“All war aims for impunity”, Michael Ignatieff

The agreement between Iran and the world’s great powers is a big political mistake paved with good intentions. It assumes that a government that has the explicit objective of the “total destruction of Israel” and that has not changed a whit its nuclear aspirations, will change. In fact, the agreement was celebrated by the Iranian news agency, since it is not a real change in its program.

“All nuclear power stations will continue their activity, Iran will continue to enrich uranium and the R&D on advanced centrifuges continues.”

Iran will keep 6,104 IR-1 centrifuges for 10 years. I am concerned that the Minister for Foreign Affairs, Javad Zarif, has confirmed that Tehran will begin to use their (IR-8) next-generation centrifuges, which enrich uranium up to 20 times faster than the current IR-1s.

The former Director of the CIA Michael Morell and a whole battery of geopolitical analysts have warned of the error of basing the agreement on the number of centrifuges and “verification”. “5,000 centrifugues is more than enough to build nuclear weapons, but not for an energy programme”.

According to the International Atomic Energy Agency, a nuclear bomb only needs 25 kilograms of enriched uranium U-235. And although it is more difficult to produce uranium 90% enriched, it is not much more complex than the 4-5% uranium required to generate electricity.

Limiting the number of centrifuges is not avoiding any risk. But it’s funny to put the nuclear program as an excuse to “diversify energy sources”. As if Iran could not diversify through natural gas, solar or wind power.

The support of Iran in the battle against the Islamic State has weighed more than the risk to Israel or the stability of the area. But the claim of the Obama Administration that verification alone will work -when only 25kg of enriched uranium can be enough to make a bomb- and leaving the region to solve its own problems are huge miatakes. And it puts Israel in danger.

The risk for stability and peace in the Middle East is huge… in exchange for a promise that “within eight years,” everything will change. It cannot be more naive.

Impact on the oil market… the only positive.

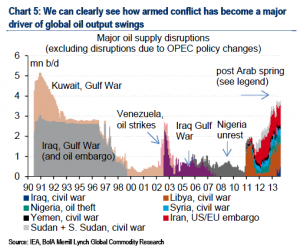

The agreement with Iran means an estimated increased investment in the country of $ 170 billion, primarily in oil and gas. The immediate impact will be to increase production in the short term between 500,000 barrels per day and a million in the medium term, being conservative. This means much more excess supply, as we mentioned many times in this column.

With the end of the embargo, the spare capacity of OPEC also doubles. In addition, investments in new oil infrastructure will help Iran to increase production above 4 million barrels per day and longer term probably to 6.5 million barrels per day.

Iran will have more than 20.8 billion dollars in annual added revenue in the short term, added to the aforementioned investments. Meanwhile, Saudi Arabia has already increased production to the historical record of 10.33 million barrels per day in May. Iraq, although not subject to quotas, also reached record levels.

The strategy of OPEC is still standing. Prove to the world that they are more competitive, flexible and reliable suppliers. Gain market share in an environment of excess of supply that they know is structural. And prove that they can win a price war against the US, Russia and renewables in an environment of low prices.

John Kerry and the negotiators know well that potential new geopolitical conflicts do not impact the “oil weapon” and with the US close to energy independence, they think that it is easy to leave the region to solve its problems without US support. Seems they have forgotten that there are more important things than cheap oil and reducing military presence in the region.

Obama says that the agreement is not based on trust but on verification. This reminds me of the scene in which Hans Blix told Kim Jong Il in the satirical film Team America that “if you don’t let us inspect your palaces we will send you a letter showing how angry we are”, seconds before being thrown into a pool of sharks by the North Korean dictator.

We may have cheap oil for a long time. But the risk to Israel, and by extension, Europe, is very high, and it is irresponsible for the world to appeal to the good will of those who want your destruction.