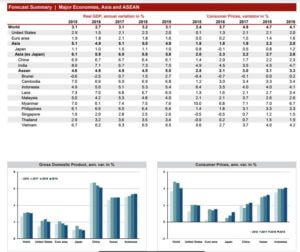

Consensus expects inflation to rise faster in 2018. However, there are important risks to this estimate:

- Technology disinflation

- Overcapacity

- Ageing of the population

We should keep an eye on these estimates because they are likely to impact emerging market growth and asset valuations.

Consensus estimates chart courtesy of Focus Economics.

Daniel Lacalle is a PhD Economist, author of Escape from the Central Bank Trap and Life In The Financial Markets. He is Chief Economist at Tressis

Inflation not going up doesn’t mean interest rates will rise slower than forecasted, too, correct? There obviously is a relationship, but it’s not the only one determining interest rates.

I am pointing this out because there is this common “inflation -> interest rates up -> stock market down” talk, which is a bit too single threaded