Front Row represents the personal view of Rodrigo Rodriguez, European Head of developed cash trading for Credit Suisse.

Thanksgiving week, a good time for all of us to thank God for being part of that small percentage in the world of privileged people who have a house , a job and hot food on the table everyday (unless you prefer salads…).

So please allow me to start this week by thanking you all for reading and helping me to improve this note every week, as well as thanking my team for contributing to the different sections and writing “Back Row” while I am away, but especially let me thank my wife (Happy Birthday Nayke!) and child for being back in London

So please allow me to start this week by thanking you all for reading and helping me to improve this note every week, as well as thanking my team for contributing to the different sections and writing “Back Row” while I am away, but especially let me thank my wife (Happy Birthday Nayke!) and child for being back in London- Japan The new Kid on the block

- What Factors are working . Capital Gains , Positioning lack of liquidity , The Yin & Jan

- Catalonia or the road to nowhere

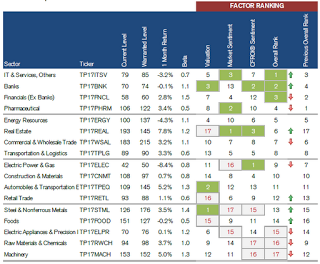

Using the HOLT database, we found that IT, Consumer Discretionary, Industrials, and Health Care are the sectors with the highest percentage of international sales. The HOLT sector ranking model (pictured below), which combines Valuation, Market Sentiment, and CFROI sentiment, also prefers IT and Health Care (and Banks). Valuation has started to work again in Japan after a three-month hiatus and the country’s market-derived discount rate declined 32 bps since May. So while there are many broken businesses in Japan, there is momentum in the inexpensive, high-export space now.

Using the HOLT database, we found that IT, Consumer Discretionary, Industrials, and Health Care are the sectors with the highest percentage of international sales. The HOLT sector ranking model (pictured below), which combines Valuation, Market Sentiment, and CFROI sentiment, also prefers IT and Health Care (and Banks). Valuation has started to work again in Japan after a three-month hiatus and the country’s market-derived discount rate declined 32 bps since May. So while there are many broken businesses in Japan, there is momentum in the inexpensive, high-export space now.What Factors are working . Capital Gains , Positioning and lack of liquidity

So once I show the results I immediately started to wonder if value would have started working again. We are all aware that this have been a strange year , where positioning has distorted most of the trades so I am clearly waiting for value to start performing as the sign that Long only money is really putting money to work and that an equities allocation is starting to happen.

This time I went to Siebert and Panos, also in HOLT ( I tell you these guys are clever!, what a platform!), and unfortunately for me the results were not exactly what I was expecting

On a cumulative basis, Valuation remains the weakest performing factor in Europe over the last 12 months.

On a month by month basis: Valuation did not work in Europe in Nov (yet) Got hurt in the first half of the month, and recovered almost completed in the last week.

But you know me , I am quite stubborn and I do not accept defeat easily so I turn to Marina and Andrew’s team, I had the feeling some indicators were turning constructive for this markets, and this is what I found:

- The US corporate net buying (i.e. share buybacks plus cash-financed bid activity minus IPOs and secondary equity issuance) surged to 5.2% of market cap (or three times its norm).

- This is primarily driven by strong share buybacks which rose to 7.1% of market cap (or 2.3 times their average).

- Combined with falling Insider (i.e. directors) Sell/ Buy ratio, this is supportive for equities

Now we are talking …

I felt that I was on the right path so I turn to my other ally Mr Ben C.and I had a chat with him that he perfectly summarized on a note yesterday, these were the highlights:

- Political events have pushed conviction levels back towards the mid-summer lows, with depressed appetite for risk evident in the recent shift in the balance of our business. Volumes are subdued, institutional flows are increasingly dominant, and signs are emerging that some hedge funds are already beginning the process of winding down risk for the year.

- Among the things that have stood out of late has been a third wave of US institutional buying of European equities, the bulk of that flow has been captured via our Delta One desk

- The most decisive shift in client activity in the last month has been volume buying of Emerging Market equities, again primarily through Delta OneIn rates, we’ve started to see the beginning of the unwind of what has been the consensus fixed income trade of 2012. Explicit Federal Reserve and implicit ECB commitments to keep rates lower for longer have led to substantial crowding in longs at the front end and intermediate parts of the curve (basically 2’s-5’s). The unwinding of what has been a profitable trade for many is contributing to the current sell-off in rates, and could obviously accelerate in the event of a broader “risk-on” move.

- One final point that I should highlight, in some ways the most important, is that we haven’t seen conclusive evidence of clients placing “upside” bets on the fiscal cliff being avoided, one doesn’t sense from recent activity that the investment community is positioned to capture the trade. This may be symptomatic of an environment in which investment horizons are now so short that people believe it pays to wait, and then buy the news. LTRO II in Europe was a case in point – the initial announcement came in December, and the LTRO rally didn’t peak until mid-March 2012. The risk, of course, is that liquidity won’t allow investors to participate in sufficient size if “the cliff” sees positive resolution, so I think this observation on flows is particularly important If political events play out positively in the next few weeks, we may find ourselves distracted from festive cheer come late December, as the market, and US capex sensitive stocks in particular, gap higher on thin volume.

But obviously not everything can smell of roses in this life, so I went to look for the Yen and there he came my friend Emmanuel with his Most important chart in the world (Yes I know I am using pieces from everyone , but we clearly seem to be at an important inflexion point

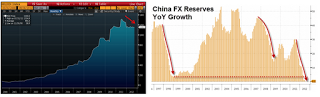

(See above) « Most Important chart in the world ». These are Russel Napier’s words. He’s a well-regarded consultant within CLSA Asia-Pacific Markets and I would like to share with you this very interesting graph, not particularly bullish for China nor the US (Graph on the right). For the first time since 1998, the rhythm of China’s FX reserves has turned negative. Slowdown of China’s reserves accumulation has begun in 2003 but has been even more obvious since 2011. Probably a consequence of Global slowdown. Last time China’s reserve growth rate went below 10% was in 1998, it was just before the burst of Tech bubble. More worryingly (for the US), Chinese holdings of US treasuries declined by $123bn (they still hold $1.156tn…). Graph on the left (HOLDCH Index). Moreover, it seems that this shift has been beneficiary to European debt issuances (France and Germany on top). One interesting figure: 40% of French issuances YTD has emanated from Asian investors vs. 5% a couple of years ago. It’s now interesting to link this with US economy financing. Chinese authorities have used these reserves to buy US treasuries, which then turned to be a significant boost to economic growth in the US and in the rest of the world. Napier says about that economic growth cornerstone : “it’s now over”. To finish on a happier note though, while Chinese authorities was decreasing their US Treasuries holdings by $123bn, Brazil, Belgium, Luxembourg, Russia, Switzerland, Taiwan and HK boosted their holdings by a collective $265bn since August 2011… Scary…..

Let me also open one more thing for discussion that I will definitely analyse deeper next week, considering this year it has all been about positioning and an increase on Capital Gain Tax next year is almost certain , do you think is clever to hold to your winners??? I think there might be clear tactical reasons for recent sell off in Apple or for the underperformance of the performers and the squeeze on the dogs….

Catalonia or the road to nowhere

This week I am certain that you would have read even more articles about this topic than about Japan, however as it is a problem near to my heart (I still support FC Barcelona even if my head wants to support Atletico) I decided to add my 2 cents to it.

The truth is that the situation is extremely dangerous and it could create unwanted noise for an already fragile European Union. However as I have mentioned before I do think that Mas has absolutely no intention of forcing or even obtaining the Independence, as he knows as well as I do , that it would not be viable for Catalonia. His technique is nothing else than a smoke and mirrors exercise, he has managed to take attention out of a disastrous policy that while was focused on austerity measures made the financial situation in Catalonia even worse and it is the mechanism to try to force Madrid into a negotiation on Fiscal autonomy.

As Christel Aranda expressed in a fantastic note this week:

“ Fiscal austerity is at the root of the call for early elections and also at the root of the more secessionist fervour. Mas’ goal is a fiscal pact for Catalonia rather than independence in our view. He has long sought to re-negotiate intra-regional transfers and for Catalonia to have more tax autonomy, along the lines of Navarre and the Basque country. It is interesting that Mas has expressed frustration that the central government in Madrid is not offering to negotiate.”

That last sentence is key, as Catalan’s say “ La pela es la pela” (One penny is one penny…every little helps) and as long as Rajoy bends to their fiscal /money demands they will forget about any unilateral declaration of independence , however Rajoy knows that Catalonia is fully dependent on Madrid financing its debts so he is in no hurry to make concessions.

In the credit market two separate countries do not have the same access to credit as they had united. It never happened. Catalonia would exist; let’s not say it’s impossible. But annual available credit would quickly fall as we saw in every other occasion. In such an environment, with doubts about every single aspect from the credit perspective I fail to see how investors would react positively to secession, either with its own new currency (massively depreciated) or within the Euro. Uncertainty and lack of clarity, as we all know, are enemies of business and job creation.

Few investor sit waiting to see if the impact of independence on GDP is 5% or 15%. There is no business sense in secession, for Catalonia or Madrid. It is extremely negative for both.

~Let me finish with some facts, from Daniel’s article, for those who think Catalonia is the richest region in Spain and clearly can survive on its own:

So far in 2012 Catalonia has received from the State €11 billion more than its share, apart from the funds needed for its financing, according to official figures.

- Catalonia’s much repeated “Spain steals from us” comes from an alleged €16bn fiscal deficit with the State which is actually a €4bn fiscal surplus, because the region does not recognize its real share of the costs of ministries, justice, defence, research, social services or state debt repayment when accounting for its “deficit”.

- Catalonia’s debt multiplied by four times since 2004, reaching 20% of GDP compared to 7% in the Spanish regions of the Basque Country or Madrid. ”. The number of public workers in Catalonia soared to 306,500 -4% of the entire population of the region- and its deficit ballooned to 3%, Furthermore, the number of regional government owned companies increased by 70% between 2008 and 2011.

- More than 19,500 businesses have closed in Catalonia in 2012. A large proportion of those have relocated to more competitive countries, Morocco among them. Do they think being independent more business will open?

- Catalonia is not self-sufficient, it needs Spain when it comes to trade. Although at 14% its French neighbour accounts for the largest share of Catalonian exports, ten out of its fifteen key trading partners are Spanish regions. The latter account for more than 60% of its total sales.

In Summary I guess there are multiple arguments I could give both ways but I do think the Catalans will come to their senses and will not give absolutely majority to Mas but hopefully even if they do , he will not be stupid enough to try to break the country. IF he does use these levels of low vol and loaded into puts as it could be the final bullet on the EU project.