There is hope and doubt among investors following the announcement of the Spanish financial reform. And like it or not, investors are the only real solution to help finance the so-called “property management agencies” (bad bank), the term used for the entities that will house the toxic assets of Spanish banks, generated after a decade of real estate bubble.

There is hope because it is the first reform that looks real. But there are doubts, especially because it is not clear which will be the discount to be applied to the valuation of toxic loans, or what will be the formula to finance the gap between loan value and real asset value. The answer, in my opinion, is that if the discount is not strong funding will be complicated.Investors told the government in many meetings that they will only accept an “American” solution, a bailout (TARP) and a complete clean-up of the toxic mess created by real estate. However, the Spanish government does not want to take such a high a political cost, by undertaking a massive bailout that previous administrations failed to undertake. The policy of “pretend and extend” has been incredibly damaging both for the country and for financial institutions. The interventionist regulation of the Bank of Spain and lousy management of the loan portfolio of some entities, not all, made the financial crisis deeper and longer.

The other solution would have been to create a giant debt-to-equity swap program that would take care of the toxic loans and re-capitalize the banks. Two problems there as well. One, the size of the problem, more than €170bn, and two, the contagion effect on the holders of that debt, mostly European banks and domestic entities, which would face the dilution with a domino effect of re-capitalization needs.The Spanish government faced the devil’s alternative, remembering Frederick Forsyth’s novel about a situation in which all options entailed huge challenges. Allowing bad banks to fail, or a “USA TARP solution” or a “Swedish solution”, buy the loans at once at real market price. But the cost to the taxpayer would be enormous, between 17 and 30% of GDP, and it could mean bankruptcy for many public institutions, which would have a greater political cost yet. The devil’s alternative.

All the options to solve the mistake of “waiting until it clears” and denying the bubble of the last four years are financially complex and politically difficult. That is why the government in Spain is hoping that the solution will include foreign investors. But these will not allow another half-baked solution, but immediate and total cleaning. And the risk is that this new reform is perceived as courageous, but with unresolved issues, and probably too long -two to five years- to implement.In 2008 we were told that the maximum exposure to troubled real estate loans of the banking system in Spain was €25 billion. Today, four years later, the figure many of us had in mind is now official. Nearly €184 billion in troubled non-performing loans. And someone should be held accountable for the loss of credibility of the enormous amount of incorrect and half-clear information that was provided to markets in the past years to try to “reassure” investors.

At least, the Government puts the problem on the table . The solution is less obvious. But the alternative of the devil tells us to be drastic. It may hurt in the short term, but it cuts the gangrene . Leaving the solution in the hands of the same regulator and the same managers which extended and masked the problem “while markets recover” can cause Spain a major problem. Because credibility is lost in a day and it does not recover in years. And it’s an urgent matter.

In Spain, which prided itself of having no sub-prime crisis – these are things of the evil Americans- no less than €73 billion of the total €184 billion in toxic loans correspond to “land”. This is important because one of the things that separates Spain’s real estate bubble from others in the OECD is that some banks and cajas (savings banks) had the brilliant idea of giving loans to land before urbanization. This has to be completely written-off. Because finished properties can be sold, maybe at 40%, 50% or 60% discount, but credit to land is worth almost nothing. The real estate adjustment cost other countries between 20% and 40% of GDP and massive dilutions in banks. In Spain it will probably be similar. But it’s the beginning of the solution.In 2004, a good friend, a professor at a prestigious business school, told me how surprised he was to see such a “diverse” professional profile in the new Spanish bankers attending his course. Politicians, trade unionists, philosophers, among others.”That’s what free money does, everybody is Rothschild until the music stops” he said. And it stopped. The problem is not that it stopped, but that many of these financial entities, mostly public-owned savings banks, waited for years hoping that the music and the party returned… Spanish real estate only fell 22% from the top while unemployment soared to 24% and the economy tanked because most of the inventory of unsold houses was kept “until prices recovered”, to avoid large mark-to-market losses, through troubled loans.

It is worth noting that the creation of real estate management vehicles (bad banks) and public capital injections will not increase credit immediately to the real economy, because the problem of Spain remains a public and private debt of 350% of GDP, and the deleveraging process is unavoidable. In addition, banks, once they have tried to put out the fire of the real estate hole, face a challenging economic environment. And with expectations of a fall of GDP also in 2013, according to the EU, the bad loans (NPLs) remain a problem. It is impossible to increase credit in an economy where credit expansion was close to 8% pa for a decade, leveraged more than three times its gross domestic product, where the return on assets of many banks is less than its cost of capital.

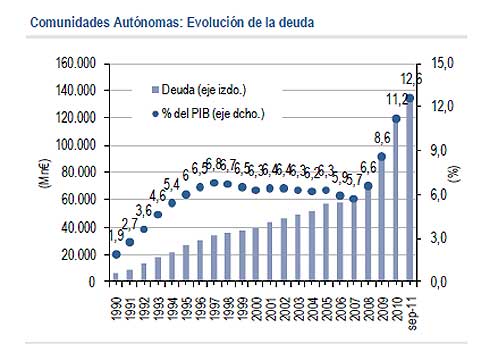

. If the State is involved in funding the bad banks, but the country accepts bubble-time valuations, the need for constant injections will keep Spain in unsustainable debt ratios. In fact, the government deficit would increase (including state guarantees) from 87% today to 110% .

. Injections of public money are short term loans and would not affect the taxpayer only if the market valuations are realistic and don’t require additional injections.. Of the €310 billion that we mentioned earlier, €184 are already considered within the category of problematic (delinquent). Of these, €44 bn are already provisioned, ie about 25% of the value of the credits. The remaining amount of real estate loans considered “healthy” and not yet provisioned (€122 bn) are not all fine and secure. As the economy worsens, a part of these will also become non-performing. Let’s face it. Because it can cost between 1% -2% of GDP over three years if the country allows more “hide, pretend and extend”.

. Spain should not try to hide the difficulties of bad banks, those are already sentenced. It should ensure and enhance the situation of the good banks -very good, some of them- and not allow a contagion from a lack of credibility and perception of mismanagement that is not, nor can be generalized . The country cannot allow a capitalization problem -serious, but solvable at market prices- to become a problem of solvency of the system.

Who funds the gap between loan value and true market value of the real estate exposure?

According to the different alternatives considered, the market supports an ECB or EFSF credit line. The problem would come from the demands on tax hikes and additional cuts that such aid would entail. And it’s the same old problem . Debt with more debt that is financed with taxes anyway.

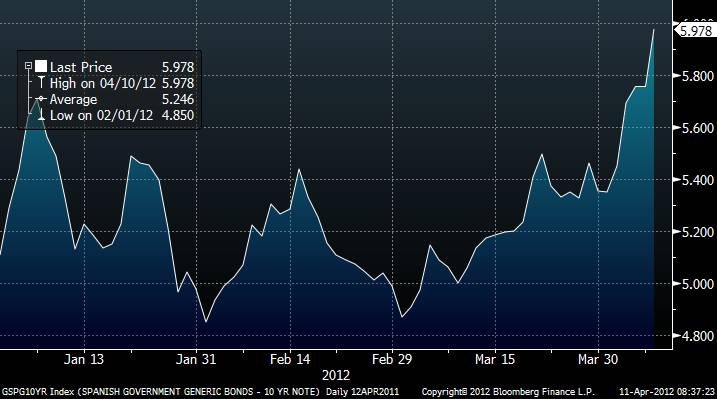

On the other hand, a public funding solution also seems remote because of the need to increase borrowing at a time when spreads to the German Bund are at all-time highs (480bps). And with the system’s credibility into question, forget about Eurobonds to finance real estate bad loans clean-up.

Of course, the most logical is to attract the participation of foreign capital , through partial debt-to-equity swaps, IPOs or placements of convertibles, which will only succeed if the market perceives that valuations of the assets are really discounted and attractive. A 20% -30% discount after a peak-to-current drop of only 22% would not easily create enough investor appetite.

The worst of past mistakes made by banks, regulators and government, is that through our stubbornness of maintaining that nothing was a real problem we have risked the discredit of our financial system, which could spread the problem from the weak banks to the good ones, and from bad managers to solid ones.

It is good to read that some bank rule out any resort to state funds and may make all provisions against operating profits. To separate the bad from the good is much better than the previous policy of infecting healthy assets mixing them with toxic assets, because the risk does not dissipate, it is contagious. Let us separate everything, and show actual market prices. And the solution will be in front of our noses. After four years of evident crisis, this is the opportunity to be realistic.To watch my interview in Al Jazeera about the Spanish banking issues go: (Quicktime or Oplayer required) http://dl.dropbox.com/u/62659029/iv_daniel_lacalle_250512_0.mpg

Further reading:

Eurobonds? No Thanks. Debt Isn’t Solved With More Debt: http://energyandmoney.blogspot.co.uk/2011/11/eurobonds-no-thanks-debt-isnt-solved.html#

What happened to put Spain on the verge of intervention?: http://energyandmoney.blogspot.co.uk/2012/04/what-happened-to-put-spain-on-verge-of.html

Why Italian and Spanish CDS can rise 40%… and Greece is not to blame: