Originally published at @Hedgeye here.

US presidents are not angels or demons. Obama had good things and the Trump administration has them, too. So far, his first hundred days in terms of the economy, are positive. Expectations of growth, consumption and investment have increased in the face of its proposals.

Three of those proposals are very positive. The reduction of the “shadow state” carried out by Rex Tillerson, the attack on useless bureaucracy advised by Carl Icahn, added to Steve Mnuchin’s tax proposal, are all very good news.

The proposed cuts go far beyond anecdotes. For now, the Secretary of State works with a cost reduction plan that would exceed $100 billion, and cuts include all those items outside of mandatory spending, focusing on political spending (read). The famous “draining the swamp” policy. Just the “shadow government” created during the previous administration entails 250 offices and 30,000 people.

Cutting red tape and bureaucracy is also essential. The addition of 43 new major rules in 2015 increased annual regulatory costs by more than $22 billion, bringing the total annual costs of the previous administration rules to an astonishing $100 billon-plus (read).

THE TAX PLAN

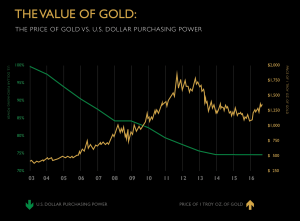

The United States, over the past eight years, has experienced the largest-ever transfer of wealth from savers and the middle class to the government. $1.5 trillion in new taxes, almost $10 trillion in new debt and $4.5 trillion in monetary expansion, all for a GDP increase of just $3 trillion.

What I find intriguing about the analysis of some economists, is that the same people who applaud higher spending, more taxes, and more deficit criticizing the tax reform because it may increase the deficit. It seems that deficit is only good when the government takes money from our pocket , not when it gives money back to taxpayers.

Mnuchin’s fiscal plan has all the economic logic and is politically brilliant. As Jeffrey Tucker of the Foundation for Economic Education explains, it is a plan that strengthens growth and improves revenues. And in addition, voters perceive it immediately in their pockets.

A much needed cut in Corporate Tax from 35% to 15%. The US has the highest corporate tax in the OECD and this is a burden on growth, investment and job creation.

A cut in the capital gains tax from 23.8% to 20%. Reducing taxes on saving is essential to rebuild the middle class and promote sound personal investment to build wealth over time.

A cut in Personal Income Tax for all citizens to 10%, 25%, and 35%. At the same time, the maximum deduction per person is doubled and deductions for mortgage and family expenses are maintained.

The cut in the Income Tax implies that citizens who earn less than $ 25,000 annually do not pay income tax, those with less than $75,000, do so only at 10%, between $ 75,000 and $ 225,000, at 20% and for the rest , 25%. This boost in disposable income is essential to improve consumption while allowing savers to recover.

‘THE LARGEST TAX CUT IN HISTORY’

The largest tax cut in history would mean that the lowest incomes would almost double their current disposable income.

The World Bank estimates that these tax cuts will strengthen growth, and Deutsche Bank believes that these are the measures that should be carried out by the European Union, estimating that the tax reform could double real GDP growth in the United States.

The evidence of the positive effect of the tax cuts is unquestionable. The example of more than 200 cases in 21 countries shows that tax cuts and expenditure reductions are much more effective in boosting growth and prosperity than spending increases. The studies of Mertens and Ravn (The dynamic effects of personal and corporate income tax changes , 2012), Alesina and Ardagna (Large changes in tax policy, taxes versus spending , 2010), Logan (2011), or the IMF conclude that in more than 170 cases, the impact of tax cuts has been much more positive for growth.

We already explained how these tax cuts would be self-financed. The positive effect of higher growth added to reduction in political spending would mean no increase in deficit.

Cutting between 10 to 20% in annual spending from unnecessary spending plans would generate an additional $750 billion over 10 years. Income from Corporate Tax would not fall thanks to higher investment and increased economic activity as well as the repatriation of funds. A long-overdue meaningful increase in real wages would reduce the cost of income tax cuts by 35%. This would lead to a zero increase in nominal terms of the country’s debt.

But how would the debt be reduced relative to GDP? With the effect of a slightly higher inflation than currently expected, better real growth and, more importantly, achieving energy independence in 2019. The energy revolution in the US created more than 2 million direct and indirect jobs while adding 1% to GDP and boosting capital expenditure. Unconventional oil and gas and renewable companies, including suppliers of equipment and materials, and energy-related jobs already added about 1.8 percent of the workforce in new -and highly paid- jobs. By 2025, an estimated additional 3.9 million jobs could be created.

WHY WE NEED TAX REFORM

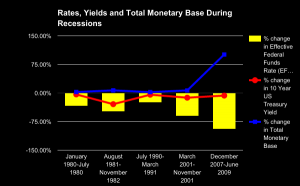

The importance of recovering from the current anaemic economic growth of the United States is essential. The US is growing at the slowest pace of any recovery in the past 60 years. Bringing the US economy back on track to achieve its potential is urgent, and it will not happen by raising taxes and destroying savers.

This reduction in US spending, bureaucracy and taxes will not be easy, as there are too many opposing forces.

There are many things that can be criticized of the Trump administration, but this is not a debate on ideology, this is common sense . If the US wants to remain the leader of the global economy, it must abandon the stagnation of productivity, investment and disposable income that has come from the assault on savers and productive sectors.

As Rex Tillerson said many years ago, tax cuts are not debatable as an engine of economic growth, creating more wealth and non-confiscatory redistribution. The goal isto recover the middle class, who has paid for the excesses of the last decade.

The fact that these measures have been criticized “for increasing the deficit” by the same people that said that it is time to increase the debt (read Time to Borrow by Krugman), shows that the tax plan is on the right track.

Mulvaney knows that these measures increase global demand for US dollars, and Mnuchin knows that the increase in growth and disposable income is very positive, economically and politically.

It is not about liberalism or conservatism. Labels are irrelevant in an economy like the US. It’s about logic.

Daniel Lacalle is a PhD in Economics and author of “Escape from the Central Bank Trap” (BEP), “Life In The Financial Markets”and “The Energy World Is Flat” (Wiley).

@dlacalle_IA

Picture courtesy of Morgan Stanley