Spain: Recovery, yes. But high taxes and bureaucracy limit potential

“The real goal should be reduced government spending, rather than balanced budgets achieved by ever rising tax rates to cover ever rising spending”. Thomas Sowell

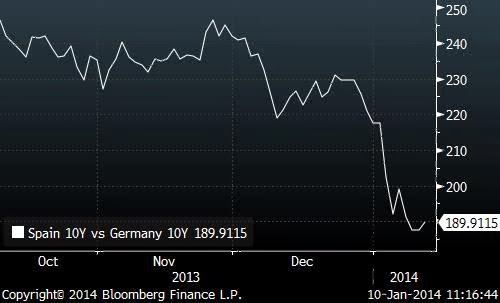

Spanish bond yields have fallen to pre-crisis levels despite debt to GDP reaching c100%, a deficit that will be above the target 6.5% and refinancing needs of c€224bn in 2014. The “Draghi put”, added to much better comps on unemployment (fallen by 147k in 2013), consumer spending (+2% in December) and added to expectations of an 0.5%-1% growth in GDP have helped. Continue reading Spain: Recovery, yes. But high taxes and bureaucracy limit potential

Commodities Update

Commodities Update: More Supply… Don’t Bet On Price Inflation

Brent – WTI differential shrunk recently from $20 to $11.5/bbl.WTI rallied due to the Keystone line fill. Before the pipeline goes into service it needs to be filled up with oil (600kbpd) so there is a continuous flow once it starts up. The pipeline is 485 miles long and goes from Cushing, OK to Nederland, TX. Careful, this is a technical and temporary effect. Continue reading Commodities Update: More Supply… Don’t Bet On Price Inflation