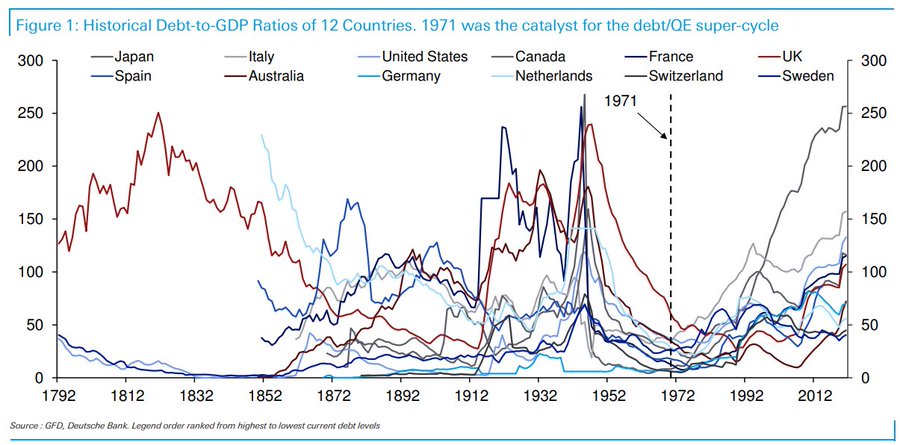

This year marks the 50th anniversary since Nixon suspended the convertibility of the USD into Gold. This began the era of a global fiat money debt-fueled economy. Since then, crises are more frequent but also shorter and always “solved” by adding more debt and more money printing.

The suspension of the gold standard was a catalyst to trigger massive global credit expansion and cement the position of the US dollar as the world’s reserve currency as it de-facto substituted gold as the reserve for the main central banks.

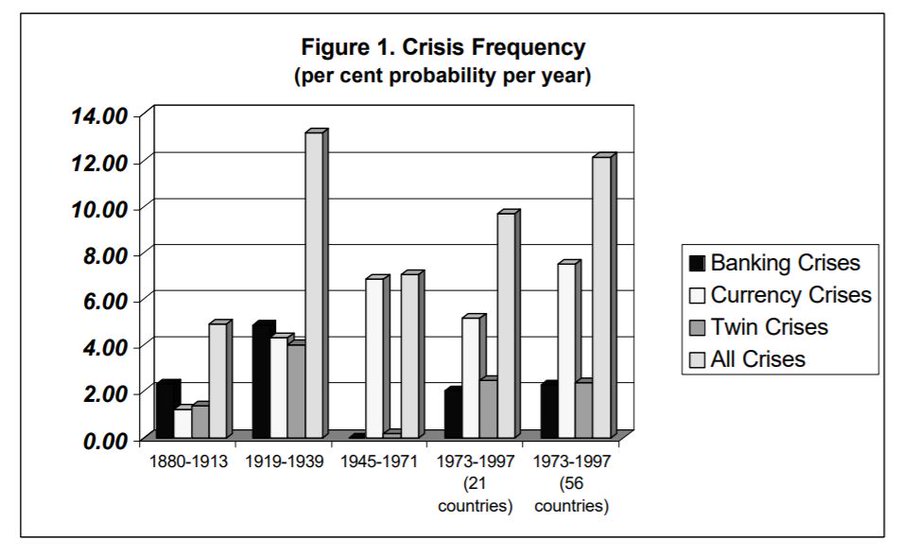

Thus, since the breakdown of the gold standard, financial crises are more frequent but also shorter than before.

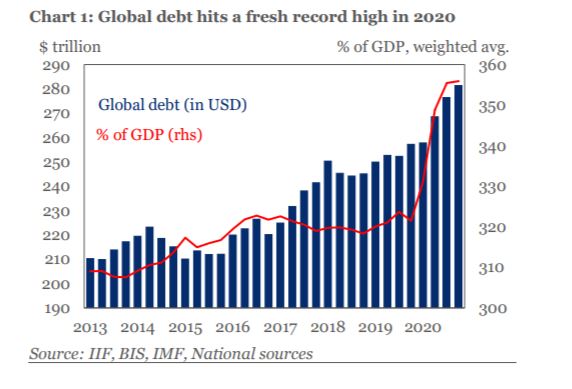

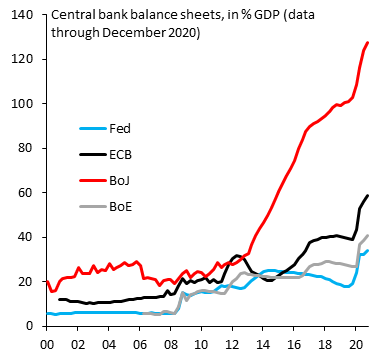

The level of global debt has skyrocketed to more than 350% of GDP, and what is mistakenly called “the financial economy”, which is actually the credit-based economy, has multiplied.

The gold standard supposed a limit to the monetary and fiscal voracity of governments and suspending it unleashed an unprecedented push to increase indebtedness and the perverse incentive of the states to pass on the current imbalances to future generations.

By substituting gold for the US dollar as a global reserve, the United States has been able to borrow and increase money supply massively without triggering hyperinflation because it exports its monetary imbalances to the rest of the world. Other currencies follow the same monetary expansion without the global demand that the US dollar enjoys, so the rising imbalances always end up making those currencies weaker versus the greenback and the economies more dependent on the US dollar.

This race to zero pursued by most central banks has also achieved that there is no real alternative to the US dollar as a reserve because the rest of the countries abandoned the monetary and fiscal orthodoxy at the same time, weakening their ability to be a world reserve alternative.

In the 1960s, any currency from a leading country could compete with the dollar if its gold reserves were sufficient. Today, no one among the fiat currencies can compete with the dollar either in financial capacity or as a reserve. The example of the Yuan is paradigmatic. The Chinese economy is almost 17% of the world’s GDP and its currency is used in less than 4% of global transactions, according to the Bank Of International Settlements.

With the suspension of the gold standard, Nixon cemented and guaranteed the financial and monetary hegemony of the United States for the long term while unleashing a global credit-fueled economy where financial risk disproportionately exceeds the real economy.

The defenders of the suspension of the gold standard contend that financial crises are shorter and that the global economy has strengthened in the period. However, it is more than debatable to consider that massive debt expansion is the cause of progress. Non-productive debt has soared and the tax wedge on citizens is elevated, while the severity of financial crises has also increased, which are always “solved” by adding more debt and more risk-taking. A debt-fueled economy and massive money creation disproportionately benefit the first recipients of money and credit, which are government and the wealthy, creating a larger problem for middle-classes and the poor to access better standards of living when asset prices are artificially inflated but real wages rise slower than the price of essential expenses like housing, healthcare, and utilities, while taxes rise.

A return to the gold standard may be unfeasible today given the size of the global monetary imbalance versus gold, which could create a giant financial crisis, but a Taylor-rule based system in monetary policy that limits central bank balance sheet expansion and a strict deficit and debt limit can be implemented if there is a political will.

EXCELLENT work Sir.

The Chinese have been reliably reported, without their confirmation of course, to have acquired *ABOUT*, 20,000 tons of gold.

I speculate, for sure without confirmation, that they have been taking delivery, slowly and methodically, of gold off COMEX.

Reliably reported that they have bought four of the worlds good delivery gold vaults, such as the JPM vault in N.Y., Barclays and two others in London, and of course control the Bejing and Singapore gold vaults.

No one that I am aware of has connected these dots.

Seems like a long term plan to me.

What think you?

The Russians with their low debt ratio’s may be in the fast lane

to returning to the gold standard and by doing so ensure financial

stability and perfered trading status with much of the world.

long term or not so long , who knows.

$100,000

What happens when the Chinese & Russians reveal their true gold reserves?

A: they form a combined, gold-backed Eurasian currency with 10-12 other signatory nations

its new name: The “CHUBLE”….. sorta catchy, huh? (you heard here first)

It makes no sense at all to “hide” your gold reserves, something that would strengthen your currency and confidence in it. Hiding true gold reserves is a myth. The Russians would be more than glad to curb the high inflation and weak ruble showing higher gold reserves if they had them. Same with the Yuan, which is not used in almost any international transaction. You may watch this video: https://www.youtube.com/watch?v=w6knHerN4v0&t=3s