Here is a link to my analysis of the Spanish elections on CNBC http://video.cnbc.com/gallery/?video=3000058799(The following article was published in Cotizalia on November 19th)If there is a chilling fact of this past week is the result of last week’s Spanish Treasury auction. There was no institutional demand. The market is scared seeing again how on Tuesday the government revised downwards the expectations of GDP growth for 2011, no less than about 40% less from +1.3% to +0.8%. € 180 million less of GDP every time they revise it, and there have been six times, while expenditures are not trimmed. So one can understand the reaction of the markets in a country which shall spend 3% of GDP in financial expenses, issues debt to pay interests and each year spends between 1 and 2% of GDP in subsidies. How is Spain going to pay that debt?

Amid all this, the media in Spain constantly mentions “attacks against the country debt” without realizing that the only thing the country has done has been to introduce risk and uncertainty for investors.Regulatory uncertainty, planning and legislation swings and turns. There is no attack. Because no one wants to invest. The market is closed. Imagine that the management of any listed company that has breached its own estimates for years demanded more funding and more support, and think how much its shares would fall. That’s the situation.

The elections have been a first step towards the solution. At least the new government has absolute majority not only at the State level, but also in 95% of the regional communities, which have been responsible for a very large part of the spending binge of 2004-2010, multiplying their budget by 3x.

Part of the solution is the famous “confidence” that the popular party advocates, and that is nothing more than credibility. Give the real figures of expenditure, deficit and exceed targets. Stop the ostrich policy of “pretend and extend”, which has been the country’s economic policy since 2008, hoping that people forget the announced estimates and forgive the mistakes.

A serious problem is the brutal installed overcapacity generated in the orgy of stimulus plans and expenditure. Ghost-airports in every region, ghost towns, a giant real estate bubble, billions in energy infrastructure and renewable subsidies optimistically estimating annual growth of 2-3% … In Spain there is little to do in the field of infrastructure for a few years. The scissor on civil works is unavoidable. Spain has invested in infrastructure like an emerging country, but with the demand of a mature country. Now it has massive spare capacity and the country has to digest, and pay, the debt created by the construction of unnecessary assets.

The good news: some companies are doing their homework and, as always, the private sector will rescue the economy. We’ve spent too much time attacking the capital markets and investors, scaring them with constant revisions of the legal framework, changing regulations in the middle of the period and looking for patch solutions to long-term problems. And while public saving has fallen by 12 percentage points of GDP, private savings reached 11 points. This saving is essential, added to a policy to attract investment capital, to boost the economy.

Well, now that the Ibex has lost all its gains in the “lost decade”, in part because many companies have spent the last ten years looking away, it is worth focusing on companies that can benefit from a situation that on one side will be incredibly complex, without growth, but in which the country and investment risk is lower.

The table below shows the companies in Spain with the largest short positions.

The first surprise is that, contrary to what people in Spain think, short positions in the IBEX are nothing special compared to other global indices. Not much of an “attack” then, even if we look by sectors. But the interesting thing is to look at the ones with the highest short interest and understand why it remains so high.

When media and banks say that stocks are cheap, the key to understand this table lies in something that no one is looking at. Namely, the outstandingly high short interest (look in the table at the ones with more than 1-1.5% of market cap) is due to a massive deterioration of working capital. The reason why hedge funds increase their short positions in some of these companies even when the stocks go up is because the cost of “survival” of these companies is rising as working capital deterioration accelerates. With a ratio of annual working capital to sales that in cases exceeds 20%, those stocks are called “living dead” (it costs more to maintain the activity than to stop it).

But there are three important points to argue:

a) In spite of strategic errors, especially those damn “acquisitions to diversify” that have destroyed so much value, several of these companies are demonstrating that their core business is being managed very well. Therefore, if they manage to stop working capital deterioration and focus on the areas where they have real competitive advantage, the market will reward them.

b) Companies should not fall back into the mistake of “diversifying” and growth for growth sake. Reducing size and being a cash machine is more attractive in the medium term, leaving the balance sheet breathing. The small, focused and efficient companies are worth more than the inoperative conglomerates.

c) No one appreciates debt reductions if they are due to financial engineering, changing of accounting parameters and other tricks.So do not try. The short covering will happen only when margins, cash and balance sheet is restored. Not because of changes in accounting.

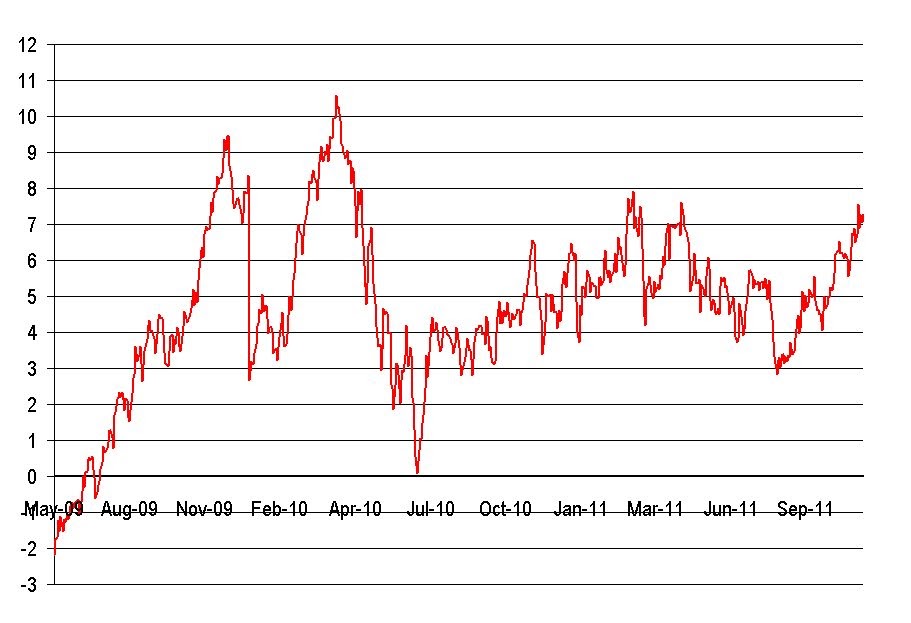

There is nothing I like more as an investor than a stock where there is a large short interest, recommendations of analysts are neutral or negative but the company is in the process of recovering quickly and efficiently. These are treasures stocks. And nothing I like more as a short than stocks where the working capital is soaring, returns plummet but have many Buy recommendations. These diamonds are the “short on strength” stocks that gave us so much joy in 2009 and 2010.

While many executives and directors are blinded by accumulating many Buy recommendations from sellside and are pleased with themselves adding revenues purchased in acquisitions at massive multiples, they should realize that the market values organic cash generation, margins, and balance sheet. Not imperialistic adventures. I was head of investor relations for several years in public companies. There is nothing better than to win the interest of bears on your stock and to prove the company is delivering and exceeding expectations of ROCE (return on capital employed) and balance sheet strength. Companies should focus their communication efforts on those investors that currently do not want to buy their shares or are short, not those who already have them, as these are the first to sell in this market. They will learn a lot.

Companies can continue blaming their share price on attacks and justifying themselves, depending on subsidies and grants, or revive. “Shrink to Earn”. It is in their hands.