The recent outperformance of the integrated oil sector has been quite amazing. It is one of the best performing sectors year-to-date.

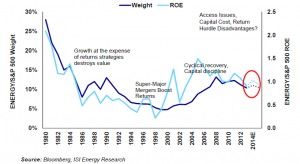

The past five years have been disappointing for investors, as the sector underperformed due to weak growth, Return On Capital Employed falling from 28% in 2007 to 13% in 2013 and various mega project delays. Focusing back on profitability and sustainable growth is part of the re-rating process.

Driven by:

- Investors looking for real yield (paid with free cash flow not debt) and boring but solid companies.

- Decent quality earnings beats. From Shell to BG and Exxon to Conoco we have seen a solid wave of better-then-expected earnings in the first quarter.

- Despite consensus estimates coming down for the full year in European majors (Shell,-5%, BP -12%, Total -10%) expectations of better free cash flow have re-rated the stocks.

- US majors have increased dividends while beating in all segments with solid production growth. So returns have improved. ISI highlighted that Integrated Oils were this attractive only 5% of the time vs. S&P during the past decade. Growth at the expense of return strategies remain discredited and lead to lower valuation and poor market performance.

- Focus on high return projects

- Lower exposure to refining and “other” experiments like renewables, power or gas transmission

- Oil companies have stronger portfolios and more diversified assets, so less dependent on the delivery of mega-projects like Kashagan to achieve their targets.

- Both oil and natiral gas prices have remained stable (big oil benefits from stable prices, not high spikes or massive volatility).

- Production pipelines can support 3.5% growth beetween 2014 and 2018

- Growing capital discipline, not capex cuts. Capex growth is still +3% expected in 2014. Majors, however, are investing better, not a lot less.

– Majors’ exploration success has started to improve (55% in last year).

– Bernstein expects 3-4% improvement in ROCE by 2018, even under a flat oil price, and growth in free cashflow yield from -3% to +8%.

However, keep in mind the risks of big oil (see my post in this site “integrateds, break up or fade away” and “the five risks of big oil“). First quarters tend to be solid. We need confirmation of this trend in the next three quarters to see a sustained, long-term re-rating.

Important Disclaimer: All of Daniel Lacalle’s views expressed in his books and this blog are strictly personal and should not be taken as buy or sell recommendations