(Article published in Spanish in Actualidad Economica magazine, June 2014 supplement: “El Espectador Incorrecto – Una mirada liberal al mundo”)

While Continental Europe is still struggling to recover from the deepest economic crisis since World War II, UK business confidence is reaching historic highs. With an expected GDP growth of 2.7% for 2014 and unemployment trending down towards 7% well earlier than planned by the Bank of England itself, the UK’s economic health is striking. The streets of London are buoyant, with retail sales booming. And importantly such confidence in the future is not limited to London but can also be felt across the country, as confirmed by a recent national survey (Grant Thornton’s UK Business Confidence Monitor – Q1 2014). The roots of such economic success go back to the Margaret Thatcher years.

It seems normal to anyone living in Britain today to shop in supermarkets at any time of day or night, to get cash at the bank’s counter or the post office on Saturdays, to switch electricity supplier in a few clicks after being alerted by the incumbent supplier itself that there is a cheaper offer with some competitors, to travel to anywhere in Europe for a fraction of a typical flight ticket, even to start a new business in a day. What a contrast with the UK of the 1970s and early 1980s, which Bank of England was qualifying as “the sick man of Europe”! Britain was paralysed by constant strikes, streets were empty after 6pm with most shops closed by then, Europe was making fun of lazy and lousy Britain. The country’s decline seemed unstoppable and both politicians and the British people seemed resigned to it.

Free markets, flexibility in employment laws, tight control of government spending, tax cuts for business and individuals, even for top earners… Such pillars of Ms Thatcher’s economic programme are hardly contested today by either Conservative or Labour leaders, who over the years have, one after the other, admitted being “Thatcherites”. Margaret Thatcher reportedly considered that her biggest victory was to have brought the Labour Party to end-up backing her economic policies. Ms Thatcher’s reforms now appear so obvious and natural that it seems that nobody can contest them anymore.

Nevertheless, the intense debate re-ignited at the time of her funeral last year shows that her legacy remains hugely controversial. As if British people were shameful of what they have become: successful and wealthier, but greedy and selfish?

While the Iron Lady obviously did not do everything right and too often seemed hermetic to people’s complaints, one has to admit that she has transformed her country to an extent that no other European nation has lived over the past 40 years.

Ms Thatcher’s eleven years in power were particularly ground-breaking in three major economic aspects:

First of all, government spending was cut dramatically and budget deficits were kept under control for the first time since the War, even turning to a surplus in the late 1980s. Ms Thatcher considered a national humiliation that her country had to request a loan from the IMF in 1976. She decided that the fight against public spending should be the country’s top priority. The only areas intentionally preserved from cuts were police, defence and the National Health Service. After reaching 44.6% of GDP just as Ms Thatcher came to power in 1979, public spending was cut back to 39.2% by the end of her three terms in 1990. This despite having to face two recessions in the meantime. Even more significantly, the control of budget deficits became the new norm so that State spending continued to drop in the 1990s, even under Tony Blair’s New Labour governments, in a clear contrast with most major industrialised economies. At the end of the 1990s, Britain had reduced public spending almost to the level of the US, well below any other large European country. Interestingly, Ms Thatcher managed to reverse the trend of Budget deficits while at the same time drastically cutting taxes. She was convinced that the country was being paralysed by the heavy weight of taxation, which was not only preventing corporates from investing but also was creating an assisted mentality and was killing any entrepreneurial spirit. Taxes had reached levels of up to 83% of income. She capped the marginal tax rate at 60% to start with, then 40%, and cut the common tax rate from 33% to 30%, while raising VAT. And she would refute accusations of favouring the rich, convinced as she was that you need to incentivise those who are ready to take risks, invest and create jobs. The reduction in Budget deficits was financed not only by spending cuts but also by a £50bn privatisation programme. Emblematic companies like Jaguar, British Telecom, BP, British Gas, British Airways, British Aerospace were either sold or privatised. But here again the National Health Service was kept under State ownership and control.

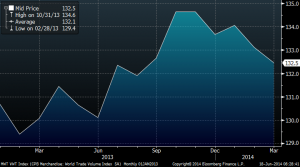

Another key aspect of Ms Thatcher’s era is how the stringent reforms underpinned individual wealth, against all odds. Since 1980, GDP per capita has increased more in the UK than in the US, Japan, Germany or France. While the UK’s GDP per capita had been lagging all major industrialised nations in the three previous decades, the situation started to reverse during Ms Thatcher’s terms and Britain took the lead in the 1990s and 2000s. Such statistics are the best answers to those who blame her for having increased the gap between the rich and the poor, as the whole population in fact got significantly wealthier. A good illustration of this is how the most modest segments of the British population gained access to the property market. Through her famous “Right to Buy” scheme, Margaret Thatcher led the State to sell 1.5 million council homes at large discounts so that the poorest could acquire the properties they were living in. The scheme was clever as it helped restore public finances, generating £18bn over the period. And it made Ms Thatcher hugely popular among popular classes!

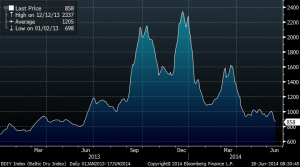

But if there was one achievement to keep in mind from Margaret Thatcher’s eleven years in power, it is how she has converted Britain to free markets. Her economic principle was to limit the State’s functions to the protection of individuals while the markets would take care of the rest, under the control of strong independent regulators. She profoundly believed in people’s sense of responsibility and therefore in private enterprise. She abolished currency exchange controls and cut State subsidies to industries. She deregulated finance, but also most utilities services, including telecoms, power and gas supply. While largely criticised in its initial stage, notably due to an initial boost in unemployment numbers, the process quickly proved to be a significant incentive to innovation and competition. In her view, economic freedom would lead to growth and job creation, which is pretty much what happened. UK regulators have not been questioned since then and are well respected today for their role to limit free market excesses. They are not only independent from the central government but also careful of interests of both private operators and final users. The British society gradually gave up its assisted mindset to adapt itself to the notion of sound emulation through competition. This has been the source of major progress and growth in the UK economy and still today represents one of the country’s key strengths relative to its peers internationally.

So Margaret Thatcher inherited from a stagnant economy, a huge, costly and inefficient public sector, a population discouraged by confiscatory tax levels and structural unemployment. Not so dissimilar to Europe today is it…? Now we know the recipe to success. But we are running late so let’s not wait, Margaret Thatcher’s era was 25 years ago!

Jean-Hugues de Lamaze

Economist and Fund Manager in London

Important Disclaimer: All of Daniel Lacalle’s views expressed in his books and this blog are strictly personal and should not be taken as buy or sell recommendations