22/3/2014 El confidencial

“We are in the middle of an epic credit bubble…the likes of which I haven’t seen in my career” Joseph Baratta (2013)

Larry Summers said a few months ago that Western economies were“doomed to go from one bubble to the next” . However, bubbles are not prevented, they are stimulated. And most economists spend more time justifying them as new paradigms than warning about them. A few months ago I commented in El País that “I do not see an incipient credit bubble, I think that it is already happening. A different issue is what it takes to explode it, even if an army of official economists deny it , as they did with housing. ” We know it’s there, but not when it will be punctured.

The U.S. Federal Reserve announced this week the withdrawal of monetary stimulus in 2015 , after almost two trillion dollars spent and 11 million people taken out of the labor market and not counted as unemployed , as I explained here.

What is the problem? Monetary policy has not benefited the ordinary citizen , only financial market participants. But the risks are paid by the citizens. Easy money has inflated financial assets, but the consequence of reducing unnecessary expansionary policies always gets paid by the people with more financial repression.

The middle class lost in the crisis, had no access to the easy money of the Fed party and will pay the hangover.

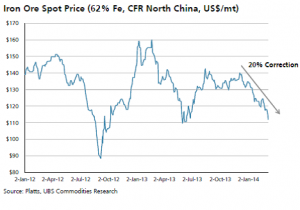

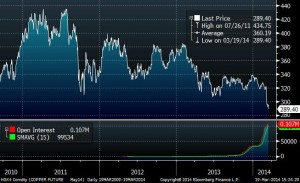

With the announcement of the end of the sugar rush fix of the economy, we begin to see as well the withdrawal of the money that went to emerging markets and high-risk assets . We are already seeing the impact on emerging markets, the “sudden stop” that I commented here.

Another symptom of the bubble of easy money is manifesting in the rapid sale of private equity stakes and the historical highs in exits and IPOs. Large investors who put tens of billions to work with the heat of low rates and monetary stimulus from the Federal Reserve are now retreating.

Buy well and sell better. That’s the goal of any investor. Notice that I have not used the words expensive and cheap, wrongly used in the investor world, because those are concepts that are subjective and depend on the mood of market participants. Now we live in a period of euphoria and anything looks cheap. Well, when I started working in the City a colleague of mine told me “do not look at who is buying but who is selling.” And now is when private equity and venture capital funds are selling more and better.

According to Brean Capital , in the last six months, 75% of companies taken public in the United States trade below the IPO price, and 30% of them have been put on the market by private equity firms selling their stakes . The number of M & A (mergers and acquisitions) deals has reached a record so far in 2014. More than 4,880 operations, a total of 552.4 billion US dollars , back at the record levels of 2007, according to Dealogic .

Exits of private equity, selling to another company or through IPO, reached $30.400 billion so far in 2014, more than double the figure in the same period in 2013 and close to the maximum of the same months in 2007 ($31.4 billion). Private equity takes advantage of market euphoria to reduce exposure.

Private equity firms have grown exponentially in the years of the money printing party and, admittedly, have played a positive role by investing in new businesses, start-ups , development and infrastructure. Thus, these firms have generated average annual returns of 21% (IRR) and managed to multiply the money invested by completed project by 1.6 times since 2008 … with an average debt to equity of 29 -33%. In 2013, according to The Wall Street Journal , the large private equity executives have pocketed $2.6 billion in bonuses.

These have been golden years for Wall Street. But in that same period we have seen productive investments fall to 1998 levels, as we mentioned in “The US Growth Mirage” . The Federal Reserve has encouraged speculative transactions while real investment is penalized, as CEOs like Rex Tillerson or Steve Wynn warned.

Assets under management of private equity and venture capital firms increased by 13% annually over the past thirteen years. And have soared 60% since the implementation of expansionary monetary policies. It is no coincidence. Bernanke and Obama have been a blessing to Wall Street.

Many venture capital firms have given good returns and have proven to overcome the image of vultures that make companies borrow and then destroy them.The sector has created positive net employment since 2008. But its role is not to increase productive investment. They are not entrepreneurs, they are asset managers.

In an environment of moderate global growth, with Chinese slowdown, problems in some emerging economies and without the gasoline of an aggressive Federal Reserve, the possibility of generating the returns described above is much lower , and that’s where the best managers can create value in periods of less euphoria.

What are the first consequences?

- The pursuit of growth for growth stops . Over 70% of the funds raised by venture capital has gone to emerging countries. It is likely that, before a rise in interest rates, capital prefers to move to safer but mature economies such as Europe and the United States.

- Liquidity is more important than high returns in the long-term. Given a scenario where the extremely generous valuations in which the funds have been able to sell calms down, moderation prevails. That’s where it’s more complicated for investors to accept periods of five years without being able to withdraw their money.

- Many of the investments made under the premise of an environment of eternally expanding global money supply and low interest rates are subject to capital losses. Some poorly managed may fall, and that is very healthy.

Expansive bubbles and easy credit always explode. Always .

A moderate investment environment will certainly have a further impact on countries accustomed to extreme liquidity. But it is essential to curb excessive credit fueled by expansionary policies, bring back investor sanity before this bubble is impossible to contain and brings unpredictable consequences. Because crises, either through inflation, devaluation or financial repression, always end up being paid by ordinary citizens .