(This article was published in Cotizalia on 19/3/2011)

Let me begin this article by sending a heartfelt remembrance to the great country of Japan, and to all those affected by the disaster and their families. We don’t forget them.

But my job is to talk about energy and the disaster has a huge importance for the market of oil, gas, nuclear energy and CO2.

The perceived risk of nuclear energy has soared , even leading to Angela Merkel to take the populist measure of ordering to stop the seven nuclear plants built before 1980 for a period of at least a month. This implies a loss of about 7.1 giga watts of electricity generation in a country that has not seen a nuclear accident of any relevance in many decades.

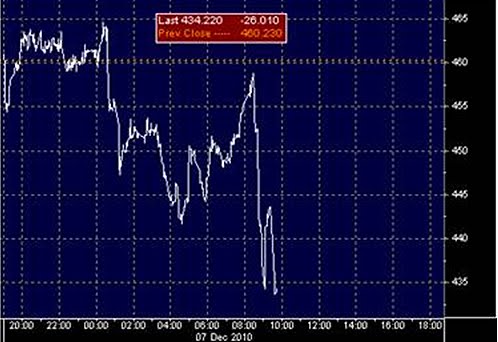

What has been achieved with this measure has been to make the country poorer as energy prices soared, but also impacting the EU, as wholesale electricity prices in UK, France and other countries, which remained depressed for months, are up 11%, coal is up 14%, gas (NBP) is up 12% and CO2 prices, which had not moved for nearly eighteen months, have risen 10%, above the expected increase in thermal generation, thus slashing any remote possibility of meeting the Kyoto targets, in addition to giving a blow to competitiveness. The price of uranium plummeted 19% to $ 54/lb on the risk of loss of at least 7% of annual demand. All for the perception of political risk, ie that the European Union will take action against nuclear energy.

The Fukushima Daiichi’s accident is very important. But it is an exception. And if there is proof of the security and reliability of nuclear power, it is shown by the fact that out of the 11 reactors affected by the earthquake, only two have suffered an accident. And this exception originated in the midst of a natural disaster which unfortunately coincided other unusual circumstances, such as the blackout of eight hours. To make wild and hasty conclusions about the rest of nuclear power stations, particularly in a country, Germany, where there is no seismic risk, is incredible. That does not mean that we should not review and improve all security systems. But … stop 30% of nuclear power stations in Germany due to an accident in Japan?.

The loss of the capacity of 11 nuclear plants in Japan has an immediate effect of increasing demand for liquefied natural gas (LNG) by substitution effect. In 2007, when Japan closed the Kashiwazaki-Kariwa nuclear plant, 40% of the lost capacity was immediately replaced by gas.

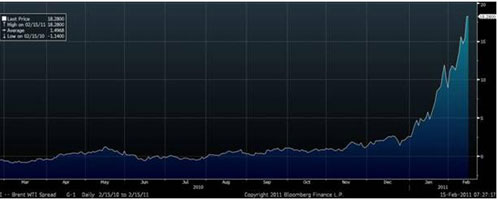

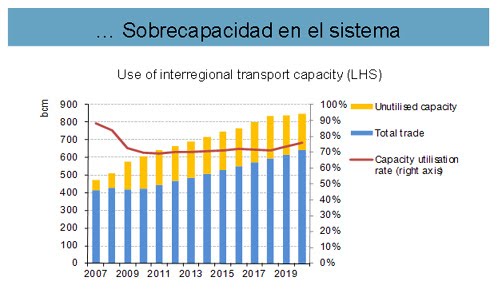

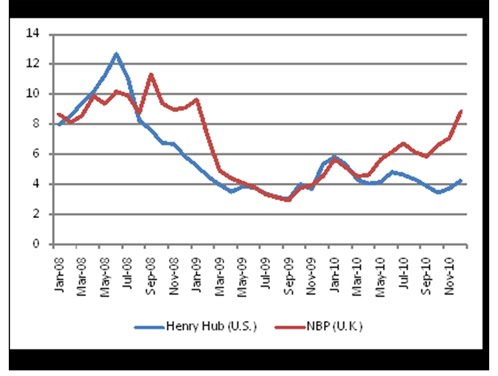

The impact on the demand for LNG (liquefied natural gas) caused by the loss of nuclear plants mentioned can be up to 0.7 BCF/ day, ie, absorbing 50% of the current excess capacity of the gas system. This would send to Japan from 5 to 6 additional LNG tankers per month . At the time of writing this article, the price of liquefied natural gas contracts for new ships had soared, from $ 9/MMBTU a month ago to nearly $14/MMBTU. Still at prices well below those of 2006, making the LNG the cheapest alternative back-up energy source today.

For the oil market, the Japanese tsunami is, to give you an idea, similar in volume to the impact of Libya for the supply side, but of opposite sign. That is, Japan means a possible loss of demand of about 1.3 million barrels per day. Assuming only the impact of Japan, which is about 4% of global refining capacity, and no contagion effect on the economies of the West, there could be a further impact on oil demand.

And all this leads to renewables. Interestingly, the initial effect has been an avalanche of buyers into solar stocks . But in a sector with structural overcapacity, the loss of demand in Japan, which is about 7-8% of global demand for solar panels, will be a real problem that will not be easily offset despite the dreams of launching more aggressive environmental policies.

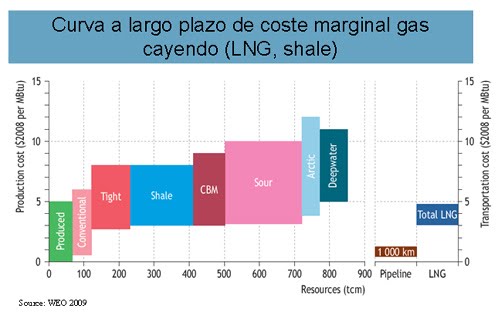

The view that solar will suddenly grow exponentially is questionable particularly when U.S. and European gas is still much cheaper than solar energy (photovoltaic) despite the cuts in the premiums seen in Germany, Spain and other countries . And coal is also much cheaper and reliable. Even if CO2 prices soar to €23/tm (it’s at €17.5/mt right now), coal generation runs at a fraction of the cost of solar photovoltaic. To give you an idea, in Germany, the same government that takes action against nuclear plants has seen the brutal effect of solar energy on prices. Germany has accumulated 40% of global solar installations over the past two years and has seen the cost of subsidies reach to more than €56/MWh, 56% of the retail price for the consumer.

Alternative energies are valid but can not replace nuclear power and, as any alternative, should prove to be cheaper than the incumbents. Because if not, the anti-nuclear rhetoric, anti-oil, anti-everything that is going on is going to prove to be anti-competitive and anti-growth. And forget about reaching Kyoto targets if Germany dismantles the nuclear park.

Nuclear energy accounts for 14% of the electricity generated in the world at a cost of about €33/MWh if we assume all costs, including closing and cleaning. Solar energy is less than 0.08% at an average cost of €410/MWh, twelve times more expensive. Solar energy today costs about $700 per barrel of oil equivalent, and therefore more than 25 times the average price for liquefied natural gas. This without mentioning the necessary investments in transmission networks, estimated at one trillion US dollars in Europe alone.

Solar energy, by definition is intermittent, ie, its plants operate at less than 10% utilization, as opposed to nuclear or hydro, operating with load factors of 70-80%. Wind energy has a much lower cost, an average of € 78/MWh, although still higher than gas, coal, nuclear and hydro, but also has the disadvantage of a low and unpredictable utilization factor (23-24 %). Additionally, it requires huge investments in networks. Therefore, an aggressive energy policy change based on an accident in a distant country seriously affects the competitiveness of countries and, after a decade of clean energy implementation, no significant net job creation or reduction in the cost of energy. It is clear that the costs exceed the alleged benefits. And studies made in Spain and the US show that for every green job created, two are lost from lost competitiveness, as industries’ costs soar. First Solar’s CEO says that solar energy will be competitive within ten years. They said the same thing years ago, referring to 2010. They have to prove it.

If we multiply by ten the OECD investments in prevention and safety of the nuclear power plants currently in operation, this would not pose anywhere near the same cost that would be needed to replace 10% of nuclear power by solar energy. And the latter would still have to compete with other sources of energy that are more abundant, cheaper and flexible.

It is worth continuing to invest in security, investigate further about economically viable and safe energy, but the greatest risk we face now is to take populist measures that sink competitiveness, curtail security of supply and make the system more expensive.

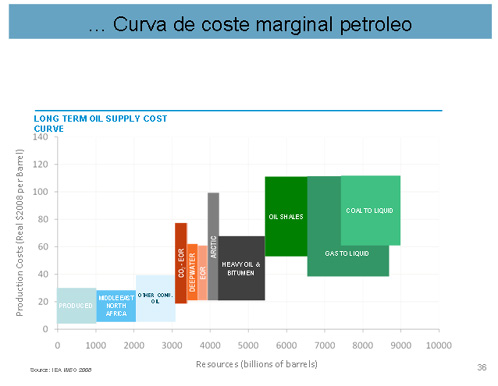

In energy, substitution can only come from competition. Either you compete or you disappear. Crude oil beat whale oil on price 120 years ago. The same happened with gas and coal. Anything else is dreaming.