I) The “other businesses”. Almost 16% of BP’s invested capital is outside the traditional oil areas (exploation, production, refining and marketing). With businesses that range from travel to solar pv. BP is a global company with the largest exposure of any oil company to alternative energies, $10-15bn (valuation range) worth of renewable (solar, wind) investments as well as biofuels, and one of the leading shipping companies (BP shipping). Is Exxon interested in adding renewables and shipping to their portfolio?.

Brazil continues to surprise: BG doubles its resource base

BG has upgraded its reserves and resources for Brazil from a range of 3 to 6bn boe to maximum of 8bn boe. The mean estimate for discovered resources is now 5.8bn boe (excluding risked exploration), which compares to previous estimates of 4.5bn boe. The group increased the previous estimate of 3 billion barrels after analyzing data from 29 wells, 19 drill stems and 14,400 square kilometers (5,500 square miles) of 3D seismic data, according to the press release.

The company is not at this stage moving estimated production from Brazil (of 550 kboed by 2015), but this is likely to be reviewed by year end.

Total reserves and resources now stand at a mid case of 5.8bn boe (4-8bnboe, P90-P10) up from an estimate of 3bnboe the last time the company disclosed a total resource estimate in February 2010.

The reserves and resources have been driven by a number of factors including better technical data from the EWTs (better reservoir properties), enhanced recovery rates and incorporating recent discoveries (Macunaíma). BG are indicating an upside potential of 8bn boe.

Assuming an average of US$5/boe for Brazil barrels, the increase of 1.25bn boe would be an incremental US$6bn, according to Citigroup, whose previous estimate on resources of 4.5bn boe was split as follows:

Lula 1.8bn

Iracema 0.4bn

Guara 0.5bn

Lara 1bn

Other discoveries 0.7bn

Further read:

http://energyandmoney.blogspot.com/2010/08/few-thoughts-on-brazil-e-through-repsol.html

http://energyandmoney.blogspot.com/2010/01/energy-opportunities-in-brazil.html

IEA Releasing Strategic Oil Reserves Reminds Me Of When UK Sold All Its Gold.

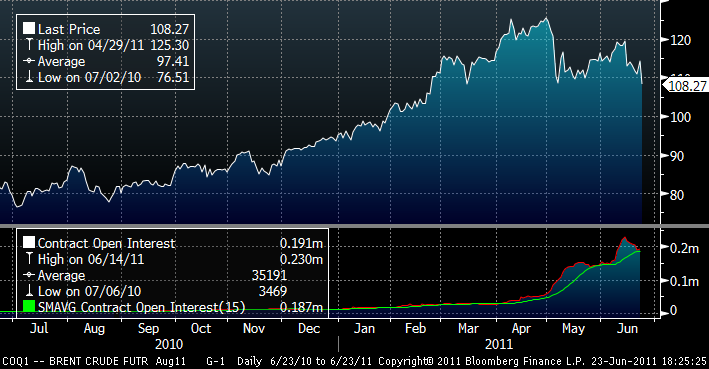

Oil fell 5.5% on Thursday 23rd June on news that the IEA’s member states are to release 60mb of their strategic stockpiles, 30mb from the US and 30mmb from elsewhere.

This could look in time as one of the dumbest decisions, in my opinion, since the day when the UK sold all its gold reserves between 1999 and 2002 at around $280/ounce… unless the IEA sees a material economic recession ahead and then the new QE of the economy is artificially lowering the price of oil.

The U.S. strategic petroleum reserve is at a historically high level with 727 millions barrels, of which 293 millions barrels (40%) are sweet and 434 millions barrels (60%) are sour. The International Energy Agency reported in April 2011 that SPR in OECD Europe and OECD Pacific totaled 186 millions barrels and 391 millions barrels, respectively.

The release of SPR crude announced today thus represents approximately 4% of U.S. reserves and 5% of SPR reserves in OECD Europe & Pacific.

This is the 3rd time in the past 50 years that IEA has released strategic reserves. The last three times, the improvement in oil prices that they looked for resulted in three subsequent super-spikes. This, I fear, will be the outcome again soon. Furthermore, this time we do not have the price-cushioning barrels of the North Sea (declining at 7% pa, as we mentioned here) or Mexico, which is falling as well. So the call on OPEC, even if demand continues to slow down, will increase to 30.1mbpd, making prices go higher.

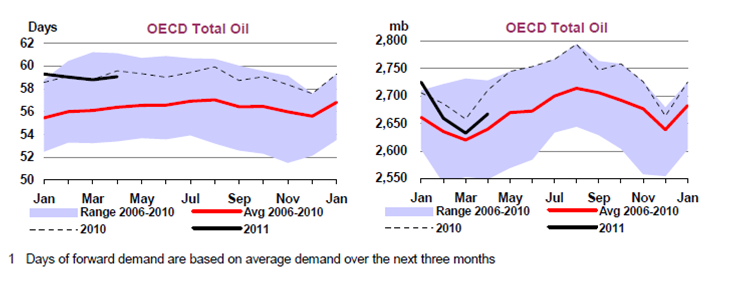

The IEA, yet again, is panicking about the impact of the Libyan conflict. It is seeing that the war is unlikely to end soon, and sees the loss of Libyan barrels (1.5mmbpd) as an issue after the failed OPEC meeting. But the market is well supplied. The only issue they worry about is price, which has been caused by the insane money-printing of the Fed not by demand-supply dynamics (hence the wild inflation in all dollar denominated commodities, of which oil incidentally is the third least appreciated since 2008, by the way).

Also, the US failed to pressure Saudi Arabia into discounting its crudes on world markets, which was one of the most paternalistic requests ever seen. Obviously, Saudi Arabia didn’t agree, because, to start with, the reason why OPEC didn’t raise quotas was because demand is weakening (as we said here), and given the 5-year high levels of inventories at Cushing, they would essentially pump oil to be added to more storage.

The IEA decision could also come from fears of escalating tensions between Iran and Saudi Arabia, with calls from the latter to “squeeze out” Iran from the oil market. Given that Iran and Venezuela stand at the highest-end of the OPEC countries’ break-even price (close to $70-80/bbl, versus peers at $45-50/bbl), the IEA might be doing Saudi Arabia a favour, but a very short term one as it can create a geopolitical issue that brings oil back right up.

But this measure is meaningless in the grand scheme of things. 60mb is about 43 days of lost Libyan barrels and, wait for this, less than 0.2% of annual global oil demand (considering 87m bpd). It will achieve only one thing: to increase the OECD dependence on OPEC by September.

Meanwhile, the drought in China is poised to drive a spike in short term diesel demand. Severe drought conditions have curtailed China’s hydroelectricity generation… and electricity consumers will look to replace state electricity with their own power generation, oil. Middle distillates already account for the largest part of Chinese oil demand, so the entire IEA decision could be absorbed by the Chinese increase in diesel consumption in two months before the rain season.

So the analysis says that give that the market is well supplied and economic data in the OECD is weakening, the IEA only wants to cover the drought-driven demand spike from China, avoid oil prices from over-heating and help the debilitated OECD recovery.

The only way in which the measure will work is if, in effect, demand will weaken into 3Q and the call on OPEC does not rise. If the demand analysis is incorrect, China and India continue to grow or geopolitical supply issues get worse (13 dead in Baghdad today not helping) then the oil market will go back to price a tighter environment. Any move in demand above 88mbpd and the entire measure is absorbed.

It doesn’t matter if OPEC has 4.5mmbpd of spare capacity, because this spare capacity is centred in Saudi Arabia, UAE and Kuwait, and is predominantly heavy-sour oil. And this measure will not help diplomatic relations with any of them, will be seen as desperate and in any way could be absorbed immediately.

Granted, the IEA can release more Strategic Reserve barrels, but then the weakness of the OECD and the call on OPEC rise. It’s a catch-22 measure and will not be of great aid to the OECD economies, which are not weakening due to high oil prices (oil burden is less than 5% of OECD GDP), but due to out-of-control spending, rampant deficit, printing of currencies and EU’s puzzling management of the Greek-PIIG crisis.

Finally, two of my industry friends rightly highlight that “we are heading into a US election year and the political dividend from appearing to push oil prices lower is very attractive (Bill Clinton knows it well, he did it too)”. “President Obama wants to appear tough on oil and keep gasoline prices low in July. But a few weeks later we will be back where we started. Lower prices only accelerate demand anyway”.

Well done, IEA. another QE in disguise.

Link to my interview in Spanish radio, go to minute 12.30 (http://gestionaradio.com/getplayer.php?aud=16502)

Other posts:

http://energyandmoney.blogspot.com/2011/01/some-energy-thoughts-for-2011.html

http://energyandmoney.blogspot.com/2011/05/impact-of-chinese-slowdown-on-oil-and.html

http://energyandmoney.blogspot.com/2011/06/china-slows-down-as-saudi-arabia.html

http://energyandmoney.blogspot.com/2011/03/war-in-lybia-and-possible-algerian.html

http://energyandmoney.blogspot.com/2011/02/lybia-in-flames-and-clash-of.html

http://energyandmoney.blogspot.com/2009/11/china-exxon-and-war-for-resources.html

State Of Fear: The German Nuclear Shutdown, Who Wins and Who Loses

(This article was published in Spain in Cotizalia on June 6th 2011)

Seems Germany will approve before mid July 2011 the closure of all nuclear plants (21GW) by 2022 . Adding insult to injury, the country might not remove the tax on nuclear power that utilities already bear.

Meanwhile consumer electricity prices rise as the populations witnesses the effect of their political demands seeing the power bill rise by 45% due to a flurry of subsidies.

But the move to close the German nuclear plants will also entail a cost of about €40 billion and an additional 45 million tons of CO2 emissions a year (the German government itself expects to offset nuclear loss with lignite coal, gas and renewables). More pollution, but also a cost to the economy of €765 million to buy additional allowances. Of course, the German government says they will implement energy efficiency measures, which have been such a resounding “success” in the past 23 years.

Now Germany will import more power from France, which is generated in its majority with their fifty-eight nuclear reactors.

As Europe became more vocal against nuclear power, CO2 emissions increased by 5% in 2010, above the 2008 peak. We pollute more and generate electricity at a higher cost due to subsidies. Not just renewable premiums. Between capacity payments to gas, coal subsidies, market restrictions and other monstrosities, almost all technologies receive some type of subsidy.

Europe, which is less than 30% of global CO2 emissions, runs with 100% of the cost as the rest of the world does not pay for carbon dioxide emissions. Europe embraced the Kyoto Protocol as the ultimate sign of identity of a common political project which did not bear fruit in most other areas, from economy to defence, and is now clinging to its environmental policy, which is the only thing that unites EU countries, at any cost, preferring to pay for all the other countries before reviewing the adequacy of their commitment.

Someone in China or India should be laughing their head off. While these countries continue to grow dramatically, moving ahead with plans to install nuclear reactors (18 in the next ten years), wind, gas, coal and everything needed, Europe becomes the “bill-payer” of Kyoto and shuts down nuclear plants because of the state of fear generated by Fukushima. But who in their right mind expects 9 Richter scale earthquake followed by a Tsunami and a 24 hour blackout in Europe?. (Read more here)

The U.S. has two nuclear reactors under construction, the UAE, China and India have reaffirmed their plans for new facilities, Korea will build five reactors… I’m not saying Europe should build new nuclear plants, first because they are not needed as reserve margins remain high, but those that work should remain active.

The costs for the grid and the system are also important. And no relief for the solar industry. Even if all German nuclear power plants to be closed were replaced by solar power plants the sector would still sell less than half of the solar pannels it has installed in recent years (3.5-4GW p.a versus recent 7-8GW).

For the wind industry, the drastic decision of replacing nuclear also generates a very small positive impact. The global installed capacity has grown from 74GW in 2006 to 200GW in 2010. But the overall installations fell 7% in 2010 and another decline is expected in 2011, just as overcapacity increases. To give you an idea, even using the expectations of the sector, which expects to multiply by three the number of global wind installations by 2020, turbine manufacturers would still have a 20% overcapacity. Also note that in the two main markets for wind, Europe and the U.S. installations have fallen inexorably (50% drop in 2010 in the U.S.) due to the dry-up of public money and the impact of cheap gas (as we said here). In 2012 the U.S. is expected to install 5GW. Annual growth in China, 13-15GW, is constrained by grid bottlenecks.

The only ones benefited so far by the nuclear shut-down in Germany have been the dinosaur gas producers, who were facing a very black-and long-horizon of excess capacity and forced to re-negotiate their long term contracts. Well, surprise, surprise, the gas glut has been half-solved by the anti-nuclear policy.

But it’s no party for gas generators either. Overcapacity in Europe affects the whole energy chain and in natural gas it still exists and it’s quite relevant. The use of combined cycles for electricity generation has fallen to become a mere anecdote that works as “back up” to renewables and European CCGTs continue to generate very poor returns.

The German nuclear power shut-down, therefore, will do nothing but increase the consumer’s electricity bill, and only replaces cheap, base-load power for costly, intermittent peak-load power, but does not solve either the high reserve margins or the efficiency of the system.

Renewables play a very relevant role and will increase significantly in the next five years. But the cost of replacing all nuclear with renewables would be prohibitive and energy dependence would increase due to the lack of domestic natural resources (Germany has lignite, Europe has shale gas, but seems more inclined to ban it than develop it) . Let’s be sensible.

Other related posts:

http://energyandmoney.blogspot.com/2011/03/anti-nuclear-state-of-fear-japan-and.html

http://energyandmoney.blogspot.com/2009/05/reserve-margins-are-clearly-acceptable.html

http://energyandmoney.blogspot.com/2009/10/careful-with-german-power-prices.html