“We will continue with Fed purchases until unemployment falls below 6.5%” Ben Bernanke

Non Farm Payroll data is positive. No doubt. Payrolls has been remarkably stable, but this represents an acceleration. All the 3 month, 6 month, 12 month averages are now at around 200k post revisions… But it is also within a broader, weak context. Unemployment is still 7.6%.

Part-time jobs soared by 360,000 to a record 28,059,000 (+557k for 2013) but Full time DECLINED 240,000 and is up only 130k in 2013

The BLS: The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by 322,000 to 8.2 million in June. (http://www.bls.gov/news.release/empsit.nr0.htm)

From CS: “Today’s employment report, while stronger than anticipated, didn’t challenge our expectations sufficiently to change our base case for Fed policy. We still look for the FOMC to scale back the size of its current $85bn/month asset purchase program later this year by $20bn”.

It is amazing how often we hear in Europe that Obama and printing money have “created” five million jobs. As if governments, or central banks, and not private enterprises, were real job creators. It obviously is a message that fits beautifully for defenders of central planning and intervention. “The Government” creates jobs. Monetary policy creates jobs. Hurrah!. No need to invest or innovate, let’s print. Really?.

Reality is that “monetary policy aimed at unemployment” is an excuse to continue feeding the Leviathan of bloated governments and massively leveraged financial entities. Keep sovereign yields low, yet raise the debt ceiling a 98th time, increase public spending… feed Wall Street some beta bloating markets +150% and bringing junk bonds to lowest yield ever… And deliver financial repression to the citizens… Who pay for it all with higher taxes to top it all.

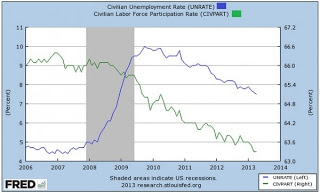

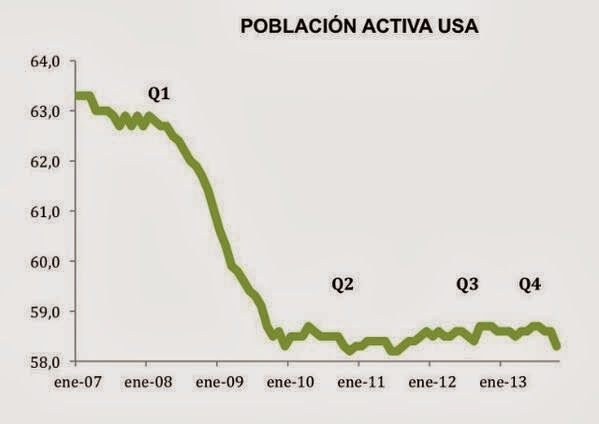

Look at the sharp fall in the labour force participation rate—the percentage of the population that is working or looking for work. This figure fell to 63.3 percent, the lowest level since 1979. Half a million people gave up looking for work in March alone.

The fall in the labour force can be explained in part by the chronic state of long-term unemployment. The average duration of unemployment increased in March to more than 37 weeks.

Interestingly enough, on one side we are told that “stimulus works” because allegedly millions of jobs are created yet at the same time, in order to justify more stimulus, the Fed members talk over and over of “very weak labour market” and “sluggish recovery”. It’s beautiful.

Feed the promise, and deliver the fear. This will keep the endless carrot and stick of monetary stimulus.

Even if we believed these policies have created 5 million jobs (and let me say it again, they haven’t as you can read here and here), the cost is astonishing. 3 trillion dollars added to the Fed balance sheet!!!

Even Ben Bernanke and David Stockman, in different areas, alert of the poor labour market and atrocious economic improvement despite trillions spent in QEs. However, adding to the “positive effects of stimulus” the jobs created in the period by Oil and Gas -if anything, an industry that received no help or support from this government- is amazing to say the least. An industry that has created c680k jobs and added 75 billion to GDP in 2012 alone cannot be deemed as a “consequence of stimulus”.

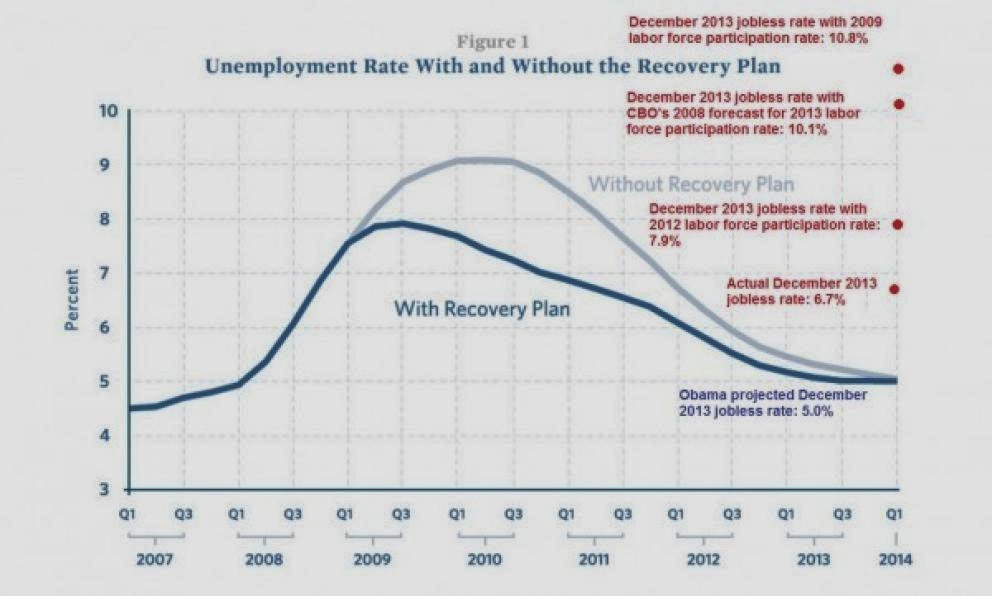

Even Ben Bernanke and David Stockman, in different areas, alert of the poor labour market and atrocious economic improvement despite trillions spent in QEs. However, adding to the “positive effects of stimulus” the jobs created in the period by Oil and Gas -if anything, an industry that received no help or support from this government- is amazing to say the least. An industry that has created c680k jobs and added 75 billion to GDP in 2012 alone cannot be deemed as a “consequence of stimulus”. I remember when I lived in the US and we were threatened that “without stimulus” unemployment would go to 7%… Congratulations, c$3 trillion afterwards, it’s at 6.7% and with 15% of the population of the US living on food stamps.

I remember when I lived in the US and we were threatened that “without stimulus” unemployment would go to 7%… Congratulations, c$3 trillion afterwards, it’s at 6.7% and with 15% of the population of the US living on food stamps.Update:

Let’s put things in context: A monetary stimulus which today means c6.5% of the GDP of the United States in annual purchases of bonds and other assets by the Federal Reserve. Now remember the promises. With the stimulus plan announced in 2009, the U.S. unemployment rate would drop to 5% by 2013. Today it is 6.7%. Not impressive, right?. Well, it’s worse if we include the ‘zombies’. Removed from the lists. See the attached chart.The labor participation rate in the U.S. has plummeted to 62.8%, the lowest level since 1978.

Let’s put things in context: A monetary stimulus which today means c6.5% of the GDP of the United States in annual purchases of bonds and other assets by the Federal Reserve. Now remember the promises. With the stimulus plan announced in 2009, the U.S. unemployment rate would drop to 5% by 2013. Today it is 6.7%. Not impressive, right?. Well, it’s worse if we include the ‘zombies’. Removed from the lists. See the attached chart.The labor participation rate in the U.S. has plummeted to 62.8%, the lowest level since 1978.

Whether you agree with quantitative easing or not, an expansion in the Fed’s balance sheet is not a cost (and please, let’s not discuss semantics as to whether QE causes an indirect cost here or there), therefore, it is plain wrong to state that the jobs created “costed” 500k. In fact, the Fed’s profits go to the Treasury as revenue.

Worst of all is you know this already, so you’re just manipulating the facts to make a point. No wonder economics is so looked down by some people these days, biased, partisan commentary is a plague.

Expansion of the balance sheet of the Fed is a cost. It is paid by all US citizens in inflation, taxes and financial repression. To state otherwise is to believe that money is a unicorn.