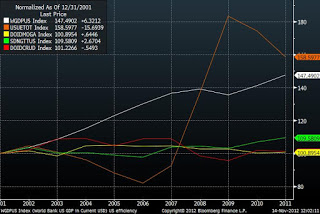

White line is US GDP, orange – unemployment, red – oil demand, yellow – gasoline demand, green – gas demand.

- US 2001 – 2011

- GDP +6.3%

- Gasoline demand +0.06%

- Oil demand: +0.05%

- Gas demand +2.6%.

The introduction of new lighting in the US will take aggregate demand growth to zero or negative over the implementation period, eg, the next 4-5 years. General Lighting is a big slice of the pie (like 12%) and a lot of the US simply never switched over to incandescent (eg, residential, and some commercial). Will have less of an impact on Europe.

Incidentally, many will make the argument that new iPads and gizmos will offset losses, we keep buying stuff and plugging it in. While true, the devil is in the details…new LED TV replacements are obliterating like-for-like consumption, particularly against gen 1.0 plasmas. New refrigerators and heaters are substantially more energy efficient.

Very interesting indeed. Curious to know what caused this? Efficiency? Structural changes in inudustry? Price effects? Other energy sources? Or just normalization effect.

Efficiency explains most of it. Because in the period US manufacturing rose c15%.

¿Cual es el futuro de la industria energetica en el que se combina una mayor facilidad de acceso a recursos energeticos con una menor necesidad de consumo debido a los avances tecnologicos?

¿Van a ser rentables las iversiones que se estan realizando en extraccion de recursos energeticos a largo plazo?