One of the most common fallacies of the new populists is to say that their model is the “Nordic” one and that those countries are successful examples of how “socialism works”. When I mentioned it to the Finnish Finance Minister Petteri Orpo at a recent ECR dinner, he could not believe it. Continue reading Face It, Nordic Countries Are Not Socialist

One of the most common fallacies of the new populists is to say that their model is the “Nordic” one and that those countries are successful examples of how “socialism works”. When I mentioned it to the Finnish Finance Minister Petteri Orpo at a recent ECR dinner, he could not believe it. Continue reading Face It, Nordic Countries Are Not Socialist

All posts by Daniel Lacalle

After Italy… Spain Risk Soars

Originally Published by Hedgeye here.

Political risk in Europe was largely ignored in international markets because of the mirage of the so-called “Macron effect”. The ECB’s massive quantitative easing program and a perception that everything was different this time in Europe added to the illusion of growth and stability. Continue reading After Italy… Spain Risk Soars

Political risk in Europe was largely ignored in international markets because of the mirage of the so-called “Macron effect”. The ECB’s massive quantitative easing program and a perception that everything was different this time in Europe added to the illusion of growth and stability. Continue reading After Italy… Spain Risk Soars

Turkish Lira Decline a ‘Symptom’ of EM Fiscal Imbalances (Bloomberg TV)

Watch the full video here.

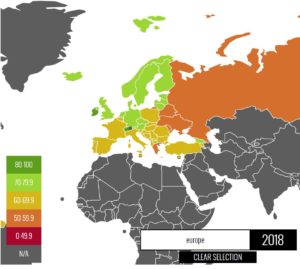

In this interview we comment on the risks of emerging markets, rising imbalances, and a consensus bet on a weak US dollar and low rates that has led to large fiscal and, in some cases, trade deficits. Continue reading Turkish Lira Decline a ‘Symptom’ of EM Fiscal Imbalances (Bloomberg TV)

Escape from the Central Bank Trap (Seeking Alpha, Hedgeye)

The Fed, ECB and BOJ have collectively added more than $20 trillion worth of asset purchases globally since the onset of the Great Recession.

This endeavor has been fundamentally misguided from the start, says economist, author and Tressis CIO Daniel Lacalle.

Central bankers cannot print growth, Lacalle says.

Continue reading Escape from the Central Bank Trap (Seeking Alpha, Hedgeye)