The market has been using Big Oil and utilities (specially large caps) as sources of funds for their beta trades, especially financials and miners. I hear that short interest in BP is 12% of free float, for example.

As the mood in the market turns bearish and the concerns on balance sheets return to a market that forgot what net debt was, the focus, like in the past November, turns to real cash monsters.

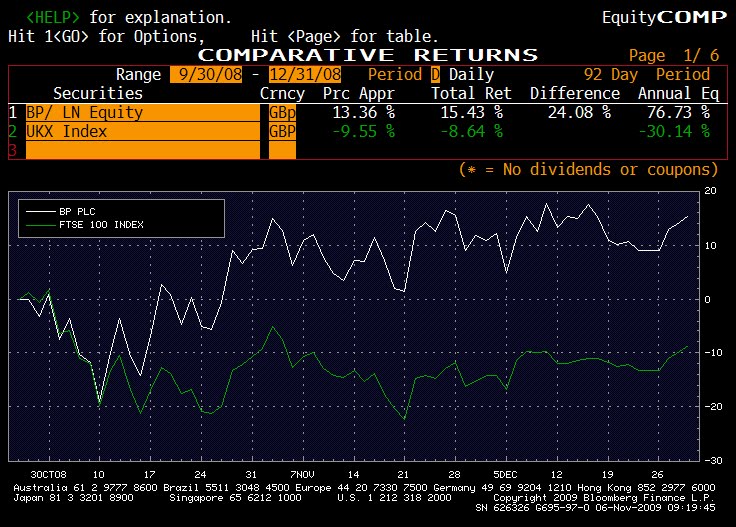

If we add to this that most of the market went short Big Oil after the 3Q results showed that growth was not appearing, and especially after lacklustre earnings from RDS and Total, we have a perfect storm. Last November, with oil going from $70 to $50 and the market disappearing downhill Big Oil outperformed the market by 12% into December.

Big Oil trades at 10x PE, 0.6x to the broad market (almost 15% from historical levels), generated 15% free cash flow yield last quarter (!!), delivers dividend yields that range from 6 to 7% and more importantly, has virtually no debt (Statoil 26% ND/Equity, BP 23%).

Into Megacap utilities, these have underperformed but now, ahead of 3Q in E.On and GSZ, the focus will turn back to free cash flow generation and balance sheet. Here the issue is that Enel, Iberdrola are massively debt constrained so the market opportunity is not as wide as in Big Oil (as utilities balance sheets are quite different, unlike in supermajors), so we are likely to see a move to real defensives, ie regulateds and megacaps.

The chart shows what BP did against the FTSE from Sept 08 to Dec 08 with oil falling and the market down.