“You gave me nothing at all, now let me give it to you. You Taught me how to be cruel, now let me try it on you “ Jim Steinman.

Every time I read estimates of future revenues if countries raised taxes to “the rich” and large companies, I am amazed at the naivety of thinking that everyone affected is going to stay put and not react . I’ve never seen a single estimate reflect the potential loss of economic activity.

All these “expected rervenues” are based on the assumption that nothing would change. And I am dismayed at how little we look abroad. Public spending estimates always start from the premise that you earn a lot and they spend little . And when fiscal revenues decline, we always hear that “here is not going to happen.”

Well, inversion deals in the United States, is something we should think of, and with concern in the EU, which is already suffering the trickle of companies moving outside its territory-what I call the “silent Depardieu” -. Please keep it in mind because it is in danger of accelerating.

WHAT IS AN ‘INVERSION DEAL’?

Imagine that you have a company and you get charged very high taxes. You may decide to acquire or merge with another in a tax friendly country and move the corporate headquarters to that nation. Thus, the new group, added to all the strategic reasons to merge, benefits from a preferential tax treatment.

It’s not easy to do. The merged company must have less than 80% of its shareholder base in the United States, and at least 25% of the activity of the new group should be generated in the new headquarter centre.

IS IT DONE JUST PAY LESSTAXES?

This is a media error. The problem, in most of the cases, is not only are the taxes paid, but the bureaucracy and obstacles to generate economic activity . Many of the companies that have left the United States for Canada or Ireland do it also because the conditions for their activity are more attractive.

Given the complexity of making the change to a different country, these transactions generally have a very clear strategic logic. Mergers ‘criticized’ by the United States government since 2004 have created more than 6 million jobs worldwide and globally generate higher tax revenues in the countries where they operate, according to UBS (” A New Wave of Tax Inversions“).

Therefore, much of the complaint of the Obama administration is not justifiable from the social point of view, only from the perspective of their revenue-raising estimates. According to Congress between 2015 and 2024 18.5 billion dollars of tax revenue could be lost to inversion. There is, however, no talk about how much more the US could earn by lowering five points the corporate tax rate. An equivalent amount if we assume the same margins and profits of 2014 and an annual 1.6% growth in Gross Domestic Product (GDP).

That concern for “lost revenue” would not exist if taxes went down . Is it a race to zero where the other countries would lower even more their tax rate? Of course not, as companies work with many scales of risk and opportunity. If taxation is competitive, it will not move because of small differences. There are many relevant factors.

CAN INVERSIONS BE AVOIDED THROUGH LEGISLATING?

In the United States Corporate tax rate is one of the highest in the OECD . Rather than reducing it, laws were implemented to avoid inversion deals, one in 1983 and another in 2004. Congress imposed its “American Jobs Creation Act” of 2004. Of course, before long, inversion deals accelerated . Between 2007 and 2014 more companies have left the United States to more business friendly countries than in the entire period from 1981 to 2003, according to the Congressional Research Service .

Legislative repression and calls to patriotism, even inflammatory proclamations to “boycott” companies, have failed. Instead of facilitating a transition to a more competitive tax and regulatory environment, and only an improvement of 5 points would have sufficed, the solution proposed now is to legislate again. And I believe it will not work.

Why should we fear it in Europe?

When we count on the money of others to maintain the bloated spending, we should at least take care of our laying hen . And in Europe the risk of a wave of migration is high.

In the Eurostoxx 50 a large proportion of big companies have behaved as “covert social security.” European companies, relative to revenues, hold between 17-20% more employees on average than their US peers. In fact, in some sectors, such as telecommunications, infrastructure and energy, European companies have an average of up to 30% more employees than their American or British competitors. Companies in the S & P 500 ( United States) at the same time have a much healthier cash situation and and debt ratios are much more robust than their European counterparts .

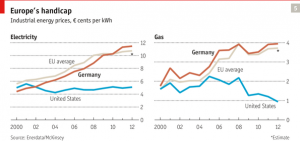

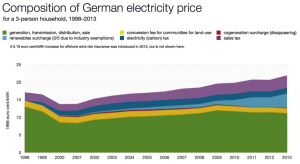

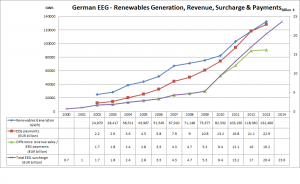

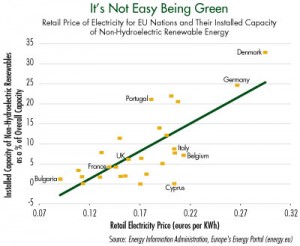

Additionally, if we consider all taxes -green, regional, local, social tariffs, etc- the largest European companies pay in taxes up to 40% of their domestic operating profit .

This explosive combination of lower productivity and increased taxation has not yet generated a large number of ‘migration’ deals as in the United States for three reasons:

- In Europe, large companies tend to maintain a strategic symbiosis governments. And that is partly why they have more employees and have less stringent profitability targets and shareholder return policies.

- Many large European companies often hold ‘captive assets’. That is, it is difficult to move to another country when you have huge regulated assets or concessions.

- A “cultural” issue. Managers who have spent many years, even decades, developing a career between local business. See how rare it is to find CEOs and business managers which are foreigners.

Considering all these barriers, company migration has not been avoided in the EU, so think what might happen if the proposed tax increases are imposed . We will see, as in the United States in 2004, an unprecedented exodus of business.

We can not stem the tide. To think we’re going to avoid the internationalization and tax optimization of companies through repression is a huge mistake. Tax receipts grow with economic activity, not because of a committee decision.

Taxes are the payment for a service, not the ransom of a kidnapping. Someday we will remember it.

Important Disclaimer: All of Daniel Lacalle’s views expressed in this blog are strictly personal and should not be taken as buy or sell recommendations.