long the inevitable reform of the Public Administration, and the bursting of the housing and civil work bubbles probably leads to a much more challenging solution. Continue reading Brussels and the Curse of Lender’s Generosity

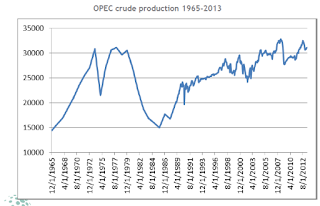

OPEC meeting … Not worried about shale oil

Following on with my post about “the US path to energy independence“, it is interesting to highlight these data-points from the OPEC meeting:Implied OPEC spare capacity likely to grow to 6.38mbpd in 2018.

Following on with my post about “the US path to energy independence“, it is interesting to highlight these data-points from the OPEC meeting:Implied OPEC spare capacity likely to grow to 6.38mbpd in 2018.