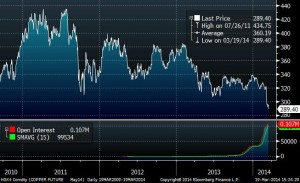

Copper has collapsed -12% so far this year and is trading below 2011 lows. Copper is a risk indicator of the weakening Chinese economy and the slowdown in global industrial production.

Reasons:

– Much of the low-quality loans in China use copper as collateral, up to 30% according to HSBC, as it is an indicator of industrial activity and closely linked to Chinese growth. When the market begins to question the debt repayment capacity of many Chinese companies in difficulties, margin calls are triggered and copper falls with it.

– It’s the most common commodity linked to industrial production. Copper price is a good indicator of the global economy as fluctuations in price are determined by industrial demand. Given that Chinese demand represents approximately 39% of global copper demand, the slowdown of its economy has a big impact on the price.

It’s a double impact: Financial and demand-led. What was supposed to be a good hedge is actually a double risk on the economic slowdown.

Lower demand, supply rises

The estimated surplus of refined copper was revised up from 327 thousand tons to 369 thousand tons for 2014 and is forecast to exceed 400 thousand tons in 2015.

Chile, China, Brazil, Peru and Mongolia seek to increase production in 2014 and 2015. Global production is expected to grow by 5.2% and 5.5% in 2014 and 2015.

In 2011, Chile accounted for 34% of the world’s copper production, approximately 19% of the revenues for the country. USA is the fourth largest copper producer in the world, after Chile, Peru and China, and Australia is fifth. All these countries aim to increase production and produce more. When prices fall producers seek to increase production to maintain revenues, a typical -and misguided- attitude of pro cyclical commodity producers.

China accounts for 39% of copper demand, followed by Europe 17%, other Asia 15%, U.S. 9%, Japan 5%. The rest are minor consumers.

A moderation in growth in demand for refined copper in China, from +8.5% to +6.5% for 2014 and 2015, along with the lower European demand, means that overcapacity increases by nearly 81,000 tons annually. China has seen its stockpiles of copper grow by 4.6% to 207,320 tonnes. It is estimated that the total copper stored in China exceeds 725,000 tons.

Demand down, supply up and a financial hedge gone wrong… Domino effect.

One thought on “Why is Copper collapsing?”