Relying on ever-rising house prices pushing home values up via artificially cheap lending creates only the illusion of growth – Ros Altmann

As you know, I have lived in London for ten years. The United Kingdom, throughout the Gordon Brown years, was the Keynesian stimulus experiment that the advocates inflation and devaluation always ‘forget’. They talk a lot about Abenomics and Obama but forget the stimulus+inflation-led economic destruction of the early 2000s, and the hole in public finances it caused. A hole that the UK has not been able to dig itself out of, despite carrying out a brutal monetary stimulus policy where the Bank of England buys nearly 70% of the public debt issued.

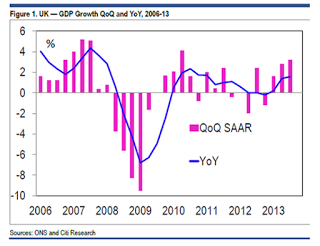

However, to the surprise of many experts, the United Kingdom appears to be starting to recover quickly. It is estimated that the economy grew by 1.5% in the first nine months, with a marked acceleration from quarter to quarter, to 3.2% annualized, and that will continue to advance by 3% in 2014. Given that in 2012 the economy grew by only 0.2%, the results are spectacular to say the least, especially considering that other members of the ‘Money Printing Club’ – Japan and the United States – continue to disappoint with very questionable macroeconomic results, from a massive trade deficit and debt in Japan, to lacklustre growth and weak labour market, according to the Federal Reserve itself, in the U.S..

However, to the surprise of many experts, the United Kingdom appears to be starting to recover quickly. It is estimated that the economy grew by 1.5% in the first nine months, with a marked acceleration from quarter to quarter, to 3.2% annualized, and that will continue to advance by 3% in 2014. Given that in 2012 the economy grew by only 0.2%, the results are spectacular to say the least, especially considering that other members of the ‘Money Printing Club’ – Japan and the United States – continue to disappoint with very questionable macroeconomic results, from a massive trade deficit and debt in Japan, to lacklustre growth and weak labour market, according to the Federal Reserve itself, in the U.S..

What is the miracle of the British economy? Probably a housing bubble of dangerous proportions, already warned by newspapers as ideologically diverse as the Daily Telegraph , The Guardian and City Am (” Subprime Britain”, read an article).

There are unquestionable positive elements:

- The UK now exports more outside the European Union (52%) than inside, being less exposed to the crisis in the Eurozone. Having reached a record high in June 2013, and growing at 3% annually, exports are about 32% of GDP.

- Car sales have soared and have almost returned to pre-crisis levels, while in the European Union these remain at depressed levels. The exchange rate pound-euro favours European car sales in the UK.

After the recent tax cuts and support for small and medium enterprises, the level of unemployment reached its lowest levels since 2009, 7.7%, despite increased immigration. In addition, consumption began to grow, with data from Coffer Peach showing sales increases in restaurants (+1.9% in August) and hotels (+4% in the first half of the year).

After the recent tax cuts and support for small and medium enterprises, the level of unemployment reached its lowest levels since 2009, 7.7%, despite increased immigration. In addition, consumption began to grow, with data from Coffer Peach showing sales increases in restaurants (+1.9% in August) and hotels (+4% in the first half of the year).- Government deficit starts to decrease significantly. Cutting taxes, attracting capital and laying the red carpet for entrepreneurs works. And has generated record tax revenues (“tax receipts hit record high of £1bn per week more than Labour grabbed” read the Daily Telegraph). 25 billion pounds more in revenues, according to HMRC. See below the graph of the UK government deficit (-10% to -5.8%).

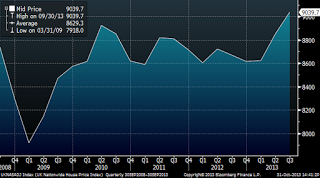

- However, all this data is positive but not comparable to the impact of the Help to Buy policy, also known in the UK as the ‘Viagra of the housing bubble’. The effects were very fast. Home prices have surpassed the 2008 peak, and they had already risen significantly with the entry of foreign money coming out of the EU looking for a safehaven against the risk of the euro break-up. This saw up to 80% of the houses sold in some areas going to Greek, Spanish, Portuguese or Italian investors in 2011-2012, according Foxton’s. Companies like Grafton, a construction material supplier, have seen their sales in the UK rise by 5.5%. Cemex commented that sales in the country grew by 9% in the second quarter. The demand for housing, according to Crest Nicholson, was up 46% since the implementation of the Help To Buy…. And the average salary of construction workers rose 20% in the first half of 2013.

See the index of house prices from Nationwide:

Is this all positive? Demand grows, the economy grows, house prices recover, people see ‘perceived wealth’ increase, more furniture and curtains are sold…

Is this all positive? Demand grows, the economy grows, house prices recover, people see ‘perceived wealth’ increase, more furniture and curtains are sold…

But there are several warning signs:

- The guarantee of cheap money from the Government increases the risk of bad payments. There have been 210 billion pounds in aid available in the Funding for Lending and Help To Buy programs, while the ratio of debt to income soared for first-time buyers from 3 to 1 to 4.4 to 1 (The Daily Telegraph).

- Most home sales -over 50% – are made without mortgage and sold to foreign investors looking to rent. But there is a lot of leverage hidden in these “yield-seeking” operations. Sometimes up to 75%. Maybe not mortgages, but loads of corporate debt. And in some cases, rental yields are as low as 2-3% (in Central London, for example). At the same time, rents have increased much faster than wages for five consecutive years, leading to an increased risk of default or exclusion, where, even if there is housing availability, conditions for rental are simply unaffordable.

- In London the housing bubble seems well supported by two factors: the City and the arrival of foreign millionaires of any country. As a friend of a real estate agency says, “there is always a country that is doing well, and those people go to London as a first option.” This is why London has become the most expensive city in the world, surpassing Tokyo. But that ‘bubble expansive wave’ is dissipated as one moves out of the M-25 (the ring road around London), which creates the risk of ‘bubble implosion’ as we saw in 2008. Prices soar starting in London and the shock waves reach up North, and when the bubble implodes, it impacts down to the South.

Of course, the Bank of England is “carefully monitoring the risk of the creation of a possible bubble.” It does not see danger today because transactions and mortgages signed are well below the highs of 2008, and because a large part is sold without any type of mortgage (but a lot of corporate debt). But that is where the risk lies… When those funds that buy real estate thinking of high rental yields find that there is an excess of unsold homes, which is never recognized as you all remember, corporate debt defaults start to rise. At the same time, the possibility of selling those houses becomes difficult because wages don’t increase and the capacity of the majority of population to acquire just gets worse … That is when the market sees the hidden stock of homes.

Perhaps this time the house price rise is more sustainable growth, as some argue, as it is less aggressive in debt. I would be cautious. This time we are substituting mortgage risk for corporate debt risk.

Economic growth supported by a disproportionate increase in the price of houses and thinking that these can only go higher because “we need to build much more to meet future demand,” explodes aggressively on almost all occasions. This time, moreover, the risk is in the balance sheet of the government that guarantees the Help To Buy, and therefore, if it goes wrong, you will pay it in tax hikes.

Yep will be the Uk tax payer that foots the bill when it all goes wrong.

http://www.whathouse.co.uk