“So long as oil is used as a source of energy, when the energy cost of recovering a barrel of oil becomes greater than the energy content of the oil, production will cease no matter what the monetary price may be.”– M. King Hubbert

Peak Oil defenders continue to make new claims. While inventories reach the highest levels of the past five years, OPEC fights to keep quotas and for a third consecutive year reserve replacement remains strong, in a world that has not seen a single day of disruption in oil supply, the defenders claim that the problem is EROEI (energy returned on energy invested) and that therefore, it doesn’t matter if supply is abundant, because it is still negative.I had the pleasure of talking with industry leaders and this is their response.

a) The concept of EROEI has to be clearly attached to profitability. Peak oil crash defenders scream at 4:1 levels as unsustainable. This is funny. An “alleged” low EROEI is not necessarily a negative in itself, given that low cost of capital and high technology developments have helped to have readily available and abundant energy all over the energy complex (not only in non-conventional, but in conventional resources), and there has been no issue with supply in any environment despite a few geopolitical bumps. Furthermore, that EROEI rises as efficiency and productivity help reduce power use and increase output.

a) The concept of EROEI has to be clearly attached to profitability. Peak oil crash defenders scream at 4:1 levels as unsustainable. This is funny. An “alleged” low EROEI is not necessarily a negative in itself, given that low cost of capital and high technology developments have helped to have readily available and abundant energy all over the energy complex (not only in non-conventional, but in conventional resources), and there has been no issue with supply in any environment despite a few geopolitical bumps. Furthermore, that EROEI rises as efficiency and productivity help reduce power use and increase output.

b) The concept of EROEI is static, it uses an estimate of energy consumption that starts at an intensive point and that just stays or rises afterwards, and this has proven to be wrong (energy used per unit produced falls dramatically in virtually all industry projects, see Shell’s analysis of oil sands extraction).

c) If EROEI estimates published by peak oil defenders were correct, given the gigantic increase in E&P and non-conventional spending we have had, power usage, and electricity prices and gas prices would have rocketed… But they have fallen. Co-generation is barely considered by EROEI doomsters either.

More importantly, in projects as energy intensive as PNG LNG, cost of energy used has fallen by 34%.

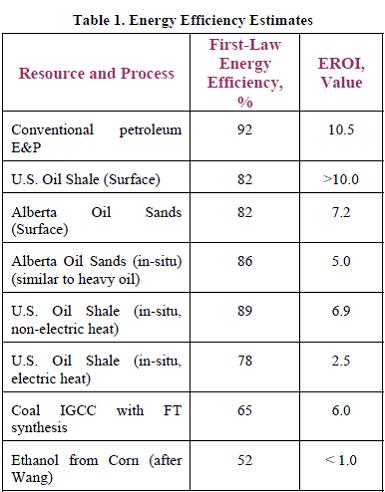

In Oil sands we have seen drops of 25% per unit of production. In shale oil as dramatic as 34%. The graph below shows the EROEI estimates of the Department of Energy in 2006 (link here). This was in 2006. Since then the efficiency and lower use of power and energy in hydraulic fracking and oil sands extraction has significantly increased the EROEI.

d) EROEI is an excuse of peak oil defenders to justify that they have been wrong about supply, turning the debate to the alleged unsustainability of that same supply as a justification.

Finally, any of the peak oil defenders needs to explain how the development cost of the industry has fallen, the energy intensity of the industry has gone down dramatically (they don’t read companies sustainability reports?) yet reserves and production have improved 2006-2010, fundamentally in unconventional.

The EROEI theory takes an individual projection (and this is typical for peak oil), leaves the negative elements untouched and stable (as if techonology and resource development did not improve) and then expands it to the entire base.

This, obviously, leads to a massive generalization and a leap of faith that can be easily denied just looking at 20-F filings, detailed analysis per project, which are available to all shareholders in strategy presentations and Fact Books, and in the brutal fact that oil sector’s electricity and gas consumption has been falling while productivity, particularly in non-conventionals, has soared.

Never bet against human ingenuity.

Further read. The Oil Drum (link here):

On EROEI of oil sands

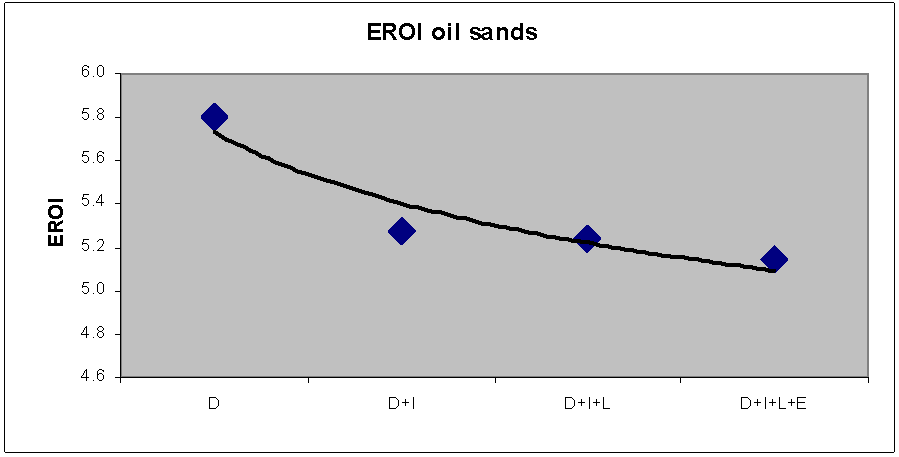

“EROI depends mostly upon the direct energy used and which alone suggests an EROI of about 5.8. Including indirect energy decreases the EROI to about 5.2”, “adding in labor and environmental costs have little effect”. “Nevertheless it appears that tar sands mining yields a significantly positive EROI”.

On shale oil “Reported EROIs (energy return on investments) are generally in the range of 1.5:1 to 4:1, with a few extreme values between 7:1 and 13:1”. “Tar sands and oil shales seem to be in the same EROI ballpark”.

Note from Daniel Lacalle: Worth noting that the assumption of energy consumption in the article for shale oil is now widely seen as excessive, so real EROEI is currently close to the latter part of the analysis (7x to 13x)

Note from Daniel Lacalle: Worth noting that the assumption of energy consumption in the article for shale oil is now widely seen as excessive, so real EROEI is currently close to the latter part of the analysis (7x to 13x)

Further read:

http://energyandmoney.blogspot.com/2009/11/peak-oil-realities-myth-and-risk.html

I’m not much convinced by the EROI argument, it’s all about making money right?

But if “un-conventional” oil is so efficient and cheap and supply is so flush, why is the OPEC basket price $40 higher than last year?

Is’t it because the last barrel is the one the price for all barrels is based on and to produce that last barrel at these record volumes takes the most unconventional, most expensive to produce oil?

You are right. As a marginal market, the price of oil is set by the most demanded one (the highest quality, low sulphur, highest API grade), and this type is scarce while costs are rising on the most challenging areas (unconventional oil sands and deep water). So in essence youa re right, Saudi Arabia and other OPEC countries are making a significant profit on their low cost barrels because the remaining barrels are more expensive to priduce. Thanks for your comment and for reading my blog.

AND, there are cases of EROEI below 1.

With Fischer–Tropsch Synthesis South Africa achieved 0.6. far from ideal, but hardly the end of the world.

EROEI only tells us part of the picture.

As you have said, technology will 1) allow us to find and dig oil in places where was previously impossible, and 2)increase efficiency when using that oil.

Thanks Arturo,

EROEI should not even be discussed as an issue, if the energy return was poor on the current non-conventional and growth production it would prove to be uneconomical and abandoned.

Hi Daniel,

I am just a layman who was pointed to your blog by a friend and I’m interested in your point of view. I am not a peak oil defender, merely a researcher of truth.

I agree with most of what you say regarding EROEI, but is this not merely an economic argument regarding certain extraction techniques without regard to the resource as a whole? And as you say should not even be regarded as an issue.

Doesn’t the fact that use of lower grades and ever convoluted methods of extraction point to a diminishing supply?

You mention in your reply to pops the scarcity of the most demanded oil grade and the expense involved in unconventional oil sands and deep water. Is this not also an indicator of the state of the resource?

I understand that if unconventional methods are still economical a great deal more oil is available to market, but it is still finite.

It may not be in my lifetime, but if we are reliant on this source of energy and have no viable alternatives, will it not run out, one day?

Best regards

Kenneth MacLean

I also was pointed here by a friend. Agreed Kenneth! Bottom line is, why should we continue to invest money and new technology into an unsustainable energy source?? And “geopolitical bumps”? Is that what you call trillions of US dollars spent and thousands of lives lost to invade Iraq? Oil is a dying energy source and it’s use will be the death of us if we don’t kick the habit.

I don’t think that oil is dying as an energy source. Remains the most efficient, transportable, plentiful source of energy. This, added to natural gas, will remain the cornerstone of energy supply. The geopolitical considerations and wars you mention will probably be mitigated soon thanks to shale oil and gas (see my articles on it in this blog) and an increasing globalization of modern democracies. Thanks for reading.

Daniel: to correct one of the more obvious fallacies in your post.

re. “oil not dying as an energy source”: IEA WEO 2011 shows the natural depletion rate in the global petroleum system is now passing through 10% per annum and rising. That’s a halving time of 7 years for your readers that aren’t familiar with exponential maths. That means that, assuming demand remains the same, a boy born today will have 0.5*0.5*0.5 = 12.5% of the oil we have today available to him on his 21st birthday.

Demand isn’t remaining the same. In fact, demand is growing at ~2% a year due to population growth, mostly in the places where folks don’t have much energy so energy efficiency measures don’t work. That’s an energy demand doubling of 35 years, for your readers following along at home.

The difference between 2% demand growth and 10% supply contraction defines the quantity of energy that must be mobilised each month by investment in some combination of hydrocarbons of declining EROEI, sunbeams and summer breezes, during the most severe and prolonged economic recession in history. The rate of energy mobilisation exceeds, by some margin, the rate we achieved even when we had access to ultra-high EROEI, light, sweet, proximate, abundant and cheap hydrocarbon fuel sources.

Colossal quantities of surplus energy allows human ingenuity (specifically, technology). It does not follow that technology allows surplus energy. Your betting advice seems to assume reversal of causality.

“Colossal quantities of surplus energy allows human ingenuity (specifically, technology). It does not follow that technology allows surplus energy. Your betting advice seems to assume reversal of causality”

–Beautiful!

Hi Rich, I strongly disagree with your oil demand growth estimate (“Demand isn’t remaining the same. In fact, demand is growing at ~2% a year due to population growth”). Demand is likely to be disappointing your estimates both in EM and OECD. Thanks for your comments.

Hi Daniel – the energy economists at the world’s third largest energy producer, BP, estimates 1.6%. I’ve added another 0.4% on the assumption that OECD might get a 10% reduction in per-capita energy intensity but that the other 80% of the planet might like to get to half the standard of living we enjoy some day. In any case, the conclusion is insensitive even to significant negative demand growth assumptions – the task of replacing 10% per annum depletion exceeds the throughput of any productive capital we have or can build. On the other hand, I do agree demand will never reach this – continuing functioning of the economy upon which such demand is predicated is in turn predicated on that supply. You are welcome.

EROEI has nothing to do with the concept of Peak Oil directly. EROEI is a general concept relating to the efficiency of energy production. Any technology that produces saleable and transportable energy at the highest EROEI is clearly deserving of strong investment since there is less energy wasted in the process of performing useful economic activities. The converse is also true. Why would anyone produce a form of energy that consumes 1 unit for every 3 produced when it is possibly to produce 20 or even 40 units of energy at a cost of only 1 unit of energy? Yes energy form matters, but when there is an order magnitude difference in efficiency then the economics should be obvious (unfortunately the little fingers already in the pie don’t want to lose out) If we look at the opportunity cost as a result of the ecological effects then any investor in tar sands should get out quickly, you are walking in a proverbial mine field and green investors will profit more in the long run because the subsidies are changing hands.

Running a society as highly evolved and complex as ours requires a certain minimum average EROEI of all our primary energy sources. Some say that our current average of about 20 to 15 is coming uncomfortably close to that threshold.

I fail to see how EROEI is a myth. It’s a self-evident truth.

I hope Mr. Lacalle will reconsider his assumptions and conclusions in light of the new evidence regarding unconventional oil (fracking, shale, tar sands). The EROEI of these sources is hovering about 5 and they are very short lived sources. Plus, they are only economically viable at oil prices above $80/barrel; this is why a rash of energy company bankruptcies are happening now. The failure to reinvest in supply will inevitably lead to supply shortfalls relative to demand. Mr. Lacalle, when you wrote this piece back in 2011 the evidence was less clear, but you would be responsible to amend your post to reflect the new realities apparent in 2016. I’m calling on you to issue a mea culpa regarding your dismissal of EROEI and peak oil. Peak oil is the even more inconvenient truth, and delays in awareness will have real consequences on our children and grandchildren.

I hope that, after five years, you acknowledge that the peak oil defenders were wrong about supply, more abundant now than ever, about spare capacity, today at record highs, and the incorrect assumptions of EROEI both on non-conventional and renewable sources (http://www.resilience.org/stories/2016-05-27/the-real-eroi-of-photovoltaic-systems-professor-hall-weighs-in) . Costs continue to fall (http://peakoil.com/production/us-shale-oil-production-costs-fell-by-30-from-decade-high), energy use per well is at 7 year low, and spare capacity in the system is at 10 year-high.

Peak oil defenders continue to defend their atrocious assumptions of supply and spare capacity like a sect. The evidence is clear. And oil prices show the glut despite demand growth.

You can’t ignore the enormous amount of debt the industry has accumulated to make this glut possible. I think the jury is still out on this one. When the dust settles and the malinvestments are liquidated, let’s see what happens to production and glut.

The whole shale bubble exists because of cheap federal reserve money printing.

Debt has NOTHING to do with EROEI. The most indebted companies are solar and green ones. EROEI is about energy consumed to generate one unit of energy, and NO ONE can deny that this ratio has massively improved in the past years. Debt is a financial metric that is caused by the falling price, which AGAIN, proves that Peak Oil is a myth… Oversupply and excess capacity HAVE INCREASED. Best regards

You’re right, it doesn’t have anything to do with EROEI, but debt can mask problems arising from a falling EROEI. Debt caused by artificial low interest rates can promote economic activity where it would otherwise not have been. Shale debt was accumulated long before 2014 when the oil prices started to drop. The debt became problematic with lower oil prices.

Oversupply has only been 1-2 million barrels per day. Shale brought more than 5 mbpd online. Shale was only possible by the creation $600 billion of debt and massive growth of debt in China, which enabled the creation of multiple ghost cities, causing artificial demand.

The four largest oil companies have a cash burn of $80 billion per year at the moment. Capital investment all but stopped in the industry, which will cause a drop in production eventually.

This is my observation at the moment, that’s why I think the jury is still out. It would be best for us all if you are right.

Debt in the industry is not an issue of production but incompetent business model based on unsustainable dividends. Erase the idiotic dividend like so many other industries have done and there is no cash burn.

When talking about supply sometimes we are comparing apples and oranges. Oversupply is 2 million barrels a day of demand vs actual supply, but spare capacity (which is what would tie up with your 5mbpd of US new supply) is above 3.5mbp`d.

Capex cuts look high only because we are comparing today´s capex with bubble period capex. And most of that excess came outside of E&P.

All these messages and other… added to the elephant in the room (eficiency gains and renewable substitution) are explained in “The Energy World Is Flat” (Wiley).

Thanks for the comments

There are basically 2 types of oil – conve9and unconventional. The unconventional can be further divided to 2 types- tight and oil shale/tar sand. The conventional has higher eroi while unconventional has lower eroi. Among unconventional, the eroi for tight oil is higher than that of oil shale or tar sand upto certain percentage extraction.

When the conventional oil goes to eroi 6, it will cease to be cheap and people will turn to unconventional tight oil which also has similar eroi. When both of them firther depletes to eroi 4, oil shale/tar sands will be used. The eroi will depend on volume of extraction along with extractable oil in place.

When the eroi further drops to 1,there can be no oil extraction possible. The only way to extract such oil where eroi is below 1 is by burning coal in excess of the energy contained in oil or by coal liquefaction which converts 45% of coal’s energy into liquids while wasting 55%. That is a wasteful thing to do. Even if we assume, that such a technique is used, world reserves of coal is 800 billion tonnes extractable and 1.6 trillion barrels oil can be milked out assuming average bituminous quality coal. Then, eventually oil will run out permanently

Lets come to calculations, conventional oil is about 900 billion barrels (gulf countries exaggerate it. I have personally researched that the oil reserves in gulf countries is about 60% of claimed reserves), venezuela thick oil is 300 bbl, tight oil is 200bbl, oil shale +tar sand is 1000bbl. The total comes out to be 2400 bbl. Similarly, conventional+shale gas is 1.5 trillion barrel equivalent. Coal reserves averaging bituminous is 800 billion tonnes. Consumption as of today : 36 billion barrels of oil, 24 billion barrel equivalent of gas and 7 billion tonnes of coal (actual is 8.5-9 billion tonnes but some are lignite and hence I assumed 2 kg lignite = 1kg bituminous coal). At current consumption, oil will run out in 70 years, gas will run out in 60 years and coal in 90 years. Since shale gas can be further made to some extent, I will give 10 year more for gas. Similarly, I will add 20 years to coal as people may find more resources. Now, lets assume that coal will be gasified and liquified after 70 years when oil and gas run out. We would need to extract 30 billion tonnes of coal additionally for it (60bbl equivalent). At that rate even the coal will run out in next 10 years. So, 80 years maximum for all of fossil fuels. After that, what will we use?

Peak oil theory is correct except that there need not be a bell curve. One could drill more wells for faster extraction as oil in wells begins to deplete. But eventually, there will be a situation where eroi will be 1 including refining and transportation energy and oil will not be feasible on a commercial scale.

By then, my friend, if it were to happen, oil will be a thing of the past and technology and substitution will have replaced it.

Gulf population is set to be 1 billion by 2060 and their oil will run out by 2050-60. They will have no food to eat as imports will require money and they can produce nothing for export other than oil. What do you expect them to do? Attack israel and trigger WW3?

Also, the oil shale that I spoke of will not be easy to extract as pee EROI calculations. There is only hopes of technology being developed. The big problem in that is the heating requirement of the oil shale is just too much to provide EROI above 1. I have also ignored the fact that tight oil, shale gas, tar sands have EROI of 5 which means 20% of the energy will be wasted in extraction. The coal will not be given by countries like Russia, India, USA to outside world as it will be their energy security.

Without coal, oil shale, and 20% deduction in other unconventional energy, the eventual oil run out will be by 2060 itself. The world population is set to grow to 10 billion by 2060. That will only exacerbate the problem. New technology hasn’t come yet. People have been trying since gulf embargo of 1970s and still there is no results. Renewables will work if population is low. But when population is so large, it won’t work

With all due respect, you are making the same mistakes made by Hubbert and co of making exaggerated assumptions long term and ignoring efficiency, tecbhnology and substitution.

Remember when Carter and the doomsayers announced that the world would run out of oil by 1990? It came and Carter’s presidency was already happily forgotten, almost as much as his prediction that oil would have run out for that year. In the early 1990s world reserves doubled those of the 1970s and the price of the barrel had dropped dramatically.

Hubbert made no such mistake. People tend to forget that the famous Hubbert curve, and the very notion of Peak Oil, appeared in a paper called “Nuclear Energy and the Fossil Fuels”.

http://www2.energybulletin.net/node/13630

His analyses of individual oil provinces were knowingly made in the presence of competing oil provinces abroad, and his analysis of the global oil resource was made with the explicit assumption that there were competing non-petroleum energy resources, particularly nuclear energy.

It’s not really Hubbert’s fault that our exploitation of non-petroleum energy has lagged behind his original optimistic assumptions.

Yes, optimistic. An earlier peak in oil production would have indicated that we’d begun in earnest to move beyond oil as our primary energy source.

Hurry up already.