(This article was published in Spain’s Cotizalia on February 11th 2010)

What timing. After months preparing for a trip to Madrid, I arrived on Thursday 4th, amid the market and debt debacle. A day after the market crash and four days before the presentation of the Spanish Secretary of State for Economic Affairs here in London. The macroeconomic forecasts “from -0.3% GDP growth in 2010 to +3% in 2012 by doubling the exports” worry me. What country will Spain double its exports to in two years with the Euro at all time highs and competitiveness at historical lows?

I have the luck or misfortune of following the economy of 58 countries. What country in the world is forecasting to increase its imports from Europe between 2010 and 2011? No idea. And above all, how can Spain take away market share from other exporting countries in an environment of aggressive competition?

Amid all this, people wonder why the markets fell and different articles comment on the role of “short speculators”. Too bad no one called us “long speculators” or “saviors of enterprises requiring capital increases” in 2009.

Going back to the Spanish Government presentation… Imagine the CEO of any publicly traded company which had breached the consensus estimates for three years in a row submitted such bullish growth plan and think how much his companies shares would drop. Obvious.

Fortunately, my meetings on Friday left me much calmer. The companies are doing their homework and, as always, it will be the private sector which will rescue the economy. I hear no one expects a quick economic recovery and corporates, which are close to the customer and the export industry are preparing themselves for several years of less than modest growth. I hear excellent plans to cut costs by 30-40%, diversification efforts and, above all, restraint in capex and debt control.

And in this day an issue did pop up constantly. In Spain there is little more that can be done in infrastructure and renewable spending for a few years. The drastic cut of the civil works and infrastructure spending is imminent. Spain has invested in infrastructure like an emerging country, but with the demand of a mature market, and now it has an enormous excess capacity while it needs to digest, and pay, the national debt increased through a stimulus plan that brought debt to GDP to 11% devoted to infrastructure and civil work with no returns, ie spending that generates debt but does not generate GDP.

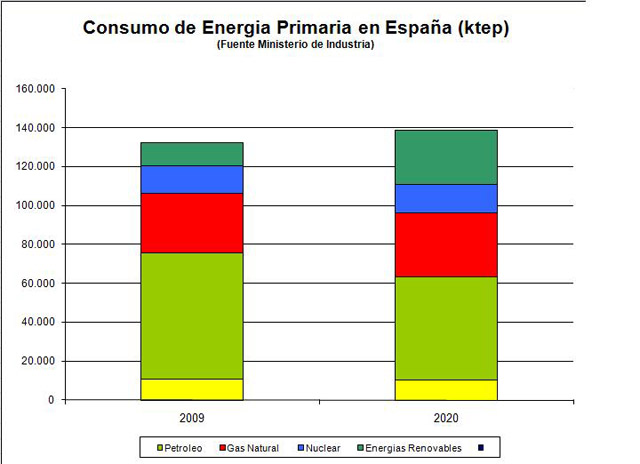

In this environment, power prices are at historic lows due to overcapacity and lack of demand, and yet the fact that renewables account for 40% of the electricity generated in some days make the premiums for these technologies (especially solar) to generate a tariff deficit of between €1bn and €1.2bn, a bill that is transferred to future generations.

This deficit is generated by the monstrous deception that is to have a government that raises electricity tariffs by a maximum 3-4% annually in one of the countries that pays less for electricity in Europe, while the real energy costs, including renewable premiums, is much higher. And this then becomes debt, owed to the power companies, that must be placed in the market to be securitised… And we have spent many months waiting for the tariff deficit securitization while the figure of debt rises month after month, which is unacceptable and introduces even more uncertainty in the power stocks. This is the national problem of Spain: to fix it all with debt, and now the bubble of debt is almost unbearable. The government has to refinance €60bn, saving banks and autonomous regions €150bn, etc … Let’s see just what kind of spreads will be required to place this paper.

Spain’s GDP is approximately €1.06 trillion, premiums for renewables account for 6 billion euros, 0.6% of GDP, and the accumulated tariff deficit is 11 billion, or about 1% of GDP. Additionally, the tariff deficit expected for the next two years is an additional €4 billion. Spain, at the same time, wants to install about 5,000 additional megawatts of wind generation and other 2,300 megawatts of solar by 2012.

Well, friends, do numbers. Either the government passes the real tariff to the consumer, which is unlikely given there is a 20% unemployment, or the bubble and its financing becomes unsustainable and with it the green economy model. Green energy costs. Let’s face it. Now it’s time to face whether the green energy model is sustainable in a weak economic and high debt environment.