It was a strong week in the oil market as Brent pushed through the $115/bbl to reach the highest level since April last year. Positive macro-economic data, coupled with the increased geopolitical risk premium provided a positive backdrop for the strong gains. In terms of fundamentals, OPEC production continued to slide in January, reportedly reaching the lowest level in 15 months. It is important to note that OPEC production is nearing the official production quota of 30mbpd level where it may stabilise. Similar to reports in December, reduction in production is largely attributed to a well-supplied market. Continue reading Commodities Weekly

Category Archives: Energy

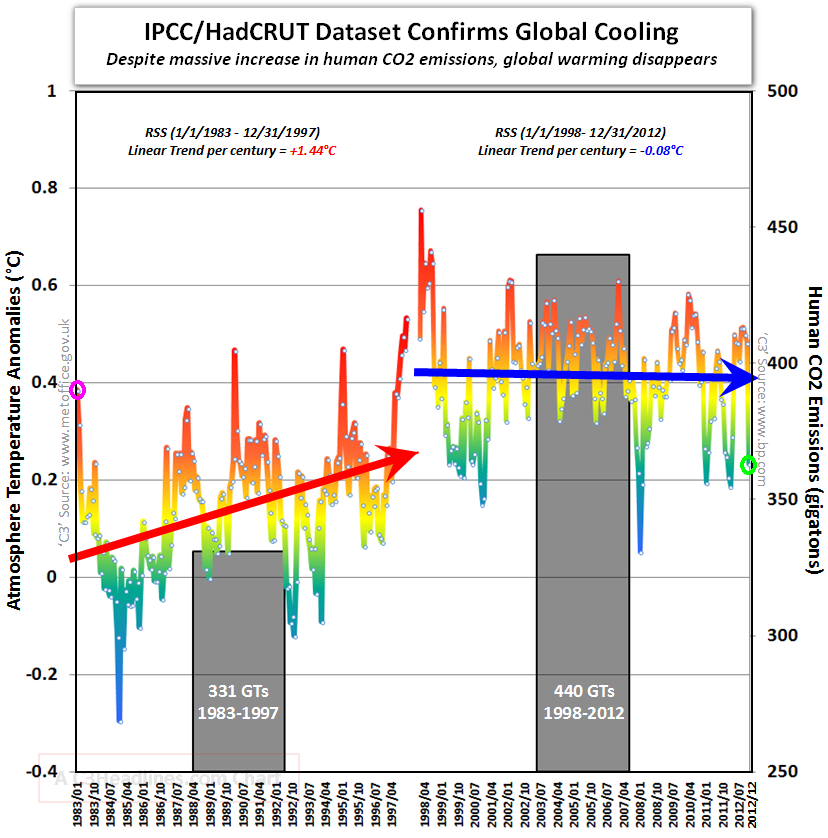

Climate protection policies, more harm than benefit?

The more I read and suffer the European policies designed to “protect climate”, the more questions I make myself, and the greater the desire to share them with you. Continue reading Climate protection policies, more harm than benefit?

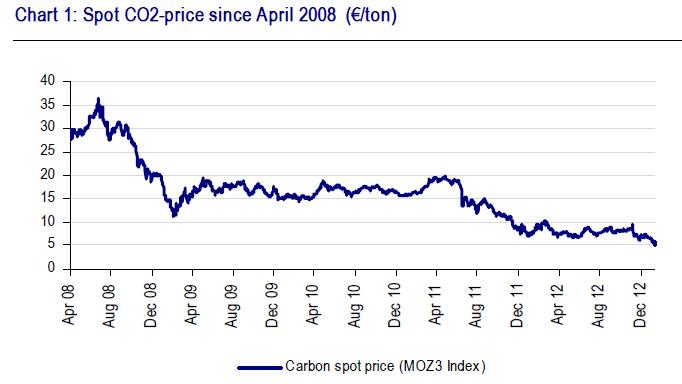

CO2 collapses to all-time low

Is CO2 dead? This is something I have been warning for a few years now. The evidence is overwhelming. Flawed concept, massive oversupply of permits and politicians optimistic predictions. Great combination. Continue reading CO2 collapses to all-time low

Is CO2 dead? This is something I have been warning for a few years now. The evidence is overwhelming. Flawed concept, massive oversupply of permits and politicians optimistic predictions. Great combination. Continue reading CO2 collapses to all-time low

Commodities Weekly

Outperformance of WTI vs. Brent continued this week as the spread between the two benchmarks narrowed further to $15.5/bbl.

The WTI benchmark is receiving support from the start-up of the expanded Seaway pipeline, with the market factoring in this recent expansion in takeaway capacity (150 thousand b/d to 400 thousand b/d) as a precursor for a reduction of surplus crude oil inventories at Cushing over the coming weeks. It is important to note however, that in the meantime crude stocks continue to climb to new record highs.