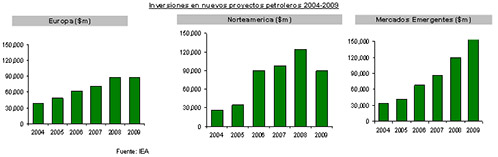

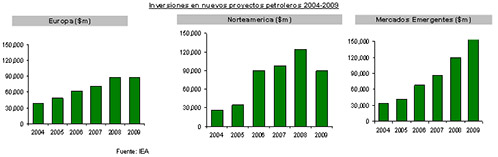

(This article was published in Spanish in Cotizalia on Thursday 2 Sep 10) The above graph shows the E&P spending in Europe, North America and Emerging Markets in $m.

If there is a sector that has surprised the market in the energy world this August it has been the oil services one. Not to us, as we already anticipated in March a very favourable environment for selected stocks in a highly fragmented sector, each in its speciality, such as Petrofac, Seadrill, Amec and Tecnicas Reunidas. And indeed, companies have shown an ability to increase margins and order book in a difficult macroeconomic environment. And in a sector,oil & gas, which is one of the worst performers of 2010 (deservedly, as we have explained on several occasions), these stocks are showing their relative strength.

And make no mistake, the environment is still difficult. Despite the overall increase in investment in exploration, production, refining and development the service sector still suffers from excess capacity in some of its segments (deep-water drilling, due to the ban at the Gulf of Mexico, or seismic and seamless pipes, for example) . The oil services industry, on average, still works at 65-70% capacity, but there are companies that take advantage of this situation to gain market share and increase margins at the same time. How is this done? Thanks to historical better cost control, better execution of projects, specialization and focus on improving returns.

When companies do not not commit excesses in the top of the investment cycle and focus on a segment of highest profitability and best suited to their technical strength, is when you get to have a winning combination at the bottom of the cycle. Petrofac, for example, increased its order book between 2007 and 2008 with investments in the oil sector, its customers, falling by 12%. Now that the big oil companies expect to increase investments by 13% and 12% in 2010 and 2011, companies that lived the crisis as winners are ready to generate superior returns. So a company like Seadrill, which specializes in drilling platforms, can pay dividend yields of 10% and still deliver backlog growth.

The services sector is an indication of the anomaly we see in the market. Large companies are swimming in cash, generating good returns and reducing costs, so their ability to invest through the cycle has improved significantly from previous troughs. However, the market is still seeing more risks than rewards despite this. Furthermore, NOCs (national oil companies) are in a much better position financially than the international quoted peers and do not need to preserve cash to pay gigantic dividends, so this allows them to invest more and more aggressively through a down cycle.

What is the main risk to the sector? Obviously a slash in investments in the oil sector. The two main drivers would come from either new episodes of drilling bans as Macondo (that affect the entire capex chain), or from oil price (and therefore revenue) falls. If oil prices were to drop below $60/bbl it would cause the cash surplus in the oil sector to shrink to a level where we would see significant cuts in investments. In my view, this could mean going back to 2008 levels of capex, and possible renegotiation of conditions and margins with service companies. But 2008 also taught us that it is very difficult to reduce these investments well below the $200 billion annually, and that costs are sticky throughout the chain as projects become more complex, larger and more labour intensive. And labour remains a big challenge in the industry, as skilled professionals are still relatively scarce. And if we consider the cost of developing Brazil, Iraq, Greenland, East Siberia and West Africa, the five frontiers of the future for the sector, it is very difficult to predict a negative environment for service companies in the key niches.

In August we have seen the oil sector fall 1.2%, 13% annualized. Meanwhile, Petrofac has risen 45% in 2010, Amec by 16% and Seadrill by 5%. Amec, an engineering and project developer from nuclear and renewables to oil, published results 8% above consensus and raised its margin expectations for 2010. Petrofac, which specializes in large engineering and construction projects, increased results by 52%, 7% above consensus and broke its own record of order intake. Seadrill, key company to look at for its exposure to drilling, published results 6% above consensus and improved margins, with the market for premium jack-ups continuing to show relative strength as the utilization of such units remains above 90% with dayrates around 130k$/day, and in the underwater market getting $450-495k/day, a negligible drop from the 2006-07 peak of day-rates.

On top of this we are seeing consolidation coming back. This underpins an environment in which it will be difficult for large companies to try to negotiate costs down, as the most inefficient players are absorbed and the industry re-focuses. If we add that Brazil will spend $224bn in the next years to develop its offshore fields, it is difficult to see a sustained environment of overcapacity.

With minimal debt and 13x PE 2011 average, a 9% discount compared to average cycle multiples of the sector, the services industry looks still relatively cheap, and in a relevant number of cases consensus has to raise estimates for 2011 and 2012 between 4% and 7%, just as the investment process resumes its cruise speed . So, as we said in March, look at companies that can increase orders and margins, well capitalized and with low costs. They will continue to surprise.