From my comments at CNBC

“He is a Sinn Fein-loving, monarchy-baiting, Israel-bashing believer in unilateral nuclear disarmament. This is a man who, for more than 30 years, has made a political career out of being explicitly and avowedly on the Spartist Left. He is a frondist, an inhabitant of the semi-Trot margin, an unrepentant lover of oppositionalism” Boris Johnson

Never in my life have I seen more euphoria after the nomination of a Labour candidate … among conservatives.

The UK has created over the past four years more jobs than the rest of the European Union put together, and spending less than half -relative to GDP- on active employment subsidies.

The country leads the growth of the most industrialized nations, the G7 , with 4.5%, and unemployment today is almost below the natural rate, at 5.6%. In effect, considering that the UK is a net recipient of tens of thousands of immigrants, we can consider it full employment .

As a country of SMEs, where meritocracy and success are highly regarded, it comes as an anachronism for Labour to elect Corbyn, who for 30 years has lived off the public sector and just complained.

The two great weaknesses of the British economy are the high trade and fiscal deficits .

Faced with such a scenario… what could be more illogical than for the Labour Party to elect someone whose main economic policy is to widen those deficits? To consider deficit spending, tax increases and white elephant public infrastructure as “solutions”, when they have failed miserably in France or Spain in the 2004-2010 period is simply unexplainable.

It is no surprise, therefore, that eight Labour cabinet members have resigned after the election of a Labour leader who proposes some of the most outdated and failed policies in modern economic history. Mr Corbyn said that the State spent too little under previous Labour governments despite the fact that the country´s financial situation deteriorated dramatically with large imbalances that are still felt today. With a current 44.4% of GDP public spending, saying the government spends “too little” is an insult to taxpayers and efficient public bodies alike. But on top, he wants to penalize the private sector creating the largest government privilege ever designed. The People´s QE (quantitative easing).

In Europe we are already accustomed to the follies of magic solutions from populist parties. Syriza, Podemos, and others always come up with “magic” and allegedly “simple” ideas to solve large and complex economic issues, and always fail when reality kicks in. But there are few that match the monumental nonsense of the “People´s QE”. The Government´s QE rather.

What is it and why is the People´s QE a bad idea?

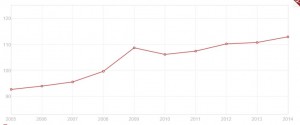

The UK policy of increasing money supply aggressively in the past has always been based on two premises to make it work and avoid hyperinflation and currency destruction: the independence of the central bank as a central pillar of monetary policy, and the constant sterilization of asset purchases (ie, what it buys is also sold to maintain as close as possible to supply and demand market principles). The balance sheet of the Bank of England has remained stable since 2012, coinciding with the highest economic growth period, and is below 25% of GDP.

However, we should not forget that the largest expansion of the balance sheet of the Bank of England coincided with a Labour government.

Corbyn´s People´s QE means that the central bank loses its independence altogether and becomes a government agency that prints currency when the government wants, but the increase of money supply does not become part of the transmission mechanism that reaches all parts of the real economy. All the new money is for the government, with the Bank of England forced to buy all the debt issued by a “Public Investment Bank”.

The first problem is evident. The Bank of England would create money to be used for white elephants, a disastrous policy as seen in Spain and other EU countries that only leaves overcapacity and a massive debt hole. By providing the public investment bank with unlimited funding, the risk of irresponsible spending is guaranteed. In a country where citizens are well aware of wasteful public infrastructure, this is not a small risk.

The second problem is that rising public debt, even if hidden at the investment bank, would still cripple the economy even with perennial QE. As Moody´s points in Brazil, public debt has to include that of state owned enterprises. Printing money does not reduce the risk of rising debt, as we are seeing in Japan or the US. And the new bank´s potential losses are covered with more taxes .

The idea of building unneeded bridges and airports all over the place to create jobs would be mildly amusing if it hadn’t failed time and time again, and forgets the cost of running those infrastructure projects once built, apart from the debt incurred. All paid by the taxpayer, who guarantees the capital of the Public Investment Bank. Anyone that travels around Spain and sees the thousands of white elephants should be scared of the consequences.

The third problem is that inflation created by these projects is paid by the usual suspects. The citizens, who do not benefit from this spending as the laws of diminishing returns and debt saturation show. Additionally, trade deficits widen to unsustainable levels as imports outweigh exports. Think of China, who today needs four times more debt to create one unit of GDP than eight years ago. Tax increases, higher cost of living and, above all, destroying a large part of the British private sector because the state monopolizes the major sectors of the economy and increases taxes for the rest.

Tax increases, higher cost of living and, above all, destroying a large part of the British private sector

The fourth problem is that this idiocy has already been done in the past . It is the Argentine model of Fernandez de Kirchner and his minister Kiciloff disguised in Anglo-Saxon terms, a model that has only created hyperinflation and stagflation, as we mentioned here , it is the Venezuela model (Mr Corbyn is a defender of Chavez and his economic policies), the Chinese model that is bursting in front of our eyes and is also the same mistake carried out by Brazil . To think that the State can decide how much money is created and spend it on whatever they want without thinking of the consequences for the economy.

Corbyn forgets that for the public sector to exist there is one thing that is required: Private sector money. Printing it does not solve the issue.

The problem in the end is always the same, the aristocrats of public spending, which have never started a business or hired anyone with their savings and effort, always think that intervening on money creation and the economy is going to solve everything.

Do Corbyn and his team know ?. Corbyn does not care, because for him the State is infallible and any mistake is excused. But his team has come out to defend the idea saying this time it is different. Socialism has such a massive track-record of failures that only a group of intellectuals can ignore it and say that they’re going to do it differently.

If Corbyn implements its Government QE, its “Kiciloff Plan with tea and cakes” , as I call it, some voters will continue to advocate printing money for nothing and, on the way home, while wondering why they cannot make ends meet and why they pay more taxes, they will blame “the rich” and will go to sleep, with the peace that comes from knowing that a man who has never created wealth tells them not to worry, that he controls everything.

If Labour keeps promising things like these, the Conservatives will be in power for many decades.