(Published in Cotizalia in October)First, excuse the interruption in posting in the past month.

Well, what I promised to my Twitter followers is debt. Here are the main conclusions of the conference.

The main concern of the producers is demand. Saudi Prince Turki Al Faisal stressed it several times. “We will not increase production of 9.2 million barrels per day to 15 million when demand is well covered by all producing countries . We’re not going to invest billions of dollars to see barrels unsold at the port. ” Still, Saudi Arabia maintains its investment program of $129 billion and the projects that would guarantee that production cushion if needed. I myself have seen the development of the Kursaniyah and Khurais fields and these can produce much more when they want … if they want. I have also seen Ghwar and the much criticised decline is being addressed through new technology and improved recovery.

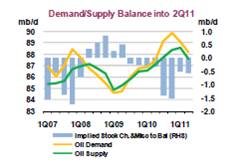

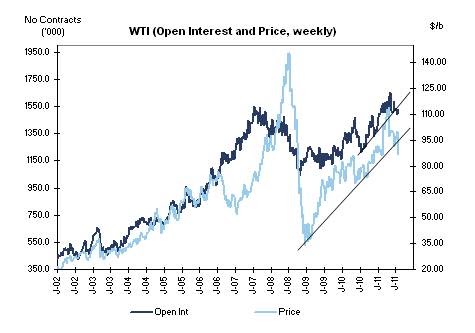

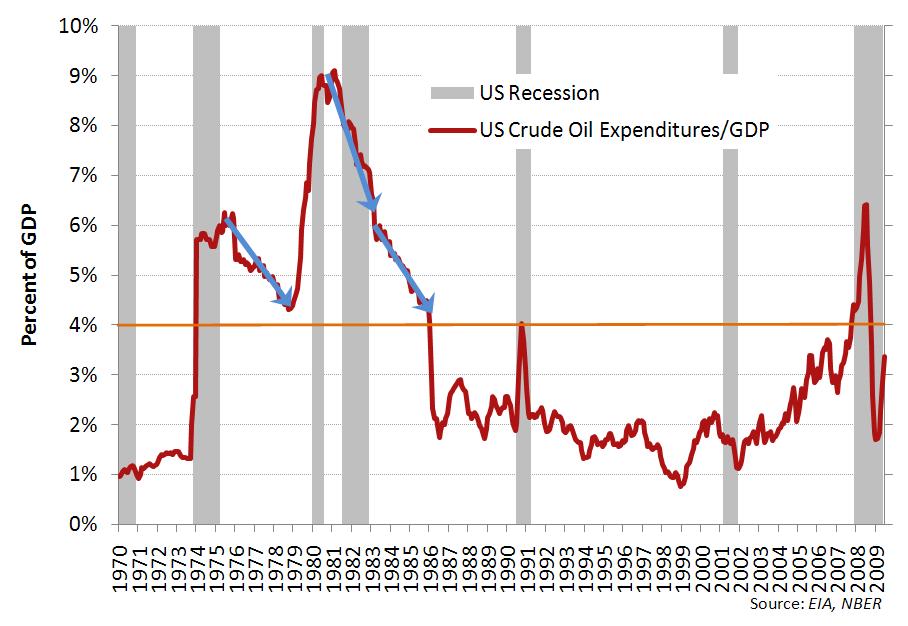

According to estimates from several industry leaders at the conference, up to 15% of current world oil demand is “credit bubble” driven, that is, generated by low interest rates. If we add to this that much of the industry leaders question the sustainability of demand in China, it is normal that during the meetings there were strong calls for a cut in quotas in OPEC’s next meeting in December. We’ll talk about it here if I’m invited to Vienna this year.

The problem is not the quantity and quality of resources available, but the increasingly onerous demands by producing countries , either excessive regulatory level U.S. and European legal uncertainty or lack of political certainty in others. Christophe de Margerie, CEO of Total, in a brilliant intervention, made it clear. To invest for 30 years $720 billion annually (global capex) the industry must have an environment that will generate adequate returns to capital cost and risk.

Worldwide, De Margeries stressed that today there are over 100 years of demand covered with proven reserves of conventional oil, heavy oil and oil sands.The problem is not of available resources, as evidenced by recent discoveries, 500 million barrels in French Guyana less than a month ago, for example, but that the industry is allowed to generate an adequate return and develop those resources safely and effectively. And there I agree. After twelve years accepting poor returns, and seeing their shares do nothing, it is logical that a ROCE (return on capital employed) of 25% at $ 80/bbl has to be a minimum target when the average cost of capital is nearly 9% and projects last 20-25 years.

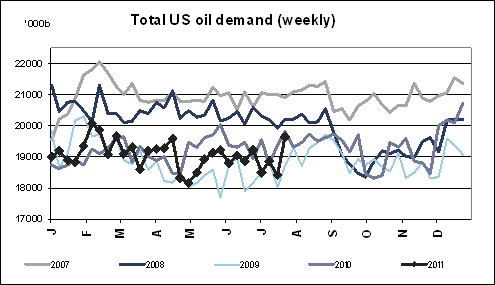

One of the most critical areas in the conversations came from the optimistic estimates of demand growth of the IEA. Everyone agrees that these will be difficult to achieve, especially in regard to the return to growth in the OECD, as estimates don’t take into account the de-industrialization and dramatic increases in efficiency, but also in regard to emerging countries. At the end of the day, the projected demand of the agencies is always “diplomatic” and tends to err in excess.

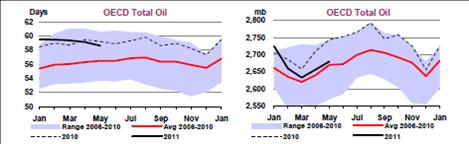

Many participants reiterated that the optimistic estimates of demand, added to some apocalyptic estimates on supply, give a sense of tightness and urgency that the physical market does not see anywhere . After all, OECD inventories are comfortably within historical average. In this sense, many criticized the exaggerated estimates saying that they generate an unnecessary investment bubble. Of course, make no mistake, no one complained that the price of oil was too high. “Doomsday predictions are making a huge favor, and free, to the industry” said a friend.

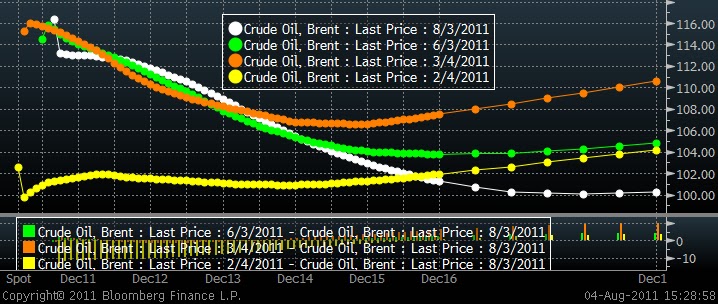

In this sense, all industry leaders criticized the monetarist policies and inflationary stimulus plans and low interest rates, as the main cause of increased commodity prices (oil has risen less than sugar and rice, for example, in 2011). Jeff Currie of Goldman Sachs noted that the impact of financial positions in the oil price has proven to be imperceptible, and that the price is not a question of lack of supply, because the commodities where there is no shortage or are cultivated have risen as much or more than oil, and reiterated the impoverishment of investment conditions as the great problem of the sector.

One of the most interesting parts was the analysis by geologists on the process of reducing the decline in production from mature fields field by field, with decline reductions of up to 30%. Petrofac is going to implement this in Mexico with Pemex. It’s all about price. With high oil, tertiary recovery is very attractive.

The Secretary of OPEC, Abdullah al-Badri, summed up the situation: OPEC does not seek to “defend” oil prices . The current price is justified by cost inflation added to a shortage of rigs available to rent that reach $ 450,000 a day, and the shortage of qualified personnel. “All the engineers are in hedge funds” a friend of Kuwait Petroleum told me.

The average price where OPEC needs to balance their budgets is an average of $ 75-85/bbl, as the social costs of the countries are increasing and therefore the average price can go up as well.

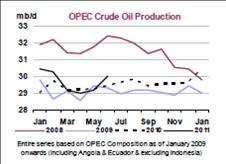

The 2010-2020 plan of the twelve OPEC countries includes 132 projects, $150 billion investment and 20 million additional barrels a day of production .The spare capacity of OPEC now stands at 5 million barrels a day , which has proven to be an excellent cushion when Libyan exports were interrupted, which is not expected to recover to pre-war level until 2013.

On Iraq, Issam Al-Chalabi, former minister of oil in the country, said that production forecasts have improved thanks to the improvement of some contracts to make the investments more attractive, and thanks to lower cost ($ 6 to $ 11 million per well), but lack of infrastructure and legal structure, as there is still no oil law, will make it difficult to reach 3.8 million barrels per day of production in 2013. Still, Iraq is exporting 2.2 million barrels / day and large projects generate returns of 23-25% (IRR).

I’ll stick with the following conclusions:

1 .- Demand is inflated and probably will not reach 92 million barrels a day if the debt reduction process of the global economic system is carried out, finally. The best thing that the industry has learned over the past 25 years is to avoid flooding the market. Seeing what has happened to other industries, it is logical that the oil industry puts back into the center of their investment decisions a decent return on capital employed, and not capex based on optimistic forecasts on demand.

2 .- Although the world is more complex today than ever and the geopolitical situation can always get worse , the industry is not going to stop investing, as it did in 2007-08 or 96-99. Annual investments to produce 90-95 million barrels per day of production (including unsold surplus capacity) will remain.

3 .- Exploration investment will not increase over the $150 billion annually but industry will intensify the investment in non-conventional oil in the United States, being of low political risk and high profitability. The industry will continue to explore and develop the frontier areas, especially West Africa, where there are no production constraints imposed by OPEC membership, crude oil quality is very high, the wells are under-explored and regulatory and legal conditions are very attractive.

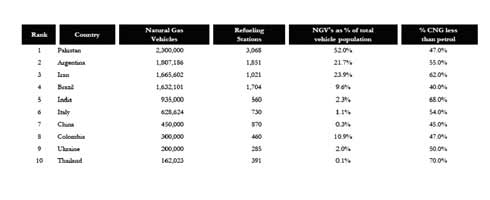

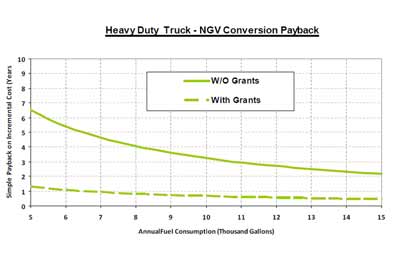

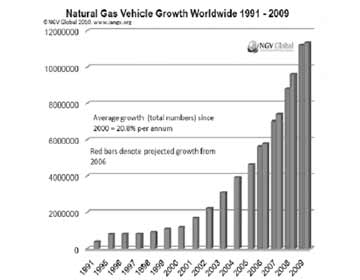

T. Boone Pickens , the billionaire American, has been saying it for a long time. It makes no sense to keep the huge fleets of trucks travelling up and down the U.S. using gasoline/ diesel when the country imports $ 1 billion per day of oil from foreign sources, while the US produces abundant natural gas cheaply and with a local industry.

T. Boone Pickens , the billionaire American, has been saying it for a long time. It makes no sense to keep the huge fleets of trucks travelling up and down the U.S. using gasoline/ diesel when the country imports $ 1 billion per day of oil from foreign sources, while the US produces abundant natural gas cheaply and with a local industry.