This article was published in El Confidencial on 22/6/2014

“There is no military solution for Iraq” Barack Obama

“Rarely has a U.S. president been so wrong about so much at the expense of so many” Dick Cheney

Getting it wrong is dangerous. Worsening things is lethal. In the case of Iraq , the United States, after spending a billion dollars to remove the regime of Saddam Hussein, has left a global security problem which may be greater than imagined when Obama decided to withdraw the troops . It’s not just about oil. Anyone who lived the Baghdad of Saddam Hussein understood that the regime was a global danger. Similarly, it is essential to understand that the threat was not only Saddam, but the many factions that existed well before the Baath dictatorship, which remained in conflict during the regime and still do so today. Leaving Iraq can become a decision that Obama will regret for a long time.

Why did the U.S. leave Iraq?

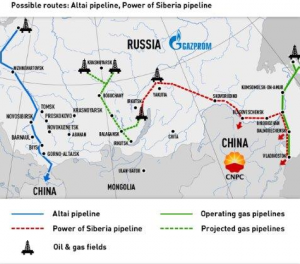

For love and peace? No. Because in 2016 the US will be energy independent -including Canada. The need to defend its interests in the area is today infinitely smaller.

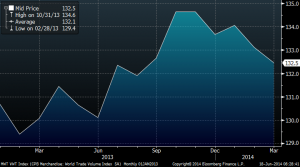

America is already independent in gas and produces 11.3 million barrels a day of oil thanks to the fracking revolution, becoming the largest producer over Saudi Arabia and surpassing the country’s own 1970’s peak.

However, removing the troops leaving behind a timebomb of sunni and shiite factions could end up turning against the United States and the OECD, as it generates an enormous risk of multiple terrorist threats. Energy is not the problem. It is a cultural problem. It is naive to say the least to think that everything will go smoothly leaving Iraq on its own when the country is decimated by clashes of tribes with invasive ambitions. it is the same mistake we have seen in Libya or Egypt after removing a dictatorship regime. The Pandora box of multiple threats opens. I recommend you read ” The Clash of Civilizations “ by Samuel Huntington and “The Lesser Evil” by Michael Ignatieff. In the West we do not want to understand the culture and customs of these countries, which are very far away from our idea of democracy. Accepting the lesser evil of maintaining a military presence is much more logical than closing our eyes in the hope that the world will move according to our wishes.

Does the Iraq crisis affect its oil exports?

The OECD placed too much trust on the unstable government of al-Maliki. US troops were disappearing and the industry seemed to be recovering. It looked as if everything was on track, but the risk had not gone away, in fact it had increased with the wrong strategic decision to pull U.S. troops from the country without a security contingent.

This week the Iraqi risk rose dramatically after terrorist attacks in the northern part from ISIS (Islamic State Of Iraq and Syria), a jihadist group that even has an annual report of its sinister achievements. See it here (http://azelin.files.wordpress.com/2014/04/al-binc481-magazine-1.pdf ) courtesy of the Financial Times .

When I traveled to Iraq people used to say: “Baghdad is a city covered in gold, but in the south is where the real gold is” (oil).

This map, courtesy of IHS Energy ( press@ihs.com ), shows the location of the main fields and refineries.

Terrorists have taken Mosul, the second largest city in Iraq, Tikrit, Tal Afar, and Dhiluiya Yathrib. However, they have not taken any of the large fields north of the country, especially the giant Kirkuk oil field in the Kurdistan region. the people I knew in the area called this field “the passport of Kurdish independence”. Today it produces 260,000 barrels a day. ISIS terrorists have no ability or desire to attack the Kurdish region.

Most of Iraq’s production, 80%, is exported and more than 77% comes from fields in the South, where terrorist ISIS militants cannot be measured with local forces and private security contingents. There has been no impact as of today in exports, which are made mostly through tankers from the South.

Is it a crisis to regain control of oil from the hands of the multinationals?

Contrary to what has been said in some press, oil in Iraq does not belong to international companies, much less American . All is state-owned fields where international, American, Russian, Italian, Chinese or British companies work with contracts for service , and they are paid to maintain or increase production. That is, the State benefits from international companies’ experience in improving productivity, and therefore has no interest in seeing these companies leaving. This type of productivity contract is what has led to Iraq recovering its pre-war peak production so quickly.

Is it all the fault of Obama or Bush?

The fights and attacks between Sunnis and Shiites are not new. It’s a conflict that has been ongoing for hundreds of years. In the era of Saddam Hussein it was already a challenge to organize security to travel from Baghdad to the border with Kurdistan. In fact, access was banned even for many potential contractors due to constant attacks.

George W. Bush made a mistake thinking that the US would be received as heroes after the invasion, as Wolfowitz expected. The moment that the regime’s repression ceased, the various factions began fighting bitterly. A weak government only reduced the perceived risk. The same mistake has been committed by the OECD in Libya and Egypt.

The Obama administration made a huge mistake by reducing up to three times the number of contingency troops that would support the weak government of al-Maliki. By reducing the promised figure of 50,000 soldiers to 25,000 and then to 3,000, aid became irrelevant, and therefore rejected by the local government.

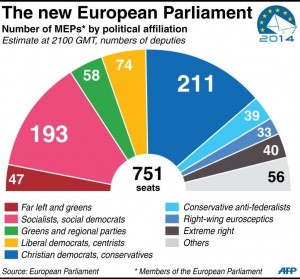

The lack of involvement of NATO countries in the Middle East problem is part of the disaster. Not only Libya and Egypt have spiralled out of control, but Al-Assad in Syria is now more powerful than ever due to the inaction of the OECD, and Syria has become the launchpad of a strengthened ISIS in North Iraq. Thus, the risk that the area controlled by ISIS becomes a huge camp of international terrorists is not small.

Proposals to divide Iraq into three (Kurdistan, a Sunni North and a Shiite South) would increase the risk of allowing to build a huge training center for global jihadists.

Is the crisis due to peak oil?

Sunnis and Shiites have been fighting for hundreds of years. The problem is not oil … Because in the oil market there is no great risk.

On 11 June, OPEC met in Vienna. Independent analysis (BP Statistical Review) confirmed that there is plenty of oil for decades. Global proven oil reserves have increased to 1,687.9 billion barrels in 2013, sufficient to meet 53.3 years of global production.

Messages from the major oil exporters focused on some aspects that I think are extremely important when assessing the geopolitical risk and not overdo it:

- The market is adequately supplied and OECD inventories in terms of demand cover are at “comfortable” levels (2,548 million barrels, 55 days, similar to the 55-60 day average level of the past ten years).

- Spare capacity, ie what OPEC can produce above the established quota of 30 million barrels per day, is today 3.5 million barrels a day.

- Iraq has reached a production of 3.3 million barrels a day, reaching record highs.

Will Iraq take oil to $ 200 a barrel?

Not likely. The OPEC spare capacity is equal to 100% of total production in Iraq.With the US producing at record levels and non-OPEC production growing by 1.2 million barrels a day in 2014, the market would be adequately supplied even if Iraq fails to export.

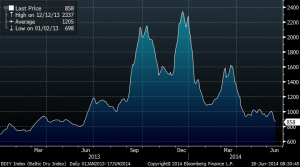

Libya, for example, has dropped to almost zero exports from one million barrels per day after the fall of Gaddafi and the oil price has not moved aggressively. The analysis is not “oil has risen to $ 115 per barrel,” but “even after the crisis in Libya, Ukraine and Iraq, oil has only risen to $115 per barrel …” And oil remains in backwardation (the future price is much lower than the spot).

Will the price of oil it create an economic crisis?

Oil does not create crisis. Excess credit and money supply that shoots commodity prices well above the fundamental levels are the ones that create crisis. The price of oil is a consequence, not a cause. In any case, the oil burden of the OECD has not reached 5.5% of GDP, far from levels that are supposed “to trigger a crisis”. The oversupply also helps to mitigate it.

The world has been operating with such crises in producing countries for decades. And the market is always adapting. But linking the Arab problem only with oil is a grave error on the part of all governments.

In the end, as Ignatieff said there is never an ideal solution. To think that the OECD will solve conflicts between Sunnis and Shiites that have been going on for centuries only with military domain is optimistic. Believing that NATO and the United States will be able to opt out of supporting Middle East security without dire consequences for the Western world is suicidal.

Important Disclaimer: All of Daniel Lacalle’s views expressed in his books and this blog are strictly personal and should not be taken as buy or sell recommendations.