The International Monetary Fund can be criticized for many things, but its analysis of countries’ debt risk tends to be worth a read.

In this case, the International Monetary Fund has once again warned Spain of the risk of reversing reforms and increasing imbalances.

If there was little doubt that the budget signed by PSOE and Podemos was an assault on the taxpayer and an economic nonsense, the presentation of the budget proved it even more. It is a budget completely devoid of credibility.

Optimistic macro picture: The government announces a macroeconomic picture that no one in their right mind can believe. It confirms the slowdown and lowers the growth estimates but gives extremely optimistic estimates of gross capital formation (+ 4.4%) and exports (+ 3.4%, growth greater than 2018 in the midst of a slowdown in global trade) and at the same time assumes a very modest increase in imports that is inconsistent with the previously mentioned gross capital formation figure… This is done to artificially make the foreign sector contribution to GDP add instead of subtracting. No one seriously believes a macroeconomic picture with a GDP deflator of 1.8%.

Inflated revenue estimates: If we look at the tax revenues, the budgets show that the estimates of new revenues are completely inflated. Spain has never been able to meet its budgetary consolidation objectives by increasing expenses and taxes, and this budget is no different.

. The government intends to collect with a new digital tax more than twice the amount estimated by the government three months ago and almost three times more than what the United Kingdom collects, with a much larger market than Spain.

. If we look at the tax on financial transactions, the government inflates the estimates to more than three times the amount collected by other countries that implemented this tax. Remember that Sweden collected ten times less than estimated and had to withdraw it.

. Corporate Taxes. The government assumes an increase in revenues of 1.77 billion above the already record figure of 2018 despite the evidence of the economic slowdown and business profit estimated by consensus (+ 5%) show an evident deceleration in 2019.

. The increase in income tax on very high incomes is clearly inflated as well. An increase of 10% in the marginal tax rate on income of salaries of more than 150,000 euros a year would decrease revenues between 500 million and 2,500 million euros, according to studies from the Complutense University.

. As for other revenues, they are based, again, on completely fictitious estimates, including 500 million euros for international anti-fraud policies that nobody has seen and 218 million for limiting the payment in cash.

This string of inflated estimates leads us to a more realistic of a maximum of 1,800 million euros of additional revenue for an increase in expenses of 16,000 million euros.

. The increase in expenses, in fact, was also manipulated. The increase in spending by all public administrations in 2019 is 16,000 million, which leads to a deficit that already started at 27 billion euros, and to which we have to add a more than likely additional imbalance of close to 3 billion that could reach up to 11 billion euros. History in Spain shows that the average error in new tax revenue estimates in periods of growth is 5.8 billion euros per year and up to 12 billion in times of slowdown.

The government increases spending and taxes, puts obstacles to growth and investment and while certifying the slowdown, not only does it not assume any negative impact on the economy but it believes that the brutal increase in taxes will have a positve (!) impact on investment, employment and tax revenues. Completely unlikely

This is not social. Taking us to a debt crisis is anti-social.

Going to the IMF, it asks to deepen in the labor reform to end structural unemployment and credible measures for the 2019 budget.

The IMF is often criticized on many sides. It is often accused of being “neoliberal” despite the fact that in almost all its recommendations aim to prevent spending cuts. It is wrongly criticized, on many occasions, for being negative on countries. It is exactly the opposite. The IMF is often too diplomatic and, above all, undemanding with governments.

A clearly diplomatic IMF has verified in its last report the important risks facing the Spanish economy. As growth slows down more quickly than expected, the risks that threaten the recovery have increased and many of the socialist government’s announcements could be counterproductive and accelerate a relapse.

In a very diplomatic but forceful way, the IMF warns about the governments’ optimistic and inflated estimates of tax revenues. No wonder, because the average error in revenue estimates for new taxes in Spain is very important, an average of 5.8 billion euro annually.

Inflated estimates are an easy trick to square budgets. Making impossible estimates of tax revenue while spending increases are very real. Then, when deficits soar, blame an external enemy.

The graph below shows the historical overestimation of tax revenues (5.8 billion euro per annum more tax revenues estimated than actually collected).

The Spanish Treasury Inspectors themselves have warned: “It would also be very interesting that those who speak again and again of these striking figures will provide the studies on which they are based to compare them. From previous unsubstantiated studies, inadequate and impossible proposals arise”(Tax Inspectors, January 2015).

That’s the IMF’s first diplomatic warning. In Spain, since 1998, fiscal consolidation has never been achieved via revenue measures and increasing expenses.

The IMF is aware, in addition, that Spain does not have fiscal space to increase deficits and alerts that increasing the deficit and spending in a growth period will lead to harder and more severe cuts when the economic cycle changes.

Budgetary buffers, which were exhausted during the crisis, must be rebuilt, and that is not done by increasing spending and taxes, because the IMF and any of us know that the estimated revenues will not be met because they are calculated in a political and fallacious way, while the expenses will likely soar above the budget.

It is almost impossible for Spain to achieve its deficit goals increasing spending, because in order to do so, the government assumes a rise in tax revenues that has not happened even in growth periods.

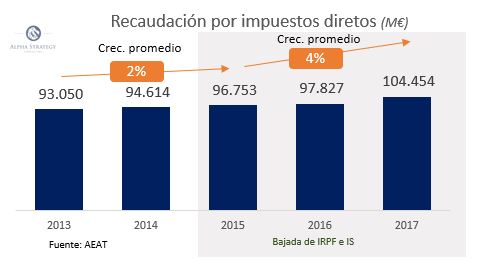

(Graph below shows growth in direct tax revenues. Tax revenues actually increased after tax cuts)

The IMF warns that governments always resort to raising taxes to cover excessive spending (“the adjustment tool preferred by the government”), and warn that these could cause distortions and have a negative impact on growth. To avoid this, “a careful design of fiscal measures is key”.

Empirical studies from more than 200 countries show that “a tax increase of 1% of GDP in periods of fiscal consolidation leads to a 1% drop in GDP in eight quarters” (IMF, Dabla-Norris, Lima).

Linking pension costs to the CPI is another error that they warn about. Because it is deeply antisocial, endangering the entire system and future pensions for not including other essential factors when valuing pensions, such as sustainability and the population pyramid. It would increase pension spending between 3 and 4 points of GDP to 2050 and send Spain to a debt crisis.

The report recalls the importance of “re-launching the structural fiscal adjustment and preserving the spirit of labor market reforms,” that is, the opposite of what the current socialist government intends to impose.

Those who criticize the IMF for being neoliberal will be surprised because all it shows in this report is common sense: Increase imbalances and expenses in times of economic boom will lead us to take much tougher measures and further cuts when unemployment rises and we enter in recession.

Spain does not need to spend more. Increasing spending, deficits and taxes now is not a social policy, but an antisocial one, because it means bigger and worse cuts in the future.

Increasing taxes is counterproductive when they were already raised during the crisis and all the regions increased their tax components. In addition, it weakens Spain’s tax bases in the face of a slowdown.

Increasing expenses is completely unnecessary when the 2018 budgets already included a 4% generalized increases in the main items. Increasing spending today is multiplying the cuts later.

Spain is facing a moderate slowdown, which should be a unique opportunity to attract more investment and more jobs from all over the world, not announcing measures that make the Spanish economy more fragile, that weaken tax bases and raises the risk of debt and deficits with it, just as interest rates rise.

None of the current governments’ measures have anything to do with a social policy. Putting the country at risk of another debt crisis with science fiction revenue estimates and increased political spending is not social. Itanti-socialial.