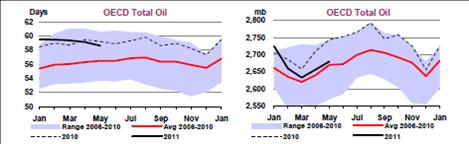

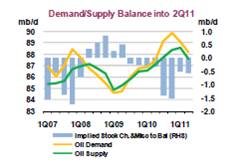

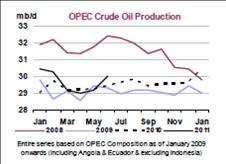

A) Oil demand is still above supply by c400kbpd but this could be short-lived if an OECD slowdown brings GDP estimates down by 2%. Given OPEC spare capacity is still at 5mmbpd and inventories in the IEA countries are in the upper range of the 2006-2010 average level, there is no small risk of entering an environment of oversupply if OPEC countries continue cheating on quotas (producing 27.5mmbpd versus 24.5mmbpd quota).

Euro Crisis & Credit Default Swaps. The Market Doesn’t Attack. It Defends Itself.

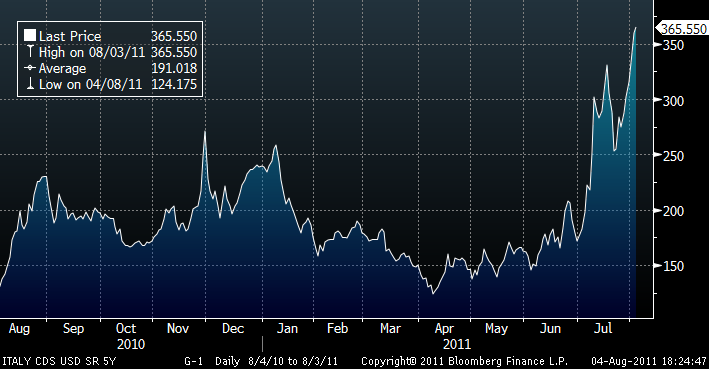

Graph above shows Italian 5 yr CDS.

I look forward to the day when I hear “risk premium rises because institutions can no longer absorb more debt than they already have”.

As in 2008, the blame now is placed among hedge funds . And wait, soon we will see European governments or the ECB making interventionist decisions. Ban Credit Default Swaps. Or ignore rating agencies. Kill the dog to get rid of the flees. Blame the customer for the restaurant food. Does anyone remember what happened in 2008 when Europe banned short positions? The market plummeted another 30%. Because that is when selling REALLY starts. So far it’s only protection seeking. Trust me.

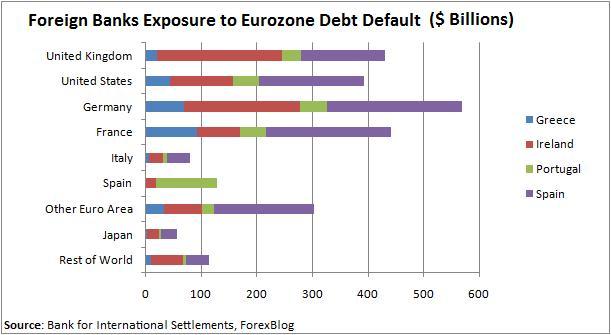

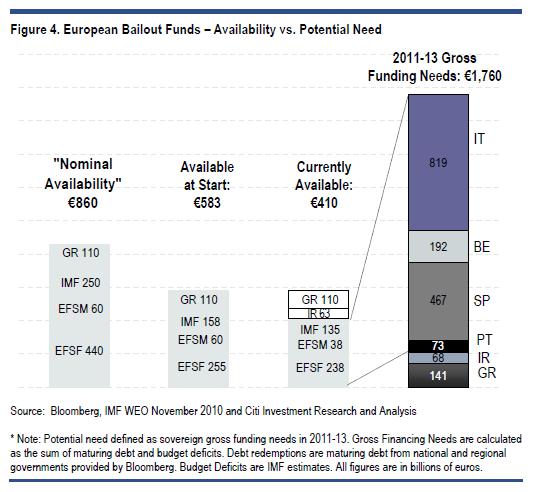

96% of the market for sovereign CDS (credit default swaps or the cost of insurance against a default) is absorbed by the European largest institutions, most of them country “flagships” or semi-state-owned entities, who are flooded with €250 billion of European sovereign bonds in their books. These entities, from DB to SocGen, the Spaniards or the Italians, seek protection and can not sell because of low liquidity, there are no buyers, and in any case they will receive the call to participate in the the next auction of debt. With a problem. The purchasing power is reduced by saturation, but also due to the increasingly stringent requirements of core reserves… While at the same time refinancing needs of indebted states are increasing. According to JP Morgan, Italy will have liquidity problems in September, and Spain in March 2012. Hedge funds don’t attack. We would be happy to invest against the rise of the risk premium if it were not justified . But that is not the case. The trend is clear and normal. It is re-evaluating sovereign risk. A sovereign debt that for decades we have been told had no risk. As the swindle of “house prices never go down.”The sovereign debt crisis has many similarities with the housing bubble. An “over-priced” asset (in this case sovereign debt, regarded as an unwarranted risk-free asset), a brutal increase in inventory (all countries issuing, using pension funds, domestic banks and social security to buy more debt) and a bubble burst, when borrowing capacity is maximized. At the same time, the pool of capital allowed to invest in sovereign debt evaporates as the CDS rises and the cost of borrow rockets, because most fixed income investors cannot take the risk and volatility implied by the high yield sovereigns.

Hedge funds don’t attack. We would be happy to invest against the rise of the risk premium if it were not justified . But that is not the case. The trend is clear and normal. It is re-evaluating sovereign risk. A sovereign debt that for decades we have been told had no risk. As the swindle of “house prices never go down.”The sovereign debt crisis has many similarities with the housing bubble. An “over-priced” asset (in this case sovereign debt, regarded as an unwarranted risk-free asset), a brutal increase in inventory (all countries issuing, using pension funds, domestic banks and social security to buy more debt) and a bubble burst, when borrowing capacity is maximized. At the same time, the pool of capital allowed to invest in sovereign debt evaporates as the CDS rises and the cost of borrow rockets, because most fixed income investors cannot take the risk and volatility implied by the high yield sovereigns.

The end in this case, as in the sub-prime crisis (read “The Big Short”) is the same. A devaluation of the underlying asset (sovereign debt) and an appreciation of its risk factor according to real actual demand and true likelihood of repayment.

Countries and institutions thought the CDS market, $60 trillion, was more than enough to ensure credit risk. Why? Because they only thought there was risk in corporate bonds and, therefore, the sovereign debt market would not need large default insurance contracts. That was OK until countries started to issue debt like crazy, creating a huge bubble of bonds that are almost impossible to insure, while at the same time GDP growth stalled and unemployment rose. And who takes the risk to insure this debt while state banks and credit institutions are struggling to remove themselves of their debt hole?

For those who blame the wicked capitalists, do not forget that over 50% of the Spanish financial system is public, the saving banks, and in Italy, Portugal and Greece the percentage is also in the region of 50%.But let us review the elements that make the snowball grow, despite the “messages” to calm the market, because actions, I must say, few. In Spain, Italy and the peripheral economies they have not implemented many of the measures announced with great fanfare.1) The precedent of “stress tests” in which banks have taken significant haircuts in the valuation of their assets, has proven to be self-indulgent and inadequate, but also has shown to the eyes of the public the very low core capital of the institutions, particularly the semi-state-owned ones.

2) The rating downgrades, which no one in any government expected, are a reality. The agencies have taken two years to reflect on their “ratings” what the market already knew. The economic fragility of the indebted countries. And its is not the “evil doings of Anglo-Saxon agencies attacking the poor European countries with imperialist tactics” as some politicians say. It is rather the opposite. Rating agencies have been monstrously generous in the past.

3) The successive bailouts of Greece and Ireland have left the financial system without “gunpowder” to address similar risks in other countries, but also these bailouts have weakened the balance sheets of the entities that hold the bonds.

4) The optimistic estimates of growth and deficit reduction . Each month we see new revised estimates of GDP in 2012. And they are too optimistic. The IMF indicates that Spain, Portugal, Italy and Greece will not meet the government forecasts of deficit for 2014. Spain will be at -3.9%, versus a target of -2.14%, as growth will probably be very low. If GDP is not growing, unemployment rises, funding costs rocket and debt goes up.But what is more important, without measures to incentivize job creation and support entrepeneurs, government revenues will be eaten by interest charges and costs that do not generate any return (GDP). Some call these costs “social” but they are just borrowing from our children’s future income.

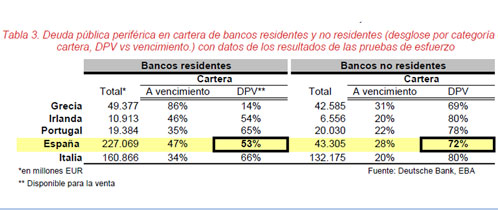

While governments gave themselves pats on the back on the success of the last auction of sovereign debt, no one wrote the headline “the latest debt auctions have only been covered by domestic institutions.” Foreign entities were flying away from peripheral sovereign debt (see graph above, sorry it’s in Spanish). And while Southern European leaders took advantage of their last months in office before an election debacle to sink the economy of their regions by increasing the debt by 43% amid economic pre-stagnation, the states were dangerously close to a level of risk country that is not acceptable for any investor. Today, the premium that Spanish ten year bonds have to offer for investors to buy them instead of German bonds is up to 6.2%. Italian one is 5.8%. If Spain or Italy reach the 7% level, many institutions simply will not be able to buy them for being too risky. The pie of available capital for investment is not only smaller and with more countries stalking it, but some countries will simply be unable to access a part of it.

The warning signs have been there since 2008 . Many of us have said this in writing. Meanwhile, the system has continued to sink into debt at a more expensive interest rate each time, while no one cared that almost 60% of peripheral countries’ state revenues are used to pay interest expenses. This year, the cash deficit reached by Spain will be 14.5 billion euros. The balance of income over expenditure is negative before paying interests.

The warning signs have been there since 2008 . Many of us have said this in writing. Meanwhile, the system has continued to sink into debt at a more expensive interest rate each time, while no one cared that almost 60% of peripheral countries’ state revenues are used to pay interest expenses. This year, the cash deficit reached by Spain will be 14.5 billion euros. The balance of income over expenditure is negative before paying interests.

And now governments demand cheaper and more credit when they are borrowing money to cover interests only. No capital. The result is that after the cuts already announced, peripheral countries will need a spending reduction of 30% to cover the cash deficit and interest. “Blame it on the wicked investors” who have the fastidious desire to recover their investment and request an interest that is appropriate to the risk. Outrageous.

The market, that evil entity that causes so much hatred among interventionists, reacts because it has been lied to. And reacts by selling equities and seeking protection on bonds.

Do the interventionist European States want to get rid of the alleged “dictatorship of the markets” that they claim is the problem? Perfect. Do not allow leaders to borrow again like crazy. No more deficit and they will not have to worry whether the blame is of hedge funds , Merkel, Fitch or the new U2 tour.

PS: Pier Luigi Bersani, Italy’s opposition leader said to Berlusconi on Wednesday: “it’s not speculation, it’s about investors and our creditors that don’t trust us any longer”. “Investors are asking a legitimate question… how can these guys pay their debt if they don’t grow”

Further read:

European crisis, falling demand more debt

http://energyandmoney.blogspot.com/2011/07/european-crisis-falling-demand-and.html

Peak Oil?… Demand Weak Again, Supply Concerns Overdone

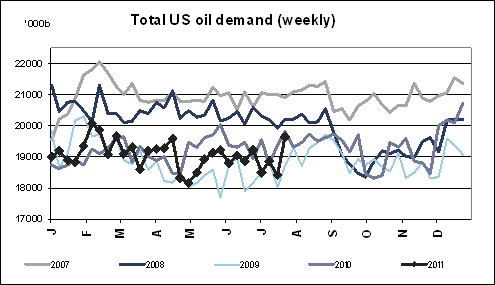

As we have said in this blog, over and over, IEA and consensus estimates of oil demand growth were too optimistic.

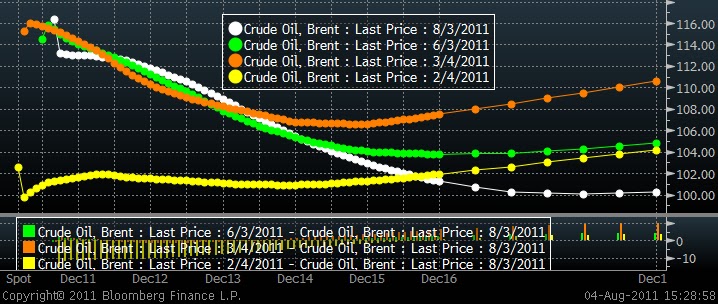

Now we have the proof. See the chart above. Oil (Brent) has gone from steep contango to a deepening backwardation in six months. What’s more important is that the backwardation has deepened as the Libya conflict intensified and prolongued.

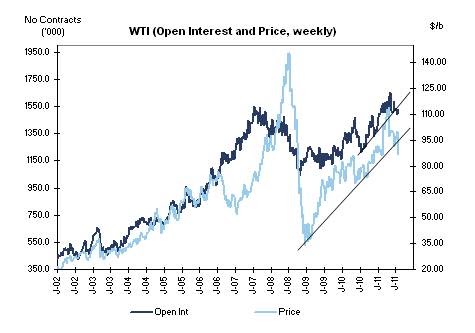

Additionally, net length from financial investors is healthily slowing down. The latest change in the crude position reflected a sharp reduction in Managed Money net length (~23k contracts) but overall positioning remains towards the upper end of the historical ranges.

And this happens as the Oil markets puts 158 projects close to end of pipeline that target 11mm bpd of supply.

If we add to this that Venezuela and Iran are pushing for higher quotas (see my article about it) and Saudi Arabia is pumping 600kbpd more than in January, we have the same recipe as in 2008… a financial crisis and a supply response that comes too late.

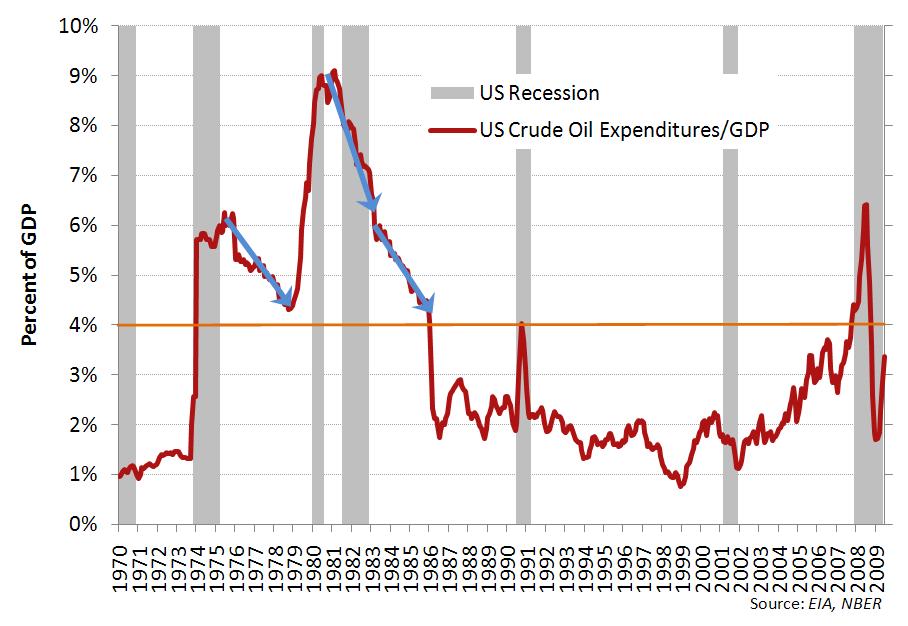

Is this financial crisis due to the high oil prices, as some argue?. No, this time it isn’t. The OECD debt crisis comes from the massive stimulus packages and printing money. Oil strength has not been a cause this time. It has been a consequence.

With EU countries running at 120% of debt to GDP in some cases and the US at 100%, the austerity measures and cost savings that we will inevitably see will bring GDP growth down. And 1% cut in global GDP means $10/bbl on oil prices, with or without Libya.

As China looks to reduce inflation and sees its banks running their own debt issues, we will also see a reduction of Asian demand.

Therefore, a simple calculation leads me to believe that OPEC spare capacity can rise back to 6mmbpd only on a 0.3% global GDP revision. If global GDP growth estimates fall by 1%, this spare capacity would rise to 6.8mmbpd at the same time as Iran, Venezuela and Saudi Arabia look to increase output by 300-600kbpd each.

The good news is that an oil price closer to $100/bbl will be equivalent to an entire QE2 on the economy, so the fear of recession might be offset by lowering energy prices. And obviously, in the US that situation will continue to be more benefitial for the economy as WTI differenctial is expected to remain at the $15/18/bbl level to Brent (see my article here).

http://energyandmoney.blogspot.com/2011/06/china-slows-down-as-saudi-arabia.html

http://energyandmoney.blogspot.com/2011/06/iea-releasing-strategic-reserves.html

http://energyandmoney.blogspot.com/2011/02/brent-wti-spread-more-fundamental-than.html

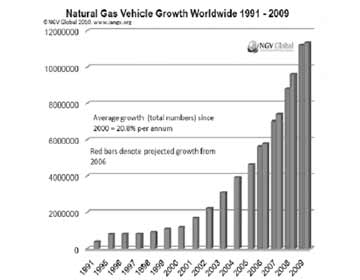

Natural Gas Vehicles… An Interesting Alternative

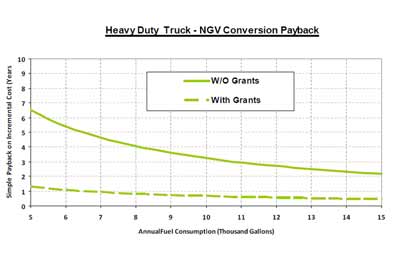

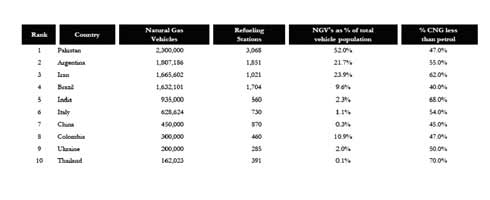

But the second I’m more interested in. Natural gas cars . The companies exposed to this sector soared in the stock market on the news that the U.S. government (if it survives) will keep the tax deduction for these vehicles. But the interesting thing is that, even without tax grants, converting vehicles to natural gas is attractive.

The advantages of the natural gas vehicles are:

– Access to an abundant source of energy, six times cheaper than oil . Even after all costs, the difference between diesel or gasoline and natural gas in the U.S. is 2 to 1.

– Very low infrastructure needs . Compared to the trillion dollars needed to adapt the country for electric car infrastructure, the U.S. already has converted service stations in almost all states.

– It’s a proven technology for vehicles of all types of tonnage. In Brazil, for example, 9% of the fleet runs on natural gas liquids.

– Does not require subsidies . A truck that consumes 15,000 gallons of gasoline a year saves $ 22,500 a year in fuel and recovers the cost of converting to natural gas in 2.9 years. If tax deductions are not approved, it would recover the investment in 4.5 years.

– They are not ugly like crazy. Unlike other unconventional vehicles, they do not need to look like clones of the Atom Ant helmet to have the autonomy of a traditional car.

T. Boone Pickens , the billionaire American, has been saying it for a long time. It makes no sense to keep the huge fleets of trucks travelling up and down the U.S. using gasoline/ diesel when the country imports $ 1 billion per day of oil from foreign sources, while the US produces abundant natural gas cheaply and with a local industry.

T. Boone Pickens , the billionaire American, has been saying it for a long time. It makes no sense to keep the huge fleets of trucks travelling up and down the U.S. using gasoline/ diesel when the country imports $ 1 billion per day of oil from foreign sources, while the US produces abundant natural gas cheaply and with a local industry.

Therefore, in a country where, thanks to shale gas the industry can benefit from abundant natural resources, low prices and a daily production of 58-60 Bcf / day, it makes perfect sense to convert a substantial portion of the fleet from gasoline to natural gas.

But most importantly, if we assume that these vehicles, the same way that electric cars, absorb 9% of the total fleet, the additional demand in 2020 (2.5 Bcf / day) would be less than 3% of the domestic production of natural gas, making the price impact of additional consumption quite limited.

Disadvantages of the natural gas car in Europe:

– In Europe we still reject to develop our reserves of shale gas, as we stated here , so the cost benefit may be lower, since the country depends on gas import from Russia, Qatar and Algeria, for example. However, even assuming the price of gas in Europe (NBP), which is two times more expensive than in the U.S., the savings compared to petrol or diesel is still relevant (38%).

– In Europe almost all countries have near-monopolies on natural gas, some state-owned, with market shares by country ranging between 60 and 80% (E.On-Ruhrgas in Germany, GDF- Suez in France , ENI in Italy, Gas Natural SDG in Spain , Galp in Portugal ) which prevents strong competition. In the U.S. there are hundreds of independent companies and none has more than 15% market share. Even after the merger of ExxonMobil with XTO the group only has 12% market share in gas.

– In Europe, unlike in the U.S., the final price of gasoline and diesel include between 55% and 60% tax . If you apply a similar tax to natural gas, and believe me it would happen, say goodbye to the benefits of conversion. But that risk, intervention and government hands in the consumer’s pocket, is going to happen in every technology, electricity included.- The main disadvantage is that if demand soars for electric cars, hybrids and natural gas vehicles, added to the “start-stop” engine that giving an additional 15% fuel efficiency, then demand for oil will collapse, making the price of crude more competitive. Obvious. But in principle, assuming a 10% penetration of the fleet in the OECD in “unconventional” transport, it seems that the impact on oil demand will not be greater than 3% overall.

What I love to see is more companies, from my dear Better Place (Israel) in electric vehicles, to EQT, Westport Innovations, Clean Energy Fuels Corp. and others in the U.S., whose business model is already beginning to sound very promising when it includes the sentence “without subsidies.” That’s enough to get me interested.

Data Source: Clean Energy Fuels, NGV, Lazard, Exxon, EQT

Further reading:

http://energyandmoney.blogspot.com/2011/05/who-killed-electric-car.html

http://energyandmoney.blogspot.com/2009/12/observations-on-arrival-of-electric-car.html

http://energyandmoney.blogspot.com/2011/07/european-crisis-falling-demand-and.html

http://energyandmoney.blogspot.com/2011/06/shale-gas-in-europe-poland-and-energy.html