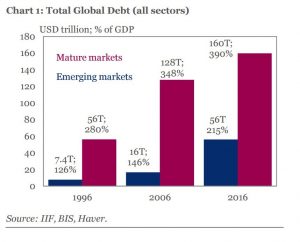

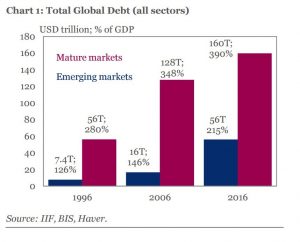

Global debt has soared to 325% of world GDP, led by increases in public debt precisely from those countries that have not implemented any kind of austerity. Public debt, in particular, has doubled in the US and China since 2006, and rose 50% in Japan and the Eurozone.

(Graph courtesy Daily Telegraph)

It is curious, or a symptom of partisan demagoguery, that the same ones that demand more stimulus and deficit spending- more debt -, raise their concerns because debt rises. It is almost a joke that mainstream proposes more white elephants and more public spending, only to fail.

“Spend to grow” has resulted in “spend to multiply debt”.

The mirage of public spending multipliers has proved-again-to be inexistent. The increase in public debt from the US to China and in the emerging countries that decided to “spend to grow” far exceeds real GDP growth since 2006 (read here). The real conclusion is that multipliers are very low or negative in open and indebted economies, precisely because they come from previous excesses created by those same “stimulus” plans.

The “expansion policies” proposed by the new inflationists have been an incorrect decision in the face of evident debt saturation. Why? Because what we are experiencing is a shock of oversupply, which leads to price declines, not a deficiency of aggregate demand. What we live is an environment of excess capacity after a decade of aggressive expansion in the face of growth expectations that did not come true. Overcapacity is evident in all major economies (read this Bloomberg post), as shown in this chart.

In fact, it has been shown that in an open economy with globalized trade and flexible exchange rates, the effectiveness of fiscal expansion is extremely limited (read this report).

Is public investment necessary? Like the private one, only if – as Lord Keynes said – it has a real economic return (read “What Keynes Really Said About Deficit Spending” ) and an obvious need. If not, it is not an investment, only spending to “sustain GDP” … And we know that wasteful spending leaves behind more debt and reduces potential growth. Overcapacity has moved from developed countries (22%) to emerging ones (Brazil about 30%) and China (more than 38%).

The fallacy of the multiplier of public spending has been demonstrated in many studies (read).

The history of more than 44 countries shows that the multiplier effect is very poor in open economies, and negative in highly indebted ones.

The study of Ilzetzki et all, ” How Big (Small?) Are Fiscal Multipliers? “analyzes the history of the cumulative impact of public spending in 44 countries, showing the very low effectiveness of fiscal stimuli.

Even if we accepted positive fiscal multipliers, the empirical evidence of the last fifteen years shows a range that, when positive, moves barely between 0.5 and 1 at most … and in most countries has been negative (“Has the IMF proved multipliers are really large?“).

Indeed, even studies analyzing a positive effect of public expenditure (read) warn that advanced and indebted economies are on the verge of their fiscal limit and their estimates lose credibility (“the effects of the monetary and fiscal policy instruments become unpredictable, and specifically, fiscal policy announcements lose credibility “).

The real conclusion – that the multipliers are very low or negative in open and indebted economies – is what is highlighted in the study by Corsetti et all (2012) ” What Determines Government Spending Multipliers? : “Fiscal multipliers are negative in times of weakness in public finances”.

In addition, massive public spending has a historically negative and dangerous impact on risk premiums, as shown by Bi, H. (2012): ” Sovereign Default, Risk Premia, Fiscal Limits, and Fiscal Policy“.

The current increase in debt has been fueled by the massive drop in interest rates, increased liquidity and wrongly-called expansionary plans, which generate excess debt and high refinancing needs that subsequently lead to a crisis, higher taxes, and subsequent larger budget cuts.

The perverse incentive to spend the money of others to cover the excesses of the past generates an increasing allocation of capital to low productivity sectors and the current expenditure is financed with higher taxes to the middle classes and high productivity industries. The so-called expansionary policies turn into a huge transfer of wealth from the productive sectors to the unproductive ones and, as it could not be otherwise, the potential growth is closed and the goals are broken.

The so-called expansionary policies turn into a huge transfer of wealth from the productive sectors to the unproductive ones, impacting potential growth and weakening the economy.

This endangers the ability to finance the economy and ends in a crisis. That is why debt shocks occur in countries, not because of their high indebtedness alone, but due to the continued deterioration of their public accounts.

One cannot criticize the rise in public debt and demand more deficits. It is like criticizing drunkenness and proposing to cure it with vodka

Very few countries -Germany, Ireland, Estonia, not many more- are implementing real measures to reduce public debt in absolute terms. Almost everyone, moderately or aggressively, makes plans assuming science fiction revenues calculated by people who know that the average error in estimates of future revenues is shameful and, of course, without contingency plans. We must think about the risk of debt shock when we meet in 2018 to 2020 with global repayments to refinance of more than one trillion dollars annually.

We must think about the risk of debt shocks when we face between 2018 and 2020 global refinancing needs of more than one trillion dollars annually. If countries decide to tackle this rise in debt spending a lot more, we will enter that crisis with much less capacity for reaction.

To think that excess debt is solved by borrowing more is like thinking that dancing in a circle will attract rain

Debt is not a right, nor an asset for a country. It is a dangerous liability. In the face of the risk of global debt accumulation, the policy should not be to join everyone to the edge of the cliff but to go in the opposite direction.

To think that the excess debt is solved by borrowing more is like thinking that dancing in a circle will attract rain.