“The most dangerous words in the English language are: I am from the government and I come here to help” (Ronald Reagan).

Category Archives: Sin categoría

The end of investment in oil as we know it

In OECD countries with current demand oil consumption is 18.3barrels a year

So if OECD countries slash their demand by 25% it will still be 14.64 barrels a year

However, if oil exporting countries demand goes up by a mere 7% their consumption will be 4.28 barrels a year.

Indigenous population growth in OECD is +0.1%, and growing 1% from immigration (ie going from countries where the average person consumes 2 barrels a year to countries where they will consume at least 4)

Population growth in oil exporting countries is up 5%.

Doing the maths, the demand doom picture is overestimated.

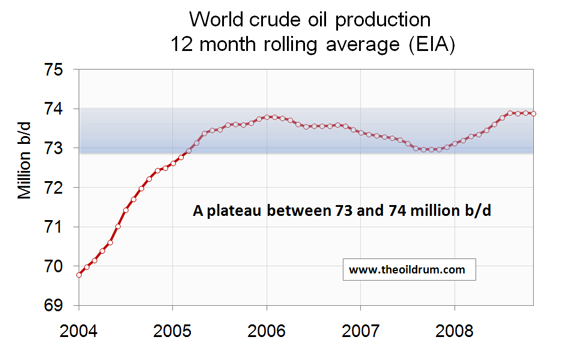

On to Supply:

A) In a tough credit environment, even large and medium sized E&Ps are and will have to drastically cut expenditure in exploration and development. Even worse, service companies are too small and cannot get credit for large rig projects (look at SBM and PFC).

B) Large caps are cutting expenditure (albeit selectively) already. If they see a weakening of demand all that RDS has to do is reduce the number of trucks in Canada bringing oil sands product from 35 trucks to 5. Boom.

C) Demand needs to fall at least 3%pa to come back in line with the usual demand-supply balance going forward

D) Even if all these things happen the call on OPEC increases, as non-OPEC supply is doing nothing but shrink.

E) 75% of the current projects require at least $40/bbl (technical, not service charge). Companies are not waiting for oil to fall to $20/bbl to revisit these projects which are only being developed because demand exists. If not, these projects can be shut down rapidly (Khursaniyah, Khurais, Genghis Khan, Atlantis, Kashagan, Rosa, Dalia).

Demand NEEDED to fall more than what consensus and sellside expected. I am happy with demand falling a lot, because the problem is depletion.

Supply is not there, and deffinitely not from non-Opec as consensus estimates (a ramp up of 1mmbpd when year to date it is down). Depletion rates are 4-6%. Even if you consider 0% depletion you need demand to fall a another 5%.

Call on OPEC increases, and self-consumption of producing countries is rising. Price, as such, is adjusting to see where mid term supply, demand and depletion go. That is not an indicator of bearishness.

I bet:

A) 12 month trail reserve replacement will be less than 90%

B) demand will fall accordingly

C) Demand – supply balance will remain the same

More importantly, I am happy that oil falls because the contango curve is steepening again… and bears have yet to explain why, if this is an anomally and fundamentally unjustified, it has continued and widened for seven months at levels never seen before October 08. As the only true safe havens of the equity market, I expect in less than a month investors will come back to revisit high quality, differentiated stocks that discount $30/bbl, trade at 7xPE 2010, 3-4.5x EV/DACF 2010 and FCF yield of 14%.

The Stimulus Package In Graph Format

See the graphic…Funny that if you look at the timeline, the cash spent / economic benefit does not really seem to kick in until 2011/2012…just in time for… the next election. Everything targeted for 2009 seems to be benefits for the unemployed which just generate deficit and debt. A friend also commented that the balloon format of the graphic is appropriate given the plan is full of hot air.

The way I see it, we may get benefit in 2009 as long as they can use their $1 Trn- $2 Trn package to clean up the financials balance sheets adequately, not making them get more geared. Even if the absolute value right now (MTM) of the liabilities is $20 Trn, taking it out of the public markets helps only moderately, because the liabilities value in my view is likely to depreciate, not appreciate, and in turn will come back to haunt the economy via taxes.

By the way, $825Bn is just a drop in the ocean compared to the loss of 40% of the securitization market, loss of hundreds of billions in annual interest bearing capacity of SIV’s, CLO’s etc… that are now gone… And the complete destruction of wealth for US consumers from dual housing and stock market declines, now estimated at $9 T. Meanwhile, the first Baby Boomers are hitting 65.

What Obama will not do (or any other Government) and should: Bulldoze unwanted/unsold housing stock and tighten that market… Everything else will follow; psychology, massive injection of new credit/capital into housing stock, refinanceability of existing CDO’s with a return of bids, on and on. Housing got the world into this problem. That is where we need to focus. That is where we will likely not. Everything else is a sympathetic symptom.