(This article was published in Cotizalia on Feb 17th 2011)

I write to you this week from Oman. Impressive country, producing 900 thousand barrels of oil a day, and 9% of GDP from oil revenues, which finances amazing investments in infrastructure and civil works from Musqat to Salalah and other cities that are downright impressive.

As a country, it’s an example of how different the countries of the area are, despite the Western media efforts to put them all in the same basket of so-called risk of Egyptian contagion.

Another week and now that the Egyptian crisis has been solved, the market continues to focus on that country and the risk involved in the Suez Canal for crude supplies. And there is no real risk. The importance of the Suez Canal for the transportation of crude oil has fallen sharply in recent decades. During the 60s and 70s, almost 10% of global oil traffic passed through the canal. Today, it’s less than 1%. Moreover, as the three largest companies working in the channel say, the traffic is roughly balanced, with 55% of oil on ships heading north (992 thousand barrels/day) and 45% (about 850 thousand barrels/day) due south. Any problem in the Canal is, first, negligible for the transit of oil and, second, very easy to re-route around the Horn of Africa, an increase of transit time of less than 15 days.

For those who care about Egypt and the Sumed pipeline, just remind them that it only moves 1.1 million barrels per day despite having a capacity of 2.4 million barrels per day. And as a good friend of EGPC told me, there are few safer places than this pipeline, where the army has more troops than any city in the country except Cairo.

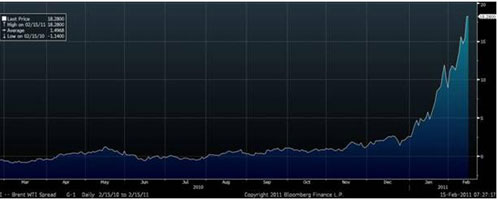

And in this environment we find the Brent and WTI spread at historical highs. Two clear effects: first the inflationary impact on Brent added to the deflationary impact on WTI to create the largest differential between the two ever seen: $14.5/bbl. Also very wide differential relative to other crude, Bonny Light (Nigeria), in particular, and Asian Tapis.

Let’s start by explaining what justifies the weakness of WTI:

Inventories at Cushing (at Oklahoma) are at historically high levels. 50% higher than the average for the past five years (25022). The problem is that the WTI weakness shows the growing isolation of the North American market and infrastructure problems to evacuate excess oil.

WTI crude trades on the basis of inventories at Cushing, in the middle of the American continent, and it is hard to move oil out of the area (called PAD II) or the large refineries on the Gulf.

1) There is enough transport capacity to carry crude from the Gulf to the center of the continent, but not vice versa. The fact that the Enbridge pipeline has had problems has increased the glut of crude in Cushing.

2) There has been an increase in exports of crude oil (oil sands) from Canada to the U.S., which increases the overcapacity in Cushing. Transcanada launched the second phase of its Keystone pipeline, which attracts even more crude to Cushing bottleneck.

3) The increase in U.S. domestic production, including Bakken, is also filling the stores in Cushing. The over-production in the U.S. is partly because the gas companies take advantage of high oil prices to produce more natural gas liquids, whose price is close to oil, in order to fund production of natural gas which today at $4/mmbtu, is not giving the best economics, actually very poor returns. Therefore they compensate for the low profitability of the gas with the price of associated liquids.

Add the fact that three refineries have been closed for maintenance, and we have the perfect storm. Excess production of high oil prices, withdrawal of the American system because of lack of infrastructure, and reduced refinery demand .

Meanwhile, Brent is affected some powerful inflationary forces:

1) The decline of production from Norway and North Sea, that previously functioned as a cushion against price increases, and does not produce that effect anymore.

2) The increase in OPEC oil transit to Asia, and rising domestic demand in exporting countries have reduced the oil for export. Saudi Arabia expects to increase its exports by 1 million barrels per day, but, for now, demand does not justify it.

3) The perception of geopolitical risk and the effect that we mentioned of transport cost increase. The market assumes that the cost of transport must rise. We are already seeing freight day rates recover, particularly in the VLCC segment, as I commented with Oman Oil. Having seen the Baltic Dry Index tumble to record lows due to excess spare capacity of ships, we could start to envision a horizon of recovery. Very gradual, and certainly not to be bullish, because overcapacity still exists (especially in the Capesize and Panamax segments.) And if freight costs rise, the chance to evacuate American crude to Europe is reduced.

As I mentioned two years ago on the differential between gas (Henry Hub) and oil, it is very dangerous to play against a very clear structural effect of isolation of a market, the American, in which the administration has no intention of promoting improvements in the system, and as a result, crude oil and domestic gas (WTI and Henry Hub) at lows is a clear boost from the country’s competitiveness.

Further read:

http://energyandmoney.blogspot.com/2010/01/revolution-of-shale-gas.html

http://energyandmoney.blogspot.com/2011/06/iea-releasing-strategic-reserves.html

Here is a summary of my views on the Egypt crisis, stocks involved and how to play it.In terms of oil, none of the countries presently affected is a major producer in a global context of oil (1.1mb/d). Yemen and Egypt are important for gas markets as significant producers of LNG for international supply (20mtpa/ 8% global capacity). However, they are very important for low cost deliveries to Europe and for South Europe refiners (Repsol gets part of its crude for Cartagena and ENI for Toscana from Egypt).

Here is a summary of my views on the Egypt crisis, stocks involved and how to play it.In terms of oil, none of the countries presently affected is a major producer in a global context of oil (1.1mb/d). Yemen and Egypt are important for gas markets as significant producers of LNG for international supply (20mtpa/ 8% global capacity). However, they are very important for low cost deliveries to Europe and for South Europe refiners (Repsol gets part of its crude for Cartagena and ENI for Toscana from Egypt).